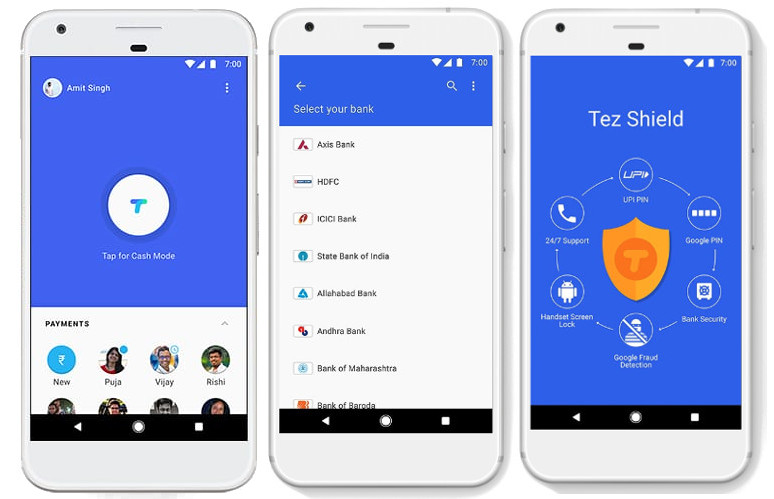

Google today announced a strategic partnership with SBI to deeply integrate SBI bank on the company’s digital payments app Google Tez. This partnership lets users create SBI UPI Id; @oksbi and get access to exclusive offers for SBI customers and enable wider adoption of digital payments and growing the digital payments ecosystem in India. Continue reading “Google Tez now lets SBI bank users create SBI UPI IDs”