India’s smartphone market saw a 7% year-on-year (YoY) drop in Q1 2025, according to CyberMedia Research’s (CMR) India Mobile Handset Market Review Report. The decline is attributed to changing user preferences and growing competition. However, demand for premium, 5G-enabled, and AI-ready smartphones continued to rise.

5G Smartphones Gaining Ground

5G devices made up 86% of total smartphone shipments in Q1 2025, growing 14% YoY. Affordable 5G phones in the Rs. 8,000–Rs. 13,000 range saw over 100% YoY growth, highlighting growing interest in budget-friendly 5G options.

CMR analyst Menka Kumari highlighted that the under-Rs. 10,000 5G segment grew by over 500% YoY, driven by brands like Xiaomi, POCO, Motorola, and Realme. She noted this reflects a “strong consumer appetite” for affordable 5G, while the 2G feature phone segment fell 17% YoY and 4G feature phones dropped 66% YoY.

The sub-Rs. 7,000 smartphone category grew slightly by 3% YoY. However, the Rs. 7,000–Rs. 25,000 value-for-money segment slipped 6% YoY, showing continued shift toward higher-end phones.

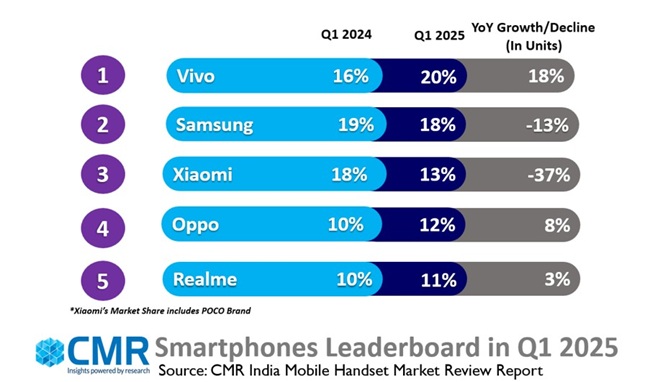

Market Leaders and Trends in Q1 2025

- vivo led the smartphone market with a 20% share, with its 5G models—vivo Y29, T3 Lite, T3X, and T4X—accounting for 43% of its 5G shipments.

- Samsung held second place with 18% overall share but saw a 13% YoY decline in the mid-range segment. The S25 Ultra helped sustain its premium Android presence.

- Xiaomi dropped to third with 13% share, marking a 37% YoY fall—the steepest among top brands—mainly due to struggles in the budget and mid-range segments.

- OPPO achieved 12% share, growing 8% YoY. The OPPO A3X, K12X, and A3 Pro led its growth.

- motorola posted 53% YoY growth, supported by its hardware-software differentiation and strong 5G lineup. It has recorded double-digit growth in six of the past seven quarters.

- Transsion Group saw a 13% YoY decline, pressured by aggressive pricing from rivals in the budget segment.

- Nothing grew over 200% YoY, with the Phone (3a) and Phone (3a) Pro adding nearly 20% to its Q1 sales mix.

Chipset Market

- MediaTek dominated overall chipset shipments with 46% share.

- Qualcomm led in the premium segment (above Rs. 25,000) with 35% market share.

Apple in India

Apple recorded 25% YoY growth with 8% market share in Q1 2025. Demand for the iPhone 16 series, including the iPhone 16e, boosted its performance. Its share rose 28% YoY in the Rs. 50,000–Rs. 1,00,000 segment, and 15% YoY in the Rs. 1,00,000+ category.

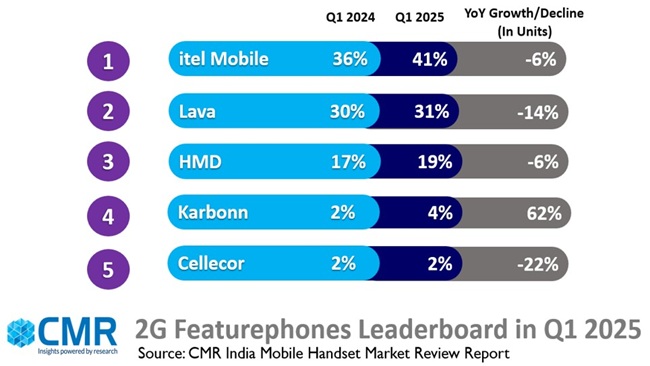

Feature Phone Market

In 2G feature phones, itel led with 41%, followed by Lava at 31%, and HMD at 19%.

Outlook for 2025

CMR expects the market to grow in single digits this year. Prabhu Ram, VP at CMR, said the future will be driven by affordable 5G, AI adoption, and supply chain localization.

Ram added that brands depending only on price advantage in the mid-range segment may lose relevance, as the premium segment accelerates with AI. He also noted that India is becoming a vital player in the global smartphone supply chain due to changing geopolitical dynamics and local manufacturing growth.