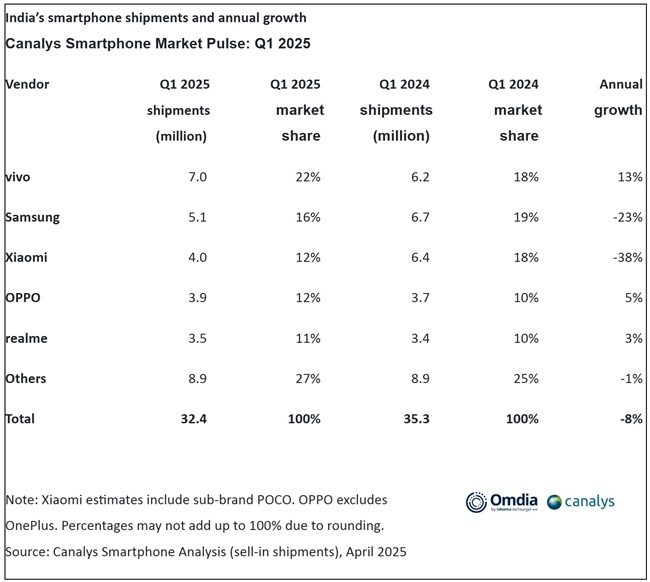

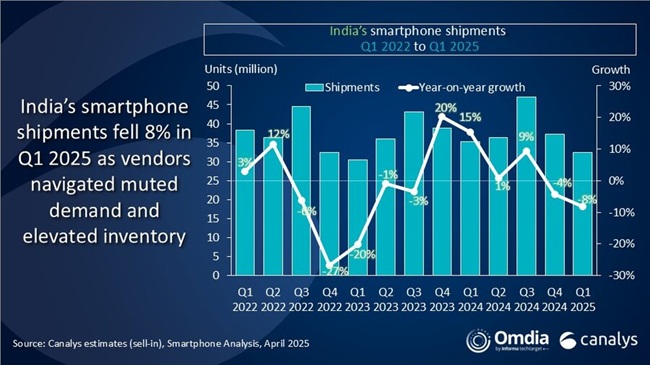

India’s smartphone market entered 2025 with caution, seeing an 8% year-on-year decline in shipments during the first quarter. Canalys reported that only 32.4 million units were shipped in Q1, mainly due to weak consumer demand and an overstocked inventory from late 2024. This excess inventory disrupted normal product launch cycles and required brands to adjust their channel strategies.

Market Share Breakdown

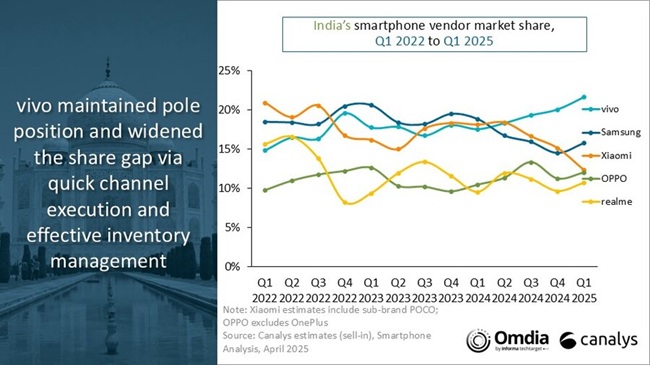

vivo led the market with 7.0 million units shipped, securing 22% of the market share, further expanding its lead. Samsung followed with 5.1 million units shipped, while Xiaomi ranked third with 4.0 million units, holding a 12% market share. OPPO (excluding OnePlus) shipped 3.9 million units, and realme recorded 3.5 million units in shipments.

Ongoing Weak Consumer Demand

Sanyam Chaurasia, Senior Analyst at Canalys, commented,

With consumer demand still fragile, 2025 is shaping up to be another channel-driven year.

He noted that in the absence of strong organic demand, vendors are relying on retail and distribution networks to stimulate sales. Channel strategies, offline activations, and better sell-out coordination are expected to play a major role in influencing market share dynamics.

vivo strengthened its position in Q1 2025 with a well-balanced product portfolio and effective channel strategies. Chaurasia pointed out that the V50 series benefited from its ZEISS partnership, wedding-season campaigns, and influencer-led events, increasing visibility. Additionally, Vivo’s T- and Y-series models ensured strong online and offline synergy.

OPPO (excluding OnePlus) capitalized on its retail strengths, promoting rugged design, water resistance, and long battery life, which contributed to steady growth. Realme regained momentum after addressing its inventory issues, with the new 14X 5G driving significant shipments. Offline channels accounted for 58% of realme’s total volume.

Xiaomi’s early launch of the Note 14 series garnered a modest response due to excess inventory and cautious retail sentiment. However, the Redmi 14C 5G helped sustain momentum in the affordable segment.

Premium Segment Growth

As demand softens, Apple and Samsung have focused their efforts on higher-end products and upgrades. Chaurasia pointed out that Apple achieved its best-ever Q1 performance in India, driven by strong demand for the iPhone 16 series and Republic Day sales promotions. The introduction of the iPhone 16e allowed Apple to expand its reach in Tier 2 and Tier 3 cities.

While Samsung started the quarter with elevated inventory and faced a 23% year-on-year drop in overall shipments, its S25 series saw a 5% growth compared to the S24 series from 2024. This growth was driven by increased demand for premium models, alongside the integration of conversational AI features.

US Tariff Changes and Their Impact

Chaurasia also noted that the shifting US tariff landscape has bolstered India’s position in the global smartphone supply chain. The changes could encourage increased local manufacturing and benefit exports. However, demand volatility remains a concern, as softer global demand—driven by higher US prices—could impact India’s export-dependent smartphone industry.

Chaurasia highlighted that consumer sentiment remains fragile, particularly in rural areas where spending is influenced by monsoon-linked income. In urban areas, upgrade cycles are slowing, and demand growth will largely depend on innovations such as AI and strong ecosystem strategies.

Outlook for 2025

With limited organic growth drivers and a reliance on channel dynamics, India’s smartphone market is expected to grow “modestly” in 2025. However, rising Average Selling Prices (ASPs) and a shift toward premium devices offer a potential growth opportunity. The market’s sweet spot is expected to shift toward the Rs. 20,000 to Rs. 30,000 (approximately US$250 to US$350) price range.