India’s smartphone shipments experienced a 3% Year-on-Year (YoY) decline in Q2 2023 (April-June) as per Counterpoint’s Monthly India Smartphone Tracker.

While this marked the fourth consecutive quarterly decline, the rate of decline reduced significantly compared to Q1, which saw a 19% decline.

According to Counterpoint, the market performed better than expected due to factors like the base effect, pent-up demand, and an improvement in macroeconomic conditions.

Premium Smartphone Segment Records Remarkable Growth

Contrary to the overall decline, the premium smartphone segment showed exceptional growth in Q2, with a staggering 112% YoY increase, contributing a record 17% to the overall shipments.

Counterpoint previously reported that global smartphone shipments also declined in Q2 2023, by 8% YoY and 5% Quarter-on-Quarter (QoQ).

Market Leaders and Competitive Analysis

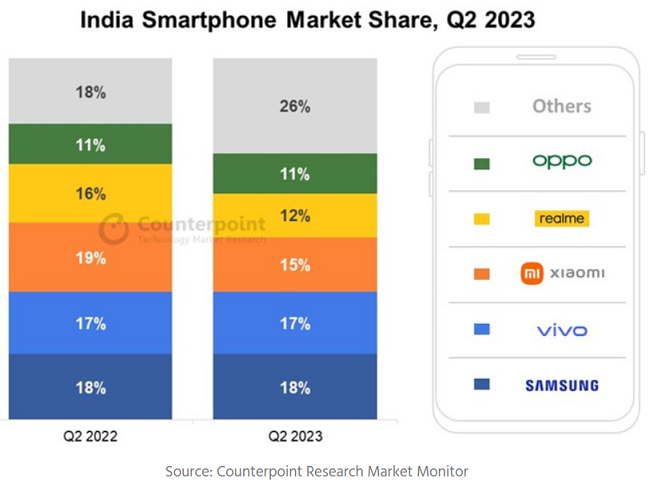

Samsung held its top position in the Indian market for the third consecutive quarter with an 18% market share and surpassed Apple in the premium segment with a 34% share.

However, Apple continued to lead in the ultra-premium segment (>INR 45,000 or ~$549) with a 59% market share. India has now become one of the top five markets for Apple.

vivo and OPPO’s Growth Strategies

vivo secured the second spot in the overall market and was the only brand among the top five to experience YoY growth. OPPO, on the other hand, focused on expanding its shipments in the higher-tier segments, becoming the leading brand in the upper mid-tier range (INR 20,000-INR 30,000 or ~$244-$366). OnePlus emerged as the fastest-growing brand in Q2 with 68% YoY growth.

Other Growing Brands

Apart from the market leaders, other notable brands that saw growth in Q2 2023 were Apple (56% YoY), Transsion (34%), Lava (53% YoY), and Nokia (6% YoY).

India’s Q2 2023 Smartphone Market Insights:

5G Smartphone Growth: 5G smartphone shipments in India surpassed 100 million cumulative units in Q2 2023, witnessing a remarkable 59% YoY growth, driven by the expansion of 5G networks and affordable device options.

Premiumization Trend: The premium smartphone segment experienced a rapid growth of 112% YoY, attributed to a value-based incentive system, aggressive promotions, financing schemes, and a focused approach by OEMs.

Channel Dynamics: Offline channel share is on the rise and is projected to reach 54% in 2023. Online-centric brands like Xiaomi, realme, and OnePlus are expanding their offline presence to enhance customer engagement, while Samsung and Apple are also increasing their offline footprint to cater to diverse consumer preferences.

4G Feature Phone Growth: 4G feature phones gained traction, accounting for 10% of overall feature phone shipments in Q2 2023, driven by launches like JioBharat and itel Guru series. This share is expected to reach 18% by the end of 2023, supported by growing demand and efforts from Reliance.

Inventory Levels: Xiaomi and realme successfully cleared most of their inventory through sales and promotions, resulting in the market exiting Q2 2023 with eight weeks of inventory.

Commenting on the market dynamics, Senior Research Analyst Shilpi Jain, Counterpoint, said:

During Q2 2023, OEMs experienced an improvement in inventory and demand due to the upcoming festive season. They took aggressive measures, including sales and promotions, to clear existing inventory. Consumers benefited from falling inflation and better growth prospects, leading to a recovery in demand. The launch of 5G devices in the INR 10,000-INR 15,000 segment also played a major role. We anticipate that brands will offer attractive launches and deals during the festive season, with 5G being a significant growth driver.