The India Mobile Handset Market Review Report for Q1 2022 from Cyber Media Research (CMR) shows that 5G shipment growth was more than 300% YoY, with overall smartphone shipment growth of 1.6% YoY. In the 5G smartphone category, Samsung had a 23% market share, followed by Xiaomi with an 18% share.

Smartphone Segment Q1 2022

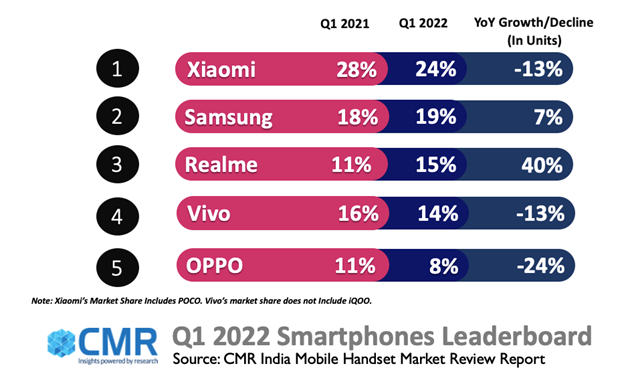

In the first quarter of 2022, Xiaomi took the top position with 24%, followed by Samsung (19%), and realme (15%) topped the smartphone leaderboard, followed by Vivo (14%) and OPPO (8%). While affordable smartphone sales (under INR 7000) fell, premium smartphone sales (over INR 25000) increased by 58% year-on-year, indicating a growing consumer desire to move to and upgrade to flagship models.

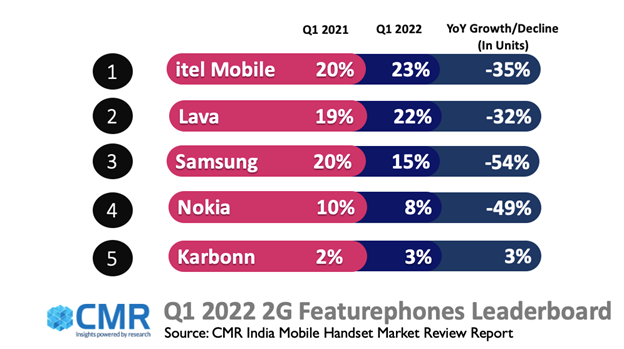

Feature Phone Segment Q1 2022

Literally, the entire feature phone subcategory plummeted 43% year-on-year in Q1 2022, owing to supply side bottlenecks, spikes in operator tariff plans, and rising inflationary tendencies. The 2G feature phone and 4G feature phone segments decreased by 42% and 50%, respectively.

Q1 2022: Indian Smartphone Market Share Highlights

- Xiaomi led the market with a 24% share. The Redmi 9A Sport as well as the Note 11 seem to have been successful. Due to fierce competition, Xiaomi’s shipments slipped 13% YoY. In Q1 2022, POCO’s sales decreased by 52% YoY.

- Samsung surpassed realme for the 2nd spot with a 19% market share. Samsung dominated the 5G smartphone rankings with the Samsung F23 and Samsung A23. Samsung ranked first in 5G Value-For-Money devices priced between INR 7000 and 25,000.

- realme ranked third with a 15% market share, with shipping increasing 40% year-on-year, the fastest among the top five. The highest-grossing devices were C11 (2021), 9i, and C21Y.

- Vivo, as well as its sub-brand iQOO, grabbed 15% of the market. The Vivo Y72 and Y75 were the most successful 5G smartphones.

- OPPO ranked 6th with an 8% share of the market. The OPPO A54 and A16 series are their most popular models. OPPO accounted for 5% of the total 5G shipments.

- OnePlus’ shipments increased 50% YoY. OnePlus Nord series achieved > 75% market dominance.

- Shipments of Apple devices grew 20% YoY. It controlled 77% of the industry’s premium price range (INR 50000–1000000).

- Shipments of Transsion Group brands (Itel, Infinix, and Tecno) plunged 12% YoY. Smartphone shipments fell 3% YoY. Nevertheless, the online exclusivity business Infinix has seen a 60% rise in sales.

According to Menka Kumari, Analyst-Industry Intelligence Group, CMR

5G smartphone shipments posted a robust growth in Q1 2022. The overall smartphone market has posted a considerable growth of 16% compared to the pre-pandemic levels of Q1 2019. However, the smartphone industry continues to face major headwinds, including prevailing supply side dynamics, and resultant raw material shortages. While the initial two months of the quarter remain muted, March bucked the trend, with growth picking-up.