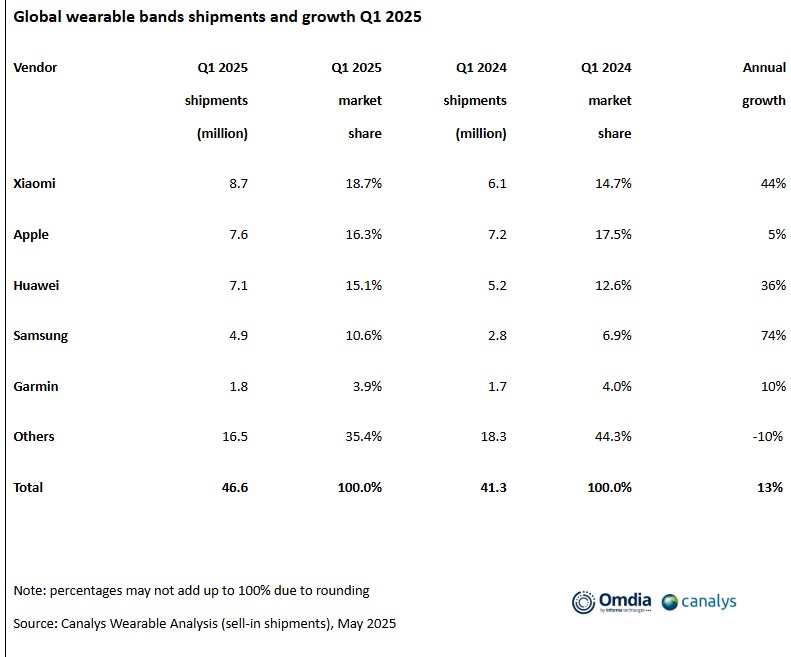

The Canalys research firm has released the Global wearable band market shipments report for Q1 2025. According to the research firm, the global wearable band market, including basic bands, watches, and smartwatches, grew 13% YoY in Q1 2025, reaching 46.6 million units.

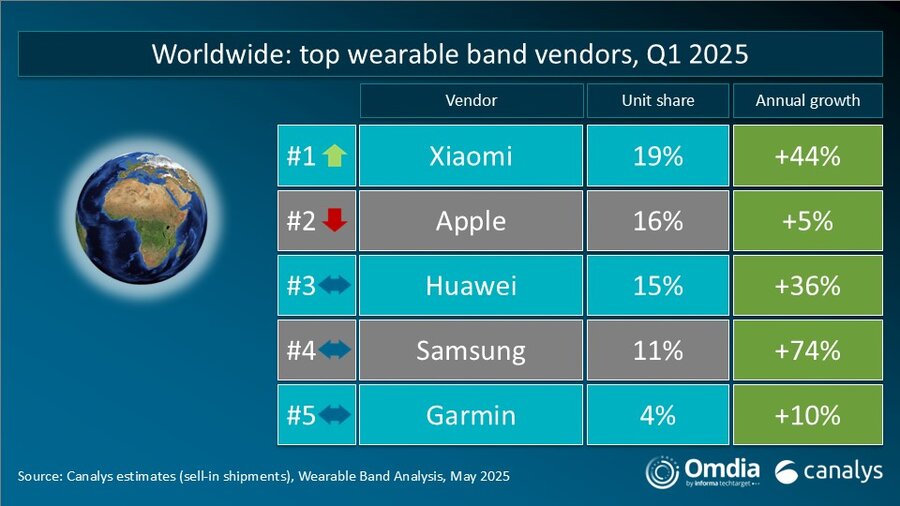

The firm cites recovering demand and a comparatively low base in the same period last year as key drivers. Interestingly, Xiaomi is leading the Q1 2025 chart, shipping the most wearable bands for the first time since Q2 2021. The 44% shipment growth is attributed to strong sales of the Xiaomi Bands and Redmi Watch.

Following Xiaomi is Apple, which showed minimal growth of 5%, with 7.6 million units shipped. HUAWEI maintained its third-place position, with shipments growing by 36% to 7.1 million units. HUAWEI’s performance is attributed to strong sales of its WATCH GT and WATCH FIT series.

Samsung caught 4th position in the chart but showed a strong 74% growth to 4.9 million. Garmin came fifth in Q1, growing its shipments 10% to 1.8 million units.

Brands’ Strategy Shift and Consumer Preferences

The recent Canalys report also analyzed the shift in focus among brands in the market, from hardware to building a solid ecosystem to encourage consumer investment in wearable bands. “With hardware profitability under strain, the wearables market is shifting from being hardware-led to ecosystem-driven,” says Cynthia Chen, Research Manager at Canalys.

Established brands in the market, such as HUAWEI and Garmin, are now focusing more on creating a closed-loop health ecosystem through their own health apps, combining hardware, data analytics, and subscription services.

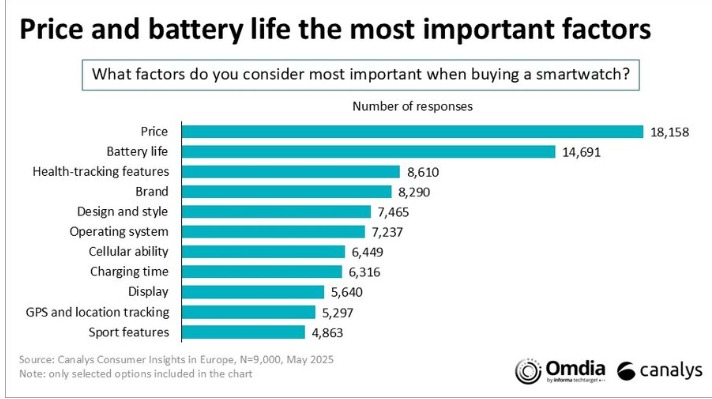

When it comes to consumer preferences while buying a smartwatch, Canalys’ recent study conducted in Europe shows that consumers rate pricing, battery life, and health-tracking features as the most important factors. This clearly indicates that consumers are not yet well-educated or informed about the advantages of ecosystems or the feasibility of applications that brands now focus on.

It may take some time for consumers to begin choosing smartwatches based on these factors. Until then, key aspects like pricing and battery life will continue to drive the majority of sales.

Regarding the matter, Jack Leathem, Analyst at Canalys (now part of Omdia), said,

Xiaomi shipped the most wearable bands for the first time since Q2 2021, driven by a broad portfolio and improved integration through HyperOS. Xiaomi has upgraded its Mi Band and Redmi Watch series with refreshed designs and advanced data capabilities, bringing comprehensive features down the price segments, boosting its value proposition. Its growth has also been supported by effective multi-category coordination and competitive pricing, particularly in emerging economies.

For many vendors, emerging markets remain key growth drivers, exemplified by TRANSSION gaining ground in Southeast Asia via precise localization and targeted value-for-money propositions. Samsung has also increased its focus on its basic bands to grow its presence in emerging economies.