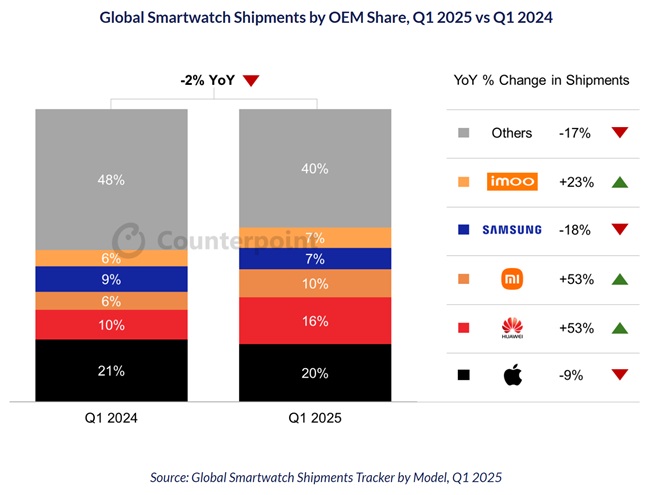

Global smartwatch shipments fell by 2% year-on-year (YoY) in the first quarter of 2025, marking the fifth consecutive quarter of YoY decline. The report stated that the slowdown mainly resulted from India’s smartwatch market cooling down and a drop in Apple’s shipment numbers, despite Apple keeping its global lead.

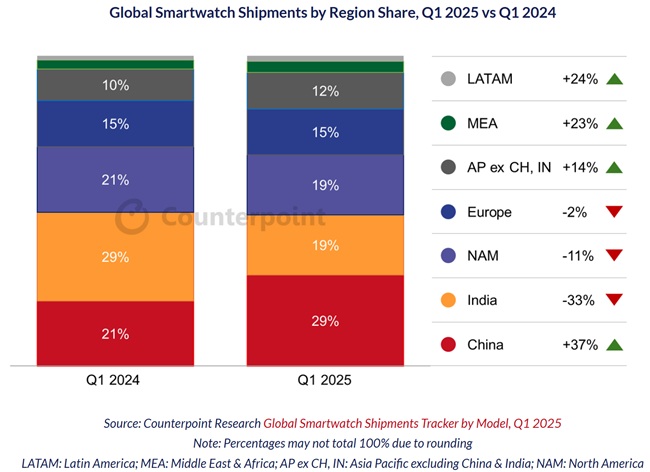

In contrast, China posted strong growth, registering a 37% YoY increase in shipments—its highest global share since Q4 2020. This momentum was driven by domestic brands such as HUAWEI, Imoo, and Xiaomi, which leveraged cost-effective models to meet rising local demand.

Q1 2025 Global Smartwatch Shipment Share (with YoY Change)

- Apple – 20% (↓ 9% YoY): Remained the global market leader, supported by its extensive iOS user ecosystem.

- Huawei – 16% (↑ 53% YoY): Grew substantially on the back of domestic performance and a wide mid-to-premium product portfolio.

- Xiaomi – 10% (↑ 53% YoY): Matched Huawei’s growth pace through competitive pricing and growing brand reach.

- Samsung – 7% (↓ 18% YoY): Recorded shipment decline due to reduced demand for previous-generation models.

- Imoo – 7% (↑ 23% YoY): Led the kids’ smartwatch category with accessible, feature-rich offerings.

- Others – 40% (↓ 17% YoY): Collectively declined as top brands increased market concentration.

Regional Insights

Senior Research Analyst Anshika Jain pointed out that China’s growth stemmed from its domestic brands expanding their presence worldwide. She emphasized that “brand loyalty among Chinese consumers is influenced by patriotic sentiment, government support, and the availability of advanced local technology across pricing tiers.”

Market Pricing Trends

According to Research Analyst Balbir Singh, consumer preferences are shifting toward higher-priced smartwatches:

- The $100–$200 segment saw 21% YoY growth, indicating increasing demand for better accuracy, health features, and ecosystem support.

- The sub-$100 segment declined 17% YoY, showing a drop in demand for entry-level models.

Kids smartwatch

Imoo drove growth in the expanding worldwide kids’ smartwatch category. Growth was most significant in China, with additional momentum in North America, Asia Pacific, and Europe. Singh cited “heightened parental focus on location tracking and postponement of early smartphone use” as key drivers.

Market Outlook

Looking ahead, Anshika Jain projected a 3% global smartwatch market recovery in 2025. Expected contributors to this rebound include:

- Adoption of AI-powered features and next-gen health sensors.

- Regulatory movement allowing certain smartwatches to gain medical-grade certifications.

- A growing user focus on “functionality, ecosystem integration, and long-term value”—driving higher demand for premium devices aligned with lifestyle, productivity, and wellness needs.