Paytm Payments Bank has launched UPI Lite Payments, which will enable customers to make payments up to ₹200 with one tap on the Paytm app. This service will never fail, even during peak transaction hours, when banks have success rate issues. Continue reading “Paytm launches never fail lightning-fast UPI payments”

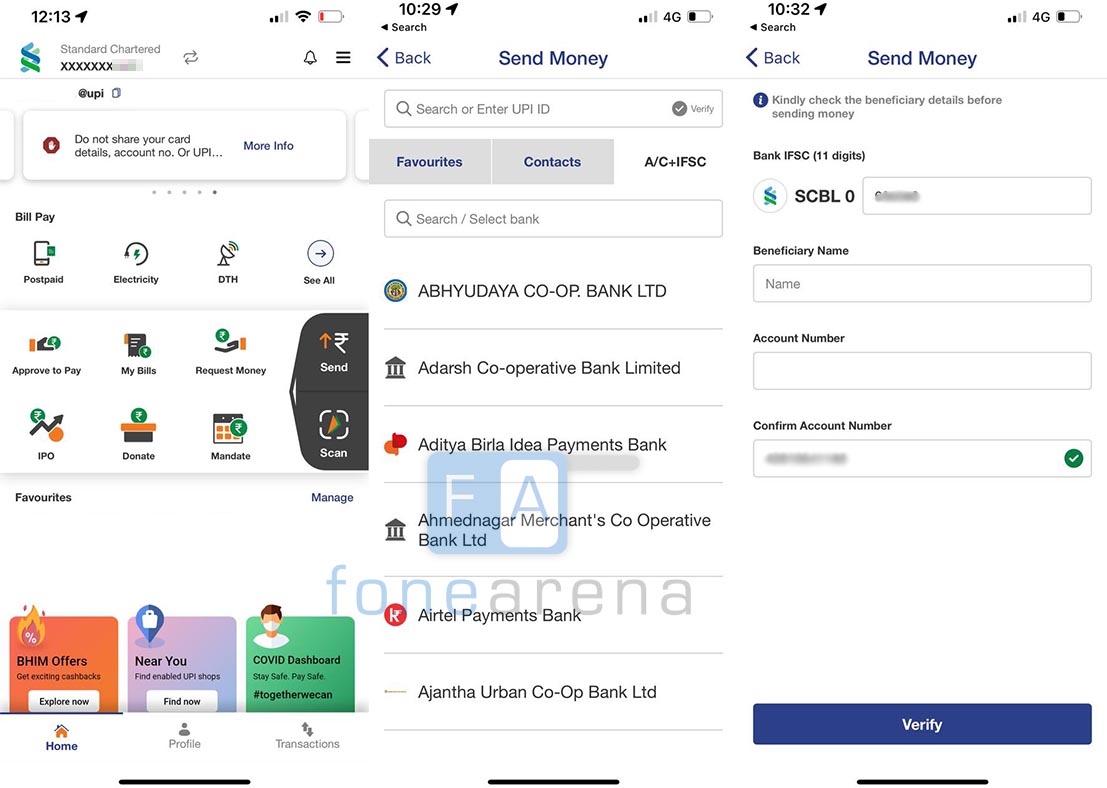

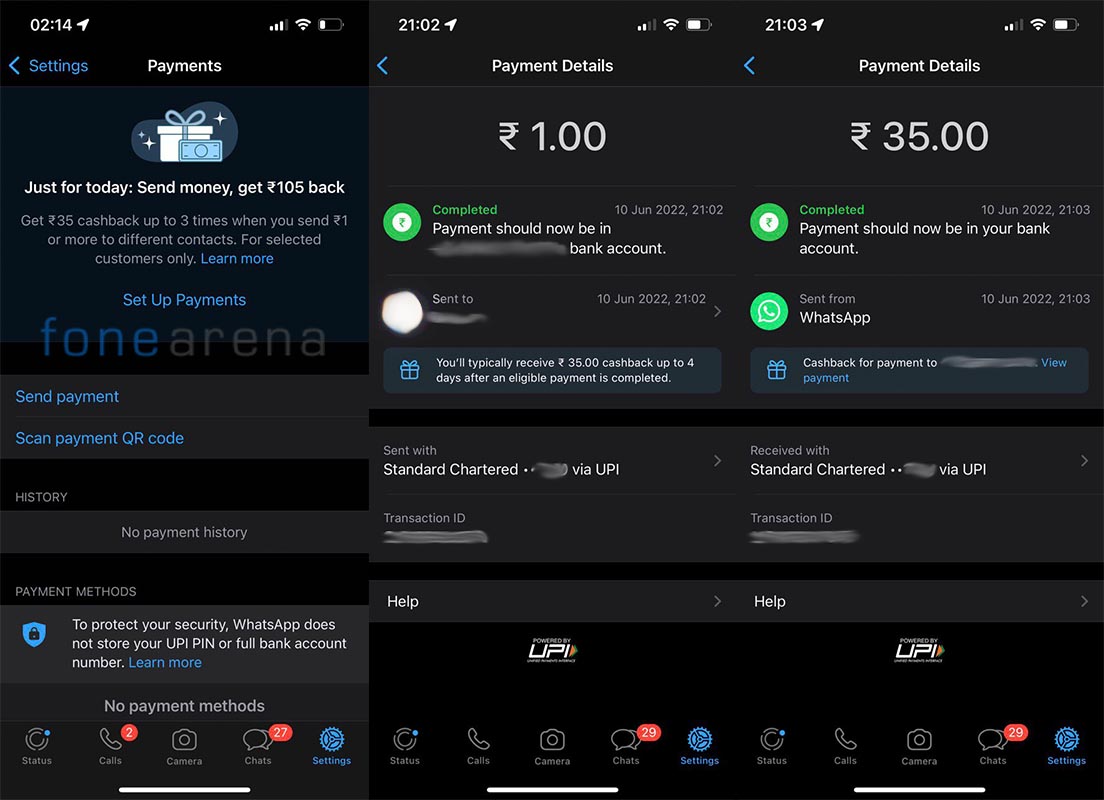

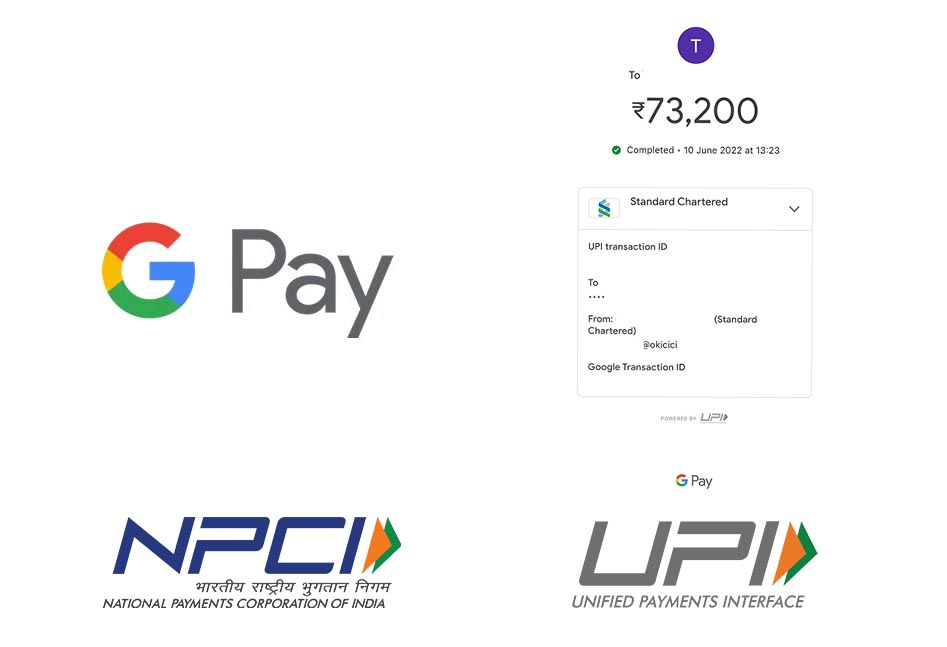

As UPI transfers are very more popular these days. More and more users are relying on UPI-based payment apps such as GooglePay (

As UPI transfers are very more popular these days. More and more users are relying on UPI-based payment apps such as GooglePay (