According to Counterpoint Research’s latest Global Smartwatch Model Tracker, global smartwatch shipments experienced a decline of 1.5% year-over-year in the first quarter of 2023. This decline comes after a growth of 12% year-over-year in 2022.

Global Smartwatch Shipments Experience YoY decline in Q1 2023

According to the latest report from Counterpoint Research, global smartwatch shipments witnessed a year-over-year decline in the first quarter of 2023.

This marks the second consecutive quarter of decreased shipments, primarily attributed to reduced demand from major players such as Apple and Samsung. The global financial pressures also dampened consumer sentiment, further impacting the market.

India’s Strong Growth Curbs the Decline

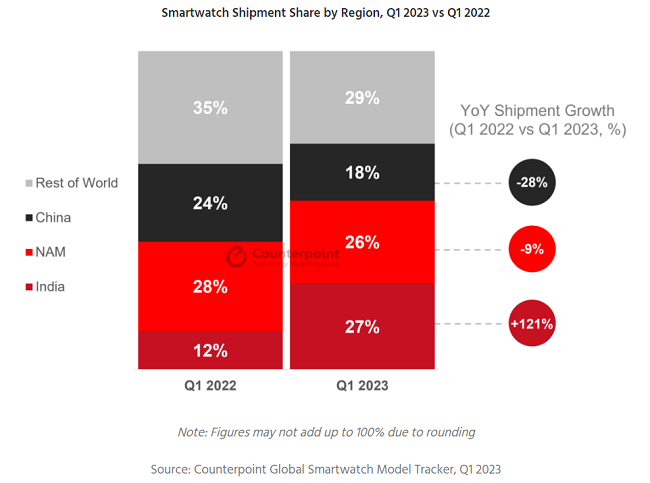

In contrast to the overall trend, India managed to achieve impressive growth in smartwatch shipments, experiencing a remarkable 121% increase. This growth played a significant role in limiting the decline in global shipments. As a result, India regained its position as the top region, surpassing North America, with a 27% share of global smartwatch shipments.

Market summary: Global Smartwatch Model Shipment & Revenue Tracker, Q1 2023

- Apple’s sales slump: The tech giant sold 20% fewer watches in Q1 2023 than in Q1 2022, falling below 10 million units for the first time in three years. Its market share dropped from 32% to 26%, as the economic crisis made its products less affordable. The new Apple Watch Series 8 failed to match the popularity of its predecessor.

- Fire-Boltt’s rise: The Indian brand became the second-largest watch seller in the world, tripling its shipments from last year and growing by 57% from last quarter. It benefited from the booming demand in its home market, where it competed with other local brands like Noise and boAt.

- Samsung’s mixed performance: The Korean company increased its shipments by 15% in North America, its main market, but lost ground in other regions. Its global shipments fell by 15% year-on-year and 21% quarter-on-quarter.

- HUAWEI’s resilience: The Chinese giant faced a 14% decline in its domestic market, where it is a dominant player. However, it expanded its presence in India, LATAM and MEA, reducing its overall global decline to 9%. It reused models from China for the international market.

Shift in Smartwatch Consumption Trends

The global smartwatch market, previously characterized by robust growth, has entered a period of stagnation since the end of last year when it recorded an 8% YoY decline in Q4 2022. The market has undergone a transformation in terms of consumption trends.

The proportion of HLOS smartwatches with high performance and high price, mainly from Apple and Samsung, dropped from 60% to 53% between Q1 2022 and Q1 2023.

Rise of Basic Smartwatches and Replacement of Smart bands

On the other hand, the market share of basic smartwatches witnessed a significant increase, rising from 23% to 34%. This growth was primarily driven by the rapid expansion of the Indian market.

Despite the overall decline in smartwatch shipments, there was substantial demand for affordable products that provide satisfactory performance. These lower-end smartwatches also absorbed or replaced the existing smart band market.

China’s Market Contraction

China’s smartwatch market experienced a substantial contraction of 28% compared to the previous year. The country’s economy displayed a slower recovery than anticipated, resulting in this significant decline.

This contraction represents the sharpest among the major regional markets and the lowest quarterly shipments since the outbreak of COVID-19 in Q1 2020.

Commenting on the report, Senior Analyst Anshika Jain, Counterpoint, said:

The smartwatch market in India soared by 121% year-on-year in Q1 2023, fueled by low prices, high demand and a wide range of options in the budget segment. The <INR 2,000 (<$25) price band accounted for 40% of the total shipments, its highest share ever. Indian players dominated the market with over 90% share, as they quickly updated their portfolios and tailored their products to customer needs at an affordable price point.