Airtel Payments Bank has introduced the Safe Second Account to help protect primary savings while enabling secure everyday digital transactions. Continue reading “Airtel Payments Bank launches Safe Second Account for secure digital transactions”

Airtel Payments Bank has introduced the Safe Second Account to help protect primary savings while enabling secure everyday digital transactions. Continue reading “Airtel Payments Bank launches Safe Second Account for secure digital transactions”

Airtel Payments Bank has launched Micro ATMs to help debit card customers outside of metro and Tier 1 cities withdraw cash. The banks will leverage their network of over 500,000 banking points in India to facilitate cash withdrawals. Continue reading “Airtel Payments Bank introduces micro ATMs”

Airtel Payment Bank has tied up with Empays, a global provider of cloud based payment solutions that lets you make card-less cash withdrawals at over 100,000 ATMs across India using its technology called IMT (Instant Money Transfer). The technology can be used for self-withdrawal or for sending money to an intended recipient for ATM cash withdrawal. Continue reading “Airtel Payments Bank now offers card-less cash withdrawal at ATMs”

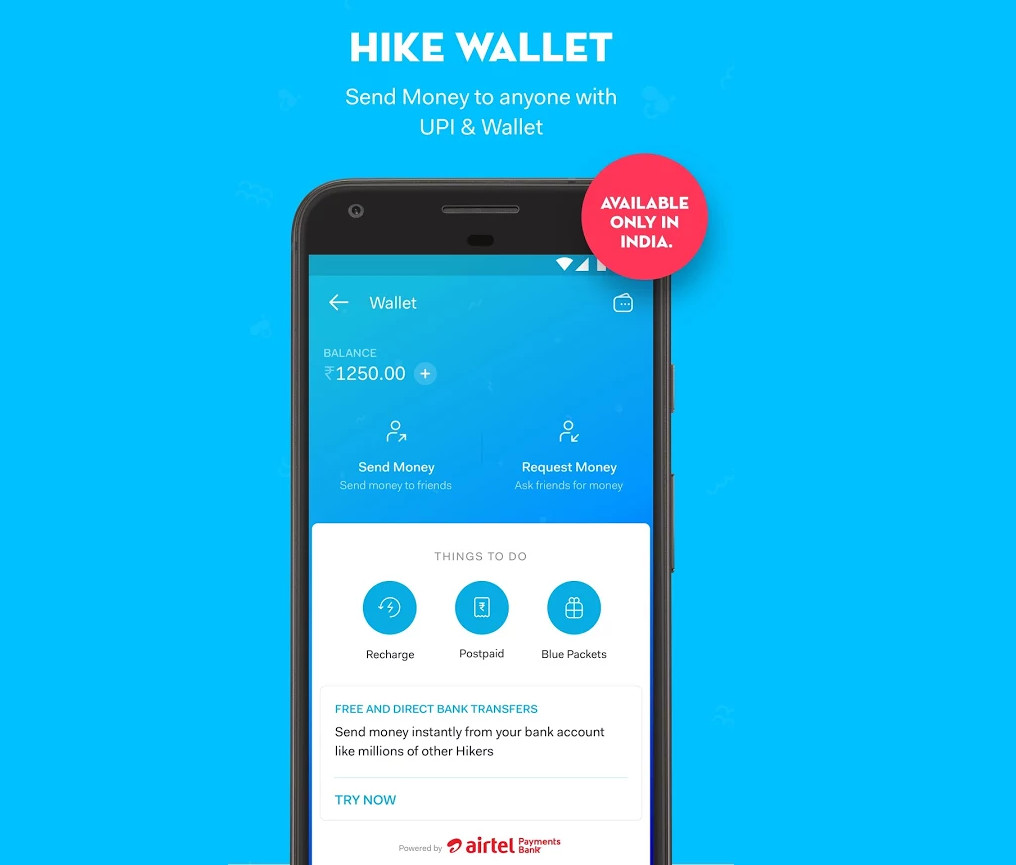

Hike introduced version 5.0 of its Messenger app back in June with new UI along with Hike Wallet to allow users to send and receive money. At that time Hike said that it had tied up with Yes Bank for UPI and wallet service. Today the company has announced its partnership with Airtel Payments Bank to power its Wallet. Hike said that it has over 100 millions users and in just 5 months of launch of Wallet, it has seen over 5 million transactions every month, growing 30% month on month. Continue reading “Hike partners with Airtel Payments Bank to power Hike Wallet”

After launching across India earlier this year, Airtel Payments Bank, a subsidiary of Bharti Airtel has announced integration of Unified Payments Interface (UPI) on its digital platform, making it the first payments bank to do so. This will allow customers to make secure digital payments to online/offline merchants and make instant money transfers to any bank account in India.

Continue reading “Airtel Payments Bank integrates UPI payments”

After rolling out pilots in several cities, Airtel Payments Bank, a subsidiary of Bharti Airtel today rolled out its banking services at 250,000 banking points in all the 29 states across the country. Airtel retail stores across the country will also function as banking points, and customers will be able to open savings accounts, deposit and withdraw cash across any of these banking points. Continue reading “Airtel Payments Bank launched in 29 states across India”

Airtel Payments Bank, a subsidiary of Bharti Airtel last week rolled out a pilot of its banking services in Rajasthan across 10,000 Airtel retail outlets, ahead of a full scale pan Indian launch. It already announced that it offers interest rate of 7.25% p.a. on savings accounts deposits, the highest in India. Today it announced that it will be offering one minute of talk time for every Rupee deposited, however this benefit is applicable on first time deposits only. This can be used to make Airtel to Airtel calls all over India and has a validity of 30 days. Continue reading “Airtel Payments Bank offers one minute of talk time for every Rupee deposited for the first time”

Airtel Payments Bank, a subsidiary of Bharti Airtel today rolled out a pilot of its banking services in Rajasthan across 10,000 Airtel retail outlets, ahead of a full scale pan Indian launch. Customers in towns and villages across Rajasthan will now be able to open bank accounts at Airtel retail outlets, which will also act as Airtel banking points and offer a range of basic, convenient banking services such as cash deposit & withdrawal facilities. Airtel said that this is the first payments bank in the country to go live.

Continue reading “Airtel launches India’s first Payments Bank, pilot begins in Rajasthan”