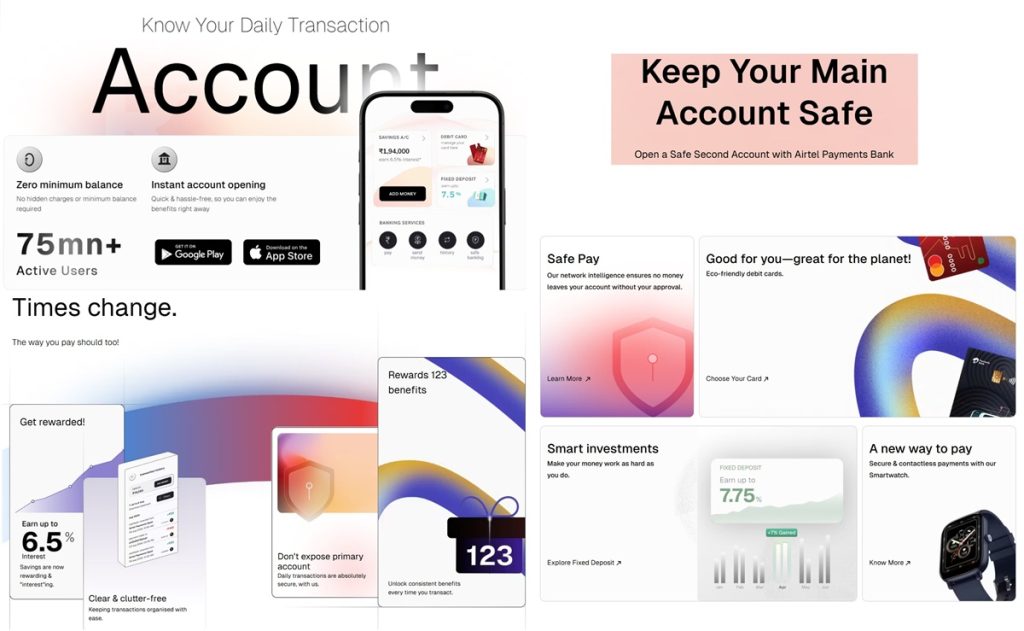

Airtel Payments Bank has introduced the Safe Second Account to help protect primary savings while enabling secure everyday digital transactions.

The company says that with digital payments now common—from UPI payments at stores to online shopping, OTT subscriptions, travel bookings, and utility bill settlements—risks such as phishing, SIM swaps, fake apps, and unauthorized transactions have increased.

Safe Second Account

The Safe Second Account allows customers to use Airtel Payments Bank as a second account for daily spending, keeping their main savings shielded from potential fraud.

Key Benefits of Safe Second Account

- Instant account opening via the Airtel Thanks app

- Interest up to 6.5% (T&C apply)

- No minimum balance requirement

- Seamless UPI integration

- Eco-friendly debit card with benefits up to Rs. 15,000

- Full suite of bill payment and recharge options

Security Features

The account includes multiple safeguards against digital fraud:

- Fraud alarm: Instantly block suspicious activity

- Sleep mode: Pause the account when not in use

- AI-driven face match: Detect high-risk transactions

- Daily transaction limits with real-time alerts

Availability

The Safe Second Account is open to all customer segments with no entry barriers and can be opened digitally through the banking section of the Airtel Thanks App.

Speaking on the development, Anubrata Biswas, MD & CEO, Airtel Payments Bank, said,

Digital payments have transformed the way India manages money, but with convenience comes the responsibility of ensuring safety. The Safe Second Account is a step in that direction – promoting a simple yet powerful habit of separating everyday transaction funds from core savings. We believe this small behavioral shift can help consumers embrace digital transactions more securely, and over time, shape the future of safe banking in India.