According to preliminary figures from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, global smartphone shipments fell 9.7% to 301.9 million units in 3Q22. As economic uncertainty continues and global demand drops, smartphone shipments fell for the fifth quarter in a row. This was the worst drop ever for the third quarter. Remember that global smartphone shipments declined 8.7% YoY in Q2 2022.

All areas except Central and Eastern Europe are anticipated to decline in 3Q22 and for the year. China’s quarterly fall should remain at just over 12%. That affects worldwide results due to China’s size.

Developed markets like North America, Western Europe, and Japan will do substantially better. However, this still indicates low to mid-single-digit drops. Asia/Pacific, Latin America, the Middle East, and Africa should witness double-digit reductions.

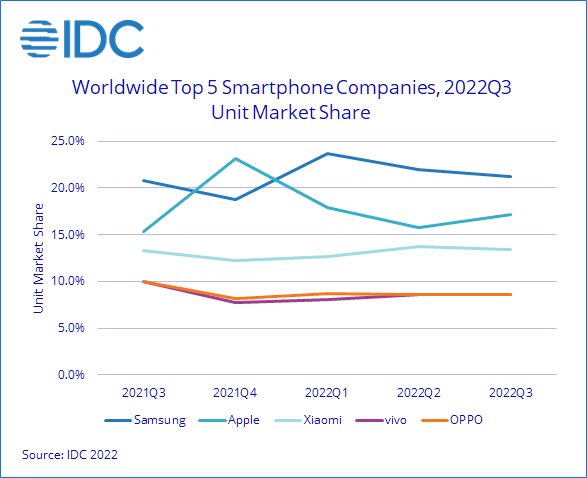

All major vendors declined year-over-year except Apple. Vivo and OPPO had double-digit declines, while Samsung and Xiaomi saw single-digit declines. Despite the tough situation, vendors’ posture remained unchanged. Samsung had a 21.2% share, Apple 17.2%, and Xiaomi 13.4%. With an 8.6% share, vivo and OPPO tied for fourth place in the quarter.

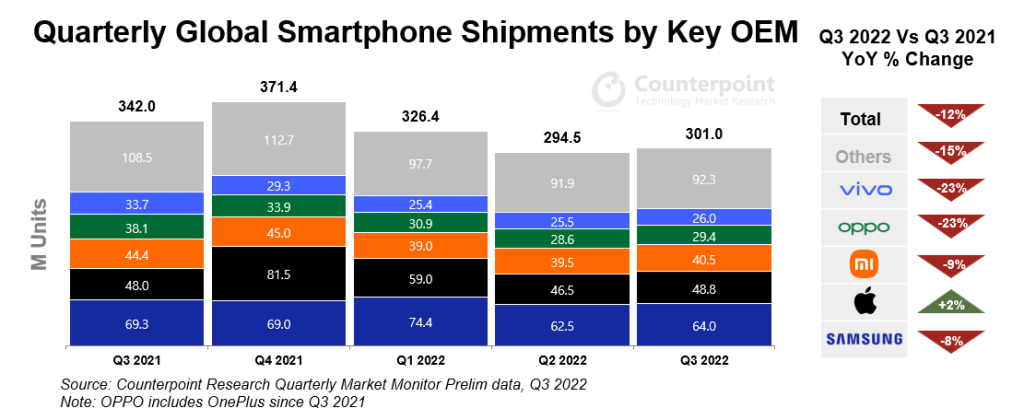

In Q3 2022, Counterpoint’s Market Monitor service reported that global smartphone shipments fell 12% year-over-year to 301 million devices. Even though Apple and Samsung had a slightly better quarter, the smartphone market was hurt by ongoing political tensions and economic instability around the world.

Samsung’s shipments dropped 8% YoY in Q3 2022 despite record presales of its premium foldable and flip devices. Consumer attitude in several important markets is to blame. Top Chinese brands, who were getting rid of surplus inventory and managing a slowdown in China, had lower exports than the previous year. They gained their share after Apple and Samsung left the Russian market.

Key Takeaways

- In Q3 2022, the worldwide smartphone market fell 12% YoY but gained 2% QoQ to 301 million devices.

- Apple and Samsung’s quarterly growth lifted the global smartphone market past 300 million units, a milestone it failed to attain last quarter, but political and economic volatility lowered consumer sentiment.

- Apple has been the only top-five smartphone brand to expand YoY, boosting shipments by 2% and market share by two percentage points to 16%.

- Samsung’s shipments fell 8% YoY but rose 5% QoQ to 64 million.

- Xiaomi, OPPO (which includes OnePlus), and vivo all came back after China put restrictions on them in Q2, and they gained market share when Apple and Samsung left Russia.

Commenting on the report, Nabila Popal, research director with IDC’s Worldwide Tracker team, said,

A majority of the decline came from emerging markets where lack of demand, rising costs, and inflation impacted consumers with lesser disposable incomes. With high inventory coming into the quarter, shipments and orders by OEMs were further reduced in an attempt to deplete inventory. Although Chinese vendors continue to suffer the most, all vendors were impacted, including Samsung and Apple. While Apple is the only vendor to deliver positive growth this quarter, it still faced challenges as its growth was stunted in many markets, including China, due to the poor macroeconomic situation. Looking to 2023, the market’s expected recovery, which we continue to believe will happen, will be pushed further into the year. Moreover, we now expect a steeper shipment decline for 2022 and a softer recovery in 2023.

Associate Director Jan Stryjak, Counterpoint research, noted,

With the full force of the latest iPhone launch being felt in Q4, we expect further quarterly improvement in the coming quarter, although central banks’ attempts to control inflation will further reduce consumer demand. The channel inventory is still higher, and the OEMs will focus on getting rid of excess inventory in Q4 as well. Hence, shipments are unlikely to reach last year’s levels, let alone pre-pandemic Q4 levels of over 400 million units. Looking further ahead into 2023, we expect sluggish demand with lengthening replacement rates, especially in the first half of the year.