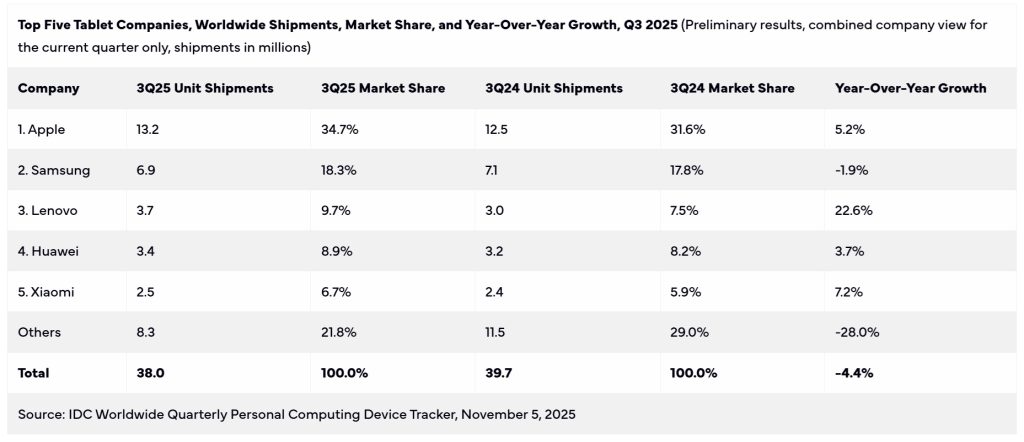

Worldwide tablet shipments declined 4.4% year-over-year in the third quarter of 2025 (3Q25), reaching 38 million units, according to the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

Market Cooling After Six Quarters of Growth

After six consecutive quarters of growth driven by product refreshes and replacement cycles, the tablet market showed signs of slowing in 3Q25. Elevated inventory levels carried over from the first half of 2025, partly due to precautionary stockpiling amid tariff concerns, contributed to weaker sales.

Demand in emerging markets remained steady, supported by education initiatives, government digitization programs, and expanded tablet offerings from smartphone vendors. Innovations such as AI-powered features, detachable form factors, and improved display technologies helped sustain engagement across both consumer and enterprise segments.

Highlights from Leading Vendors in 3Q25

- Apple: Maintained the top position, shipping 13.2 million units, up 5.2% year-over-year. Shipments of the 10.9-inch iPad contributed to growth despite a strong 3Q24 that featured iPad Pro and iPad Air refreshes.

- Samsung: Held second place with 6.9 million units shipped, down 1.9% YoY. S10/S11 models performed well in the consumer segment and the A-series lineup expanded, while fewer commercial projects led to an overall decline.

- Lenovo: Remained third with 3.7 million units shipped, up 22.6% YoY. Growth was driven by new XiaoxinPad launches and increased consumer demand.

- HUAWEI: Returned to the top five with 3.4 million units shipped, up 3.7% YoY. Slower shipments in China were offset by MatePad Mini launches and expansion in Latin America, Europe, and the Middle East.

- Xiaomi: Maintained fifth place with 2.5 million units shipped, up 7.2% YoY. Shipments were supported by new models including the Pad 8, Pad 8 Pro, and Redmi Pad 2.

Market Outlook

IDC senior research analyst Anuroopa Nataraj noted that the market is transitioning from pandemic-driven demand to steady, value-oriented growth. Replacement cycles are lengthening, but mid-premium and productivity-focused tablets are expected to lead near-term recovery.