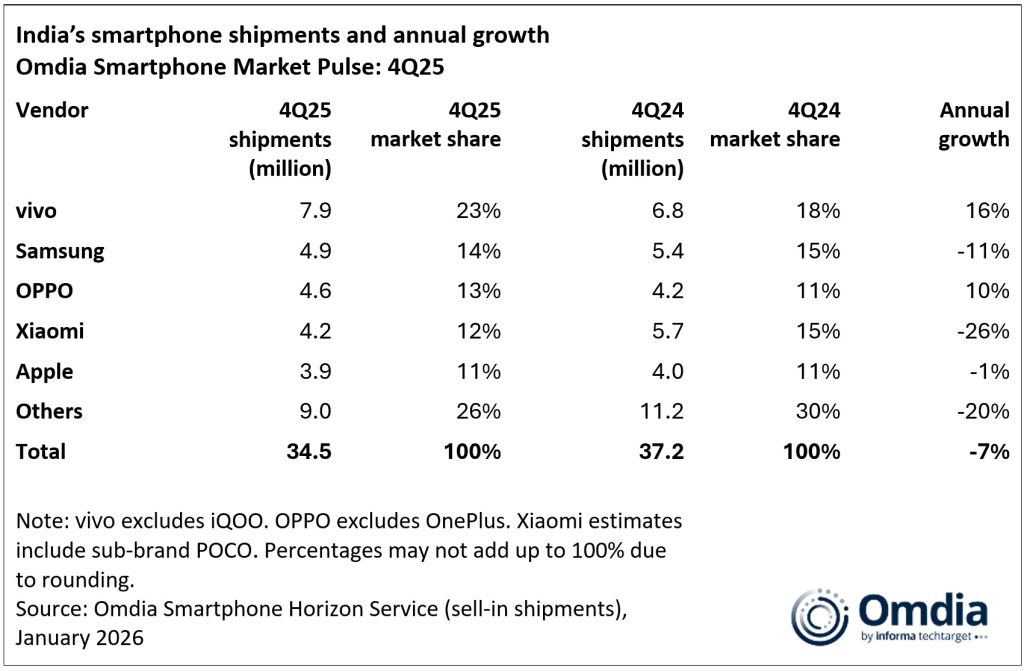

India’s smartphone market recorded a modest decline in 2025 amid weaker demand and rising costs, according to Omdia. Shipments fell 7% year-on-year to 34.5 million units in 4Q25, reflecting a post-festive slowdown, elevated channel inventories, a depreciating rupee, and reduced mass-market affordability following price increases driven by memory cost pressures.

Market Leadership in Q4 and Full-Year 2025

vivo retained its lead with 7.9 million units shipped (23% market share) in 4Q25, maintaining top position for the full year. Samsung followed with 4.9 million units (14% share). OPPO (excluding OnePlus) overtook Xiaomi for third place with 4.6 million units (13% share), while Xiaomi and Apple shipped 4.2 million and 3.9 million units, respectively.

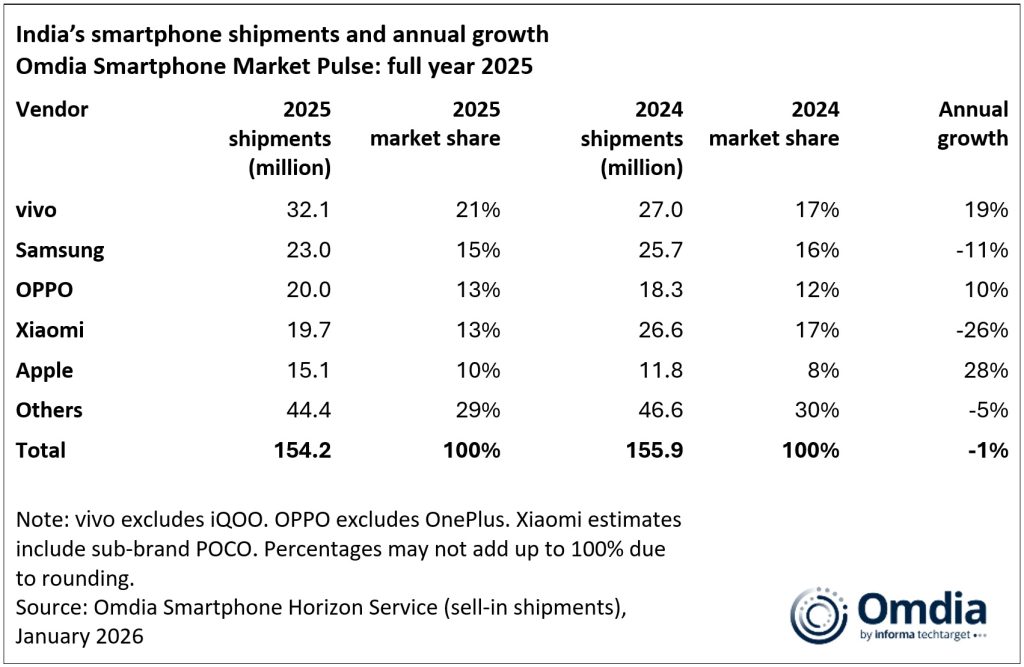

For the full year, India shipped 154.2 million smartphones, marking a 1% decline. The market showed signs of maturation, with value-focused strategies and disciplined portfolio management outperforming volume-led approaches.

4Q25 Market Trends

According to Sanyam Chaurasia, Principal Analyst at Omdia, several brands quietly adjusted market operating prices (MOPs), particularly in LPDDR4-heavy, price-sensitive segments, to pass through higher component costs. Rising memory prices and a depreciating rupee forced vendors to recalibrate pricing for both new and carry-over models.

Despite these pressures, vivo and OPPO achieved double-digit year-on-year growth, reflecting the strength of their retail-first execution. vivo emerged as the primary pull brand, commanding demand from both consumers and retailers. OPPO maintained momentum through its A- and K-series portfolios, six-month refresh cadence for V- and Reno-series models, and proactive support for ageing-stock clearance.

Meanwhile, Samsung, Xiaomi, realme, and Apple faced volume pressures due to cautious channels and weaker mass-market demand. OnePlus, Motorola, and Nothing focused on selective offline expansion with targeted promoter deployment to sustain presence.

Brand Highlights

- vivo: Growth driven by Y31 5G, Y19s 5G, T4X 5G, and V60e, supported by strong offline presence and decentralized agent-led execution. Chaurasia highlighted vivo’s deep offline penetration and one of the largest on-ground promoter networks in the industry.

- OPPO: Balanced A- and K-series strategy, proactive retail support, and channel management. Chaurasia noted OPPO’s efforts in shelf-level competition management and retailer support.

- Samsung & Xiaomi: Volumes softened despite value-led programs and entry-level models, including Redmi 14C 5G and POCO C75 for Xiaomi.

- Apple: Flat performance, with strong demand for the iPhone 17 base model, though some consumers delayed purchases in anticipation of promotions on iPhone 15 and 16.

- Other brands: OnePlus returned to growth with strong offline response to the OnePlus 15 series; Motorola and Nothing expanded selectively, focusing on high-traffic stores and targeted promoter deployment.

- realme: Experienced some pressure following price adjustments, though models like 15X, C71, and C73 helped maintain stability.

Outlook for 2026

Sanyam Chaurasia expects India’s smartphone market to decline mid-single-digit in 2026, driven by higher prices and cautious consumer spending. He noted that while seasonality and potential policy support may stabilize demand in the second half, growth will rely more on cost discipline and channel execution than hardware innovation.

Chaurasia added that Chinese OEMs will likely focus on the Rs. 25,000–Rs. 60,000 “flagship killer” segment, where margins are better protected against rising memory costs. The Rs. 60,000+ premium segment will continue to be dominated by Apple, Samsung, and vivo.

He also emphasized that brands will increasingly depend on channel-led strategies, including service and ecosystem bundling, trade-ins, deeper financing, and phased launches aligned with component availability. Effective retail execution, promoter strength, inventory support, and localized sell-through programs will be essential to sustaining market stability through 2026.