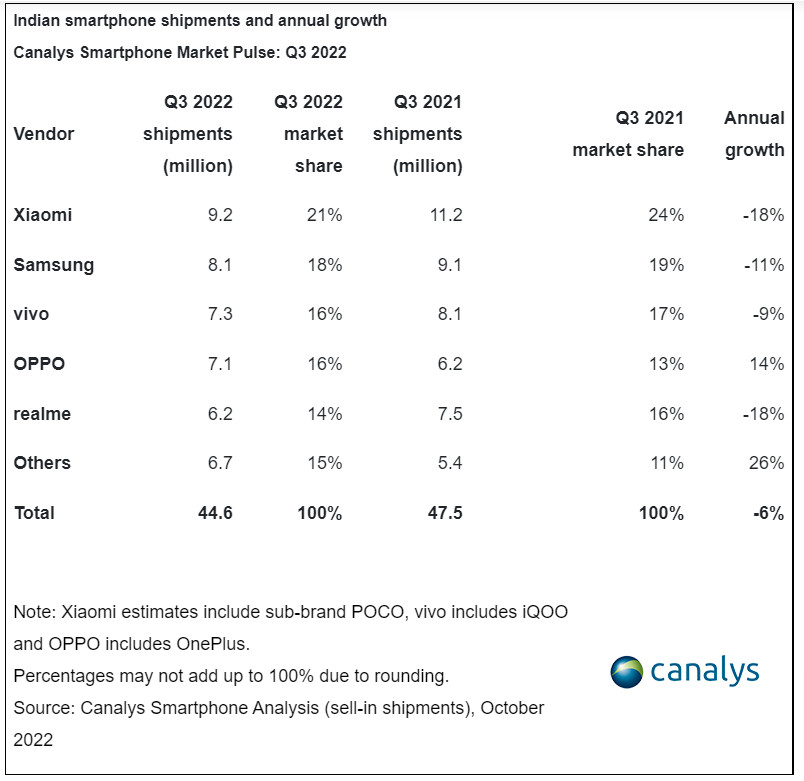

The Canalys research firm has released Indian smartphone shipments report for Q3 2022. According to the research firm, India’s smartphone shipments fell by 6% YoY and were able to ship 44.6 million units. The festival season sale, which began in the last few weeks of the quarter, saved the total shipment percentage, while entry-level device contribution declined this year.

Indian Smartphone Shipments, Q3 2022

Xiaomi maintained its market leadership, shipping 9.2 million handsets compared to 7 million in Q2 2022. Please keep in mind that Xiaomi shares include both POCO and Redmi sales. Samsung came in second with 8.1 million units, closing in on Xiaomi. Samsung has a market share of 18% and a yearly decline rate of 11%.

vivo grabbed the third spot from realme which had the same position in Q2 2022. vivo (including iQOO) sold 7.3 million units and controls 16% of the market. OPPO and realme completed the top five with 7.1 million and 6.2 million units shipped, respectively.

OPPO’s fourth-place finish was aided by a 16% market share, while realme’s fifth-place finish was aided by a 14% share. OnePlus’ sales data is included in OPPO’s figure.

Analysts predict that brands will need to find new ways to improve operational and channel efficiency in the fourth quarter of 2022 in order to avoid increased costs being passed on to end consumers. This is due to the Indian rupee’s consistent depreciation against the US dollar, which may increase operational costs.

Regarding the smartphone shipments in Q3 2022, Canalys Analyst Sanyam Chaurasia said,

Early Monsoon and Independence Day online sales were great opportunities for vendors to clear inventory before heading into the festive season. The good news is, as the festival season began, in the last few weeks of the quarter, consumer demand improved. Hit by inflation, entry-level device contribution declined this year, while the mid-to-high segment performed relatively well thanks to aggressive promotions.

OPPO’s OnePlus and vivo’s iQOO were the two brands driving mid-range growth in the e-commerce channel during this period. Ultra-premium category smartphones, especially older generation flagships, also experienced strong demand momentum amid price cuts. Samsung offered deep discounts on its older generation Galaxy Z Fold3 and latest Galaxy S22 series in online and offline channels. Similarly, demand for the aggressively discounted iPhone 13 outstripped the latest iPhone 14, whose value proposition is very similar to the former.