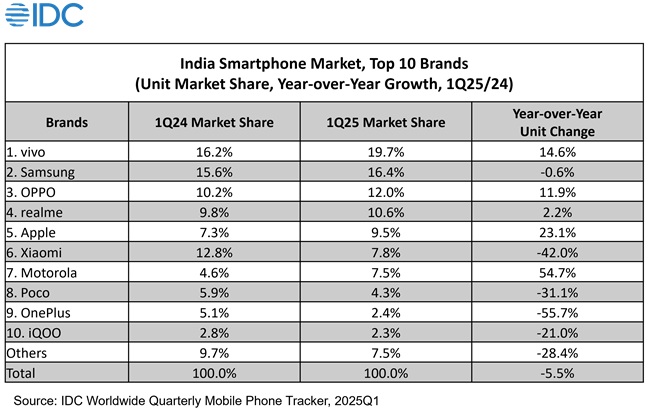

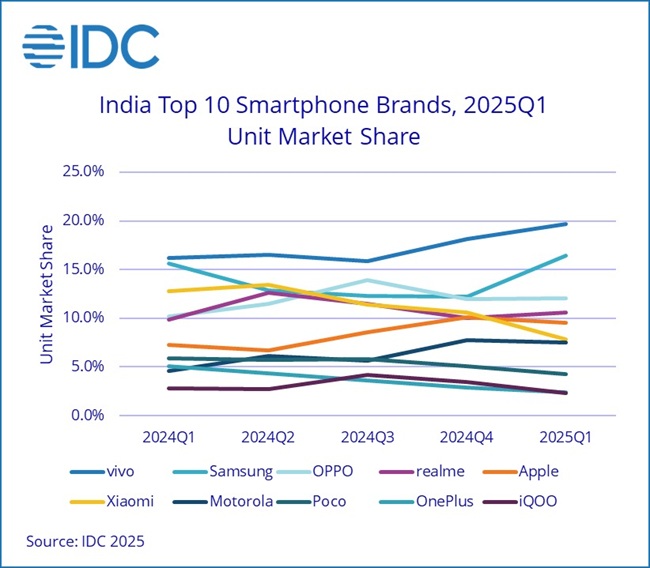

India’s smartphone market recorded a 5.5% year-on-year (YoY) drop in shipments during the first quarter of 2025, reaching 32 million units, according to IDC’s latest Worldwide Quarterly Mobile Phone Tracker. This marks the second straight quarter of shipment decline, driven by weak demand and leftover inventory from late 2024.

Apple logs best Q1 performance; iPhone 16 leads

Among the top five brands, Apple recorded the highest growth with a 23% increase in shipments compared to the previous year. The company shipped 3 million smartphones during the quarter—a record for Apple in Q1 in India. The iPhone 16 was its most popular model, accounting for 4% of total smartphone shipments.

IDC’s Aditya Rampal said that in the early part of the quarter, fewer new models were launched, as brands concentrated on clearing older inventory through “retail support, discounts and price drops.” He added that March saw a rise in new launches across price categories, with brands stepping up “marketing activities to drive demand.”

Segment-wise pricing trends

- The average selling price (ASP) reached US$274, the highest recorded so far, with a 4% year-on-year increase.

- The budget segment (US$100 to US$200) dropped 21.9% in shipments and now accounts for 40% of the market, down from 48% last year.

- The premium segment (US$600 to US$800) grew 78.6% and doubled its market share to 4%, largely driven by iPhone 16, which made up 32% of this segment.

- Mid-premium devices (US$400 to US$600) also saw 74% growth, increasing their share from 3% to 6%, led by the iPhone 13 and Galaxy A56.

5G adoption grows rapidly

A total of 29 million 5G smartphones were shipped in the quarter, with 5G devices now making up 88% of the total market—up from 69% in Q1 2024. The ASP for 5G phones fell by 11% year-on-year to US$300.

- 7% of 5G phones shipped were priced under US$100, supported by new low-cost launches.

- 45% of the 5G shipments came from the US$100–US$200 bracket.

- The top 5G smartphones shipped during the quarter included Apple’s iPhone 16, Xiaomi Redmi 14C, OPPO K12x/A3x, and realme 14x.

Chipset performance: Qualcomm grows, MediaTek declines

Smartphones powered by Qualcomm chipsets saw a 40.8% rise in shipments year-over-year, capturing 31.8% of the market during the quarter. This growth was led by models such as Xiaomi’s Redmi 14C. MediaTek, on the other hand, saw a 25.5% year-on-year decline in shipments, with its share falling from 55.3% to 43.6%.

Offline sales rise as online channels shrink

Offline smartphone sales rose by 10% year-on-year and now represent 58.1% of total shipments. In contrast, online sales dropped 21.1%, bringing their share down to 41.9%, the lowest since Q3 2019. This shift is due to brands investing in omnichannel strategies, expanding into smaller towns and offering better margins and support to offline retailers.

vivo remained the leader in offline sales, followed by OPPO and Samsung. Samsung also led in the online channel, with Motorola second and realme moving up to third place from the previous quarter.

Brand rankings and shifts

Compared to the previous quarter, the top three brands held their positions, while realme climbed to fourth place ahead of Xiaomi, helped by the launch of models from the realme 14, Narzo 80, and P3 series; the highest overall growth was seen by Nothing, with Google and Motorola following behind.

Market forecast and manufacturing outlook

IDC expects India’s smartphone shipments to see only low single-digit growth in 2025, though the market’s value may grow at a mid-single-digit rate due to rising ASPs.

According to the report, brands will aim to strengthen their offline presence while maintaining digital sales, introduce more financing options to improve affordability, focus on the entry-premium segment (US$200 to US$400), and push generative AI features across multiple price tiers.

Upasana Joshi, Senior Research Manager at IDC Asia Pacific, said that India is increasingly being considered a global manufacturing destination amid geopolitical risks. She added that scaling local production through Indian contract manufacturers will be important in transforming India into a global smartphone manufacturing hub.