India’s traditional PC market, which includes desktops, notebooks, and workstations, saw an 8.1% increase in shipments year-over-year (YoY) during the first quarter of 2025 (1Q25).

The total units shipped reached 3.3 million, according to the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker. This marks the seventh straight quarter of growth.

Key Highlights

- Notebook shipments rose 13.8% YoY.

- Workstation shipments increased by 30.4% YoY.

- Desktop shipments fell by 2.4% YoY.

- Premium notebooks priced above US$1,000 grew by 8% YoY in 1Q25.

- AI notebooks surged 185.1% YoY, though from a small base.

Market Segments

- The consumer PC market grew 8.9% YoY, boosted by Republic Day sales and strong shipments in March.

- The e-tail (online retail) channel grew 21.9% YoY.

- The commercial segment recorded a 7.5% YoY increase, supported by stronger enterprise demand for commercial notebooks.

- Commercial desktops declined 2.5% YoY, with the government sector falling 27.4% YoY.

Industry Insight

Bharath Shenoy, Research Manager at IDC India & South Asia, said the consumer PC market showed strong growth thanks to the e-tail channel and offline expansion.

Vendors are broadening their physical presence through new brand stores and large format retail outlets, alongside providing discounts and cashback offers online; however, Bharath Shenoy pointed out that despite strong shipment numbers, rising channel inventory may create challenges in the near future.

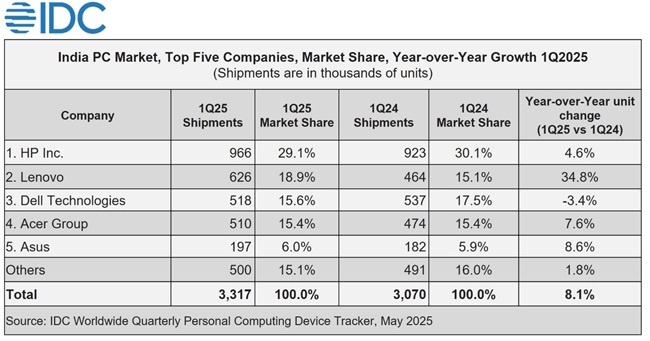

Top 5 Companies: Q1 2025

- HP Inc. led with a 29.1% market share in 1Q25, leading both consumer and commercial segments. It held a 32.7% share in the commercial segment, supported by a 60.6% YoY rise in enterprise-related demand. HP’s consumer segment declined 1.4% YoY due to inventory adjustments.

- Lenovo held 18.9% share, growing 36.4% in consumer and 33.8% in commercial segments. Enterprise and SMB demand boosted commercial sales, while retail and e-tail growth helped the consumer segment.

- Dell Technologies ranked third with 15.6% share, holding second place in commercial with 22%, driven by enterprise sales. It reduced consumer shipments to manage inventory, falling behind Apple in consumer ranking.

- Acer Group had 15.4% market share with 7.6% YoY growth. Its consumer segment surged 95.5% YoY due to online and offline pushes, while the commercial segment dropped 21.1% YoY due to fewer government and education orders.

- Asus held 6% share with 8.6% YoY growth. Starting with low inventory helped it ship more units. Asus is expanding its attention to commercial PCs, achieving a 41.1% increase, although starting from a modest base.

Outlook

Navkendar Singh, Associate Vice President at IDC India, South Asia & ANZ, observed that while enterprise orders continue to grow and support commercial PC demand, the Indian IT/ITES sector remains cautious, focusing on maximizing the use of existing IT resources.

He added that demand for gaming notebooks is helping consumer market growth. Singh also noted that AI-powered PCs are being adopted by organizations to improve productivity, security, and automation, with growth expected to continue in coming quarters.