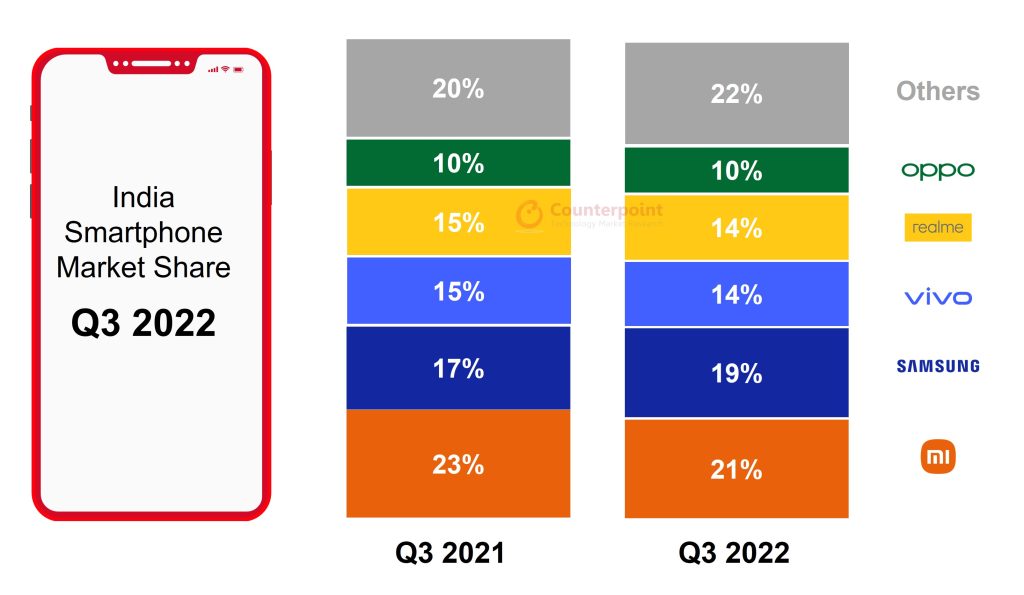

According to the most recent Counterpoint Market Monitor data, smartphone shipments in India fell 11% year-on-year to over 45 million units in Q3 2022 (July–September). The YoY fall, the first for a third quarter, can be attributed to a high base last year due to pent-up demand in Q3 2021 as well as reduced consumer demand in the entry-tier and budget segments in Q3 2022.

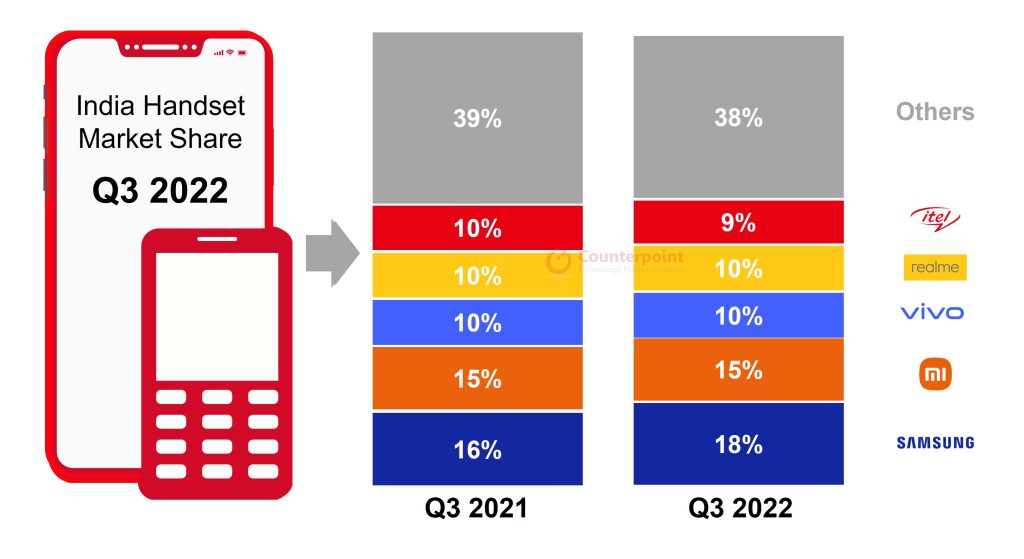

In the third quarter of 2022, the market for mobile handsets in India, which includes both smartphones and feature phones, fell by 15% year over year. The market for feature phones experienced a year-over-year fall of 24% as a direct result of unfavorable macroeconomic conditions continuing to have an effect on consumers at the bottom of the pyramid.

Itel dominated the feature phone market in India in the third quarter of 2022, holding a share of 28%. Itel has been the most successful brand of feature phone for the past two and a half years running. To recall, “Made in India” smartphone shipments grew 16% YoY in Q2 2022.

Counterpoint Research Market Monitor, Q3 2022

- Xiaomi led the Indian smartphone market in Q3 2022, despite shipments falling 19% year over year. Weak entry-level consumer demand caused this drop. Xiaomi will launch 5G smartphones under INR 20,000 in Q3 2022.

- Samsung placed second in Q3 2022. It was the only top-five smartphone brand to expand annually. With 18% of the handset market, Samsung also led. India’s top 5G smartphone brand was it. It led the INR 10,000–INR 20,000 price category because of the Galaxy M and F series handsets’ outstanding success.

- vivo placed third despite a 15% YoY drop in shipments. During the quarter, vivo maintained its third place by focusing on the budget category with the Y01 and Y15s in offline sales, updating the V series, and growing its online presence with iQOO and T-series devices. In Q3 2022, the Y01 sold second in India.

- realme stayed fourth in Q3 2022 with 14% share posting 2% QoQ growth. realme had three of the top 10 INR 10,000–INR 15,000 models. Realme’s C series drove Q3 2022 shipments with 55% of its portfolio.

- Despite a 7% YoY fall in Q3 2022, OPPO remained fifth in India’s smartphone market. High-end OPPO shipments are rising. OPPO’s portfolio was 15% above INR 20,000 in Q3 2021 and 22% in Q3 2022. The Reno 8 Pro re-entered the ultra-premium sector (over INR 45,000).

- Transsion Group brands Itel, Infinix, and TECNO took 12% of India’s handset market to rank third. The A23 Pro and A27 helped collectively capture 56% of the sub-INR 6,000 smartphone market. The Spark Go 2022 and Pop 5 LTE drove TECNO to third place in the sub-INR 8,000 smartphone sector.

- A robust channel push ahead of the festive season helped Apple earn its largest smartphone market share of 5% in India during the quarter. The iPhone 13 was India’s first quarter-topping smartphone. Apple shipped 40% of premium smartphones (INR 30,000).

- Nothing launched its first smartphone this quarter and captured premium segment mindshare and market share.

- Google’s Pixel 6a did well in August and September in the premium sector.

Commenting on the market dynamics, Senior Research Analyst Prachir Singh said,

Consumer demand started increasing in August and peaked in the last week of September during the festive sales, especially in the mid-tier and premium segments. However, as the market exited Q2 2022 with high inventory, and there was modest demand in the entry-tier and budget segments, we saw less than expected shipments during Q3 2022. Almost all the brands were impacted, especially in the entry-tier and budget segments. The unfavorable macroeconomic conditions will continue to affect the Indian smartphone market in Q4 2022 as well, especially after Diwali. However, we may witness a demand uptick during the year-end sales.