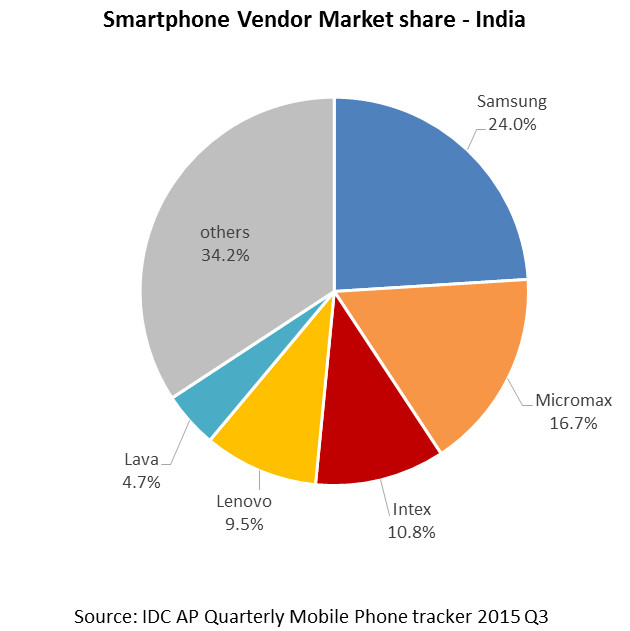

International Data Corporation (IDC) has announced that 28.3 million smartphones were shipped to India in the third quarter of 2015 that ended September 30th. This is up 21.4% from 23.3 million units for the same period last year, said the report. It also said that one out of 3 smartphones shipped in India in Q3 2015 were 4G-enabled. Samsung is still the top smartphone vendor in the country by shipments with 24% market share, up 1% compared to the last quarter.

Even Micromax retained the second position with 6.4% sequential growth QoQ. “YU Phones have been performing well and are leading contributors to Micromax’s 4G portfolio. However, YU faces strong competition from Chinese players in the online segment,” said the report.

Intex still holds the third sport with 9.4% growth. “It witnessed a sharp rise in shipments in the sub-US$50 segment and also entry level 3G-enabled devices,” said IDC. Intex said that it sold 87,55,697 mobile phones last quarter. It also said that it is the No: 1 Indian mobile handset player in the country, even though Micromax has more market share, since Micromax shipped only 8.6 million handsets in the quarter. But Micromax denied it saying that it imported 9.7 million devices in the quarter citing import data from Infodrive.

Sanjay Kumar Kalirona, Business Head Mobiles, Intex Technologies, said:

Becoming the No 1 Indian mobile brand is a reiteration of our commitment to bring the best in class products to our consumers and we are thankful to our consumers for their love and support. We are all very excited with this achievement and will continue to work towards strengthening our market leadership in the coming months.

Lenovo group (Lenovo & Motorola) has moved up to fourth spot with 9.5% market share with strong 58.6% sequential growth QoQ, mainly due to Lenovo K3 note, A6000 plus and Moto G 3rd Gen. It also started local manufacturing of its smartphones in India recently.

“The smartphone consumer base in India has evolved over the last few years. While the Indian market is flooded with several smartphone brands, we have consistently offered reliable and efficient smartphones based on disruptive technology at the right value. This has been one of the reasons for Lenovo’s popularity and rise to the number four brand in the country within two years of entry into India.”

said Sudhin Mathur, Director- Smartphones, Lenovo India.

Lava moved down to fifth place with a sequential drop of 2% market share in Q2 2015. Shipments dropped 24.9% sequentially QoQ. “While its Xolo series continues to slide down, Lava has also not moved fast enough to capitalize on the fast growing 4G market or diversified their channel strategy in favor of online channels,” said IDC.