According to the latest analysis from Counterpoint’s IoT service, India’s TWS (True Wireless earphones) market grew 66% year over year in Q1 2022. Local brands were able to outperform Chinese vendors thanks to their outstanding value proposition. The growth of the market was also helped by aggressive celebrity endorsements and domestic production.

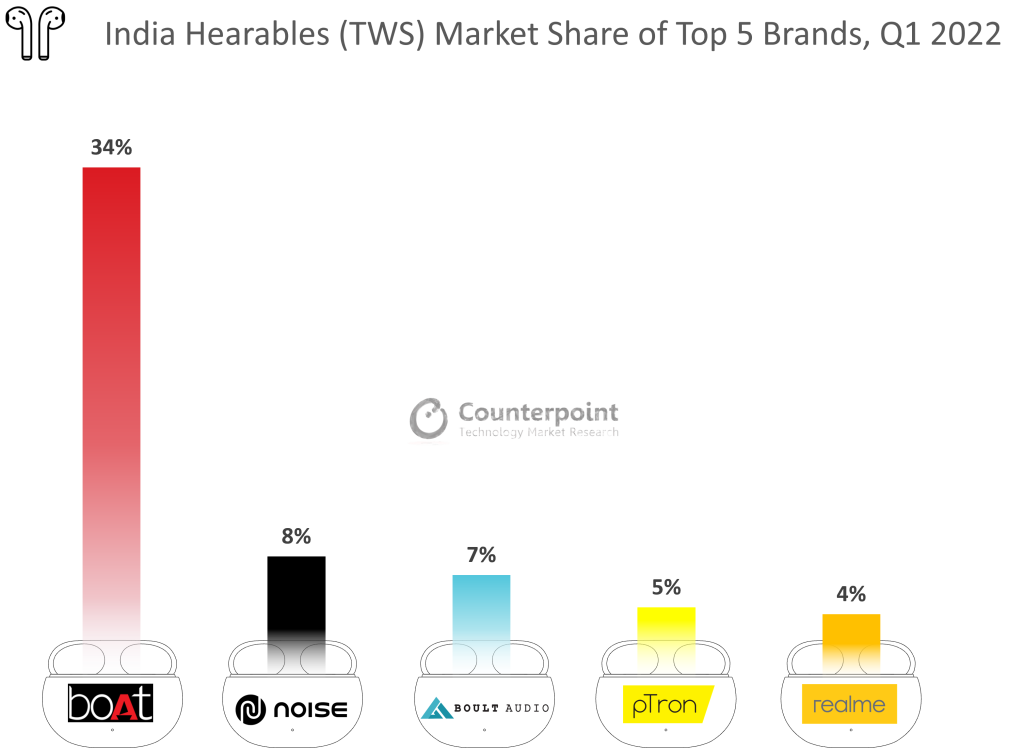

In Q1 2022, Indian brands had a 72% share, up from 57% in Q1 2021. Indian brands dominated the top five positions. BoAt led the market with a 34% share, whereas Noise took second place for the second quarter. Boult Audio, the third-largest TWS brand, hit 7%. In Q1 2022, 10 new brands emerged. Domestic manufacturing was down 14%. In Q1 2021, it was insignificant. 8/10 models are sold online, with Flipkart leading the outlets.

India TWS Market Summary: Q1 2022

- boAt topped the market for the eighth consecutive quarter in Q1 2022, backed by new launches, celebrity endorsements, and promotions. The most popular TWS earbuds were the Airdopes 131, which made up 32% of the brand’s line.

- The Noise brand came in second place, with a 214% YoY increase driven by various sales activities and a new edition in the low-cost VS series. The brand’s best-selling TWS model was the Noise Airbuds small, which made up 38% of the brand’s whole line.

- Boult Audio grew 266% year-on-year to 7% share. It mainly targets low-cost customers and has gradually grown its TWS products. This quarter, the brand played an active role in the Amazon Great Republic sale.

- PTron climbed to fourth with a 5% share thanks to its solid entry-level price range (around INR 1,000 or $13). Its expansion was fueled by low prices, home manufacturing, and a wide range of options.

- realme ranked fifth among the top TWS brands with a 4% market share; this was accompanied by the Buds Air 2 and Q2 Neo.

Top Emerging Brands in Q1 2022

- Mivi, a full-fledged domestic brand, stayed in the top 10 owing to lower-priced devices.

- OPPO increased by 365% year on year thanks to the Enco Buds, Enco W11 low-cost variants, and the Buds Air 2 mid-range model.

- After the Buds Z model was a huge hit, OnePlus added the Buds Z2 to its mid-priced TWS line.

- With the recent release of the Airpods 3, Apple has taken the top spot among elite brands.

- Nothing stayed in the top five luxury brands because it was cheaper and had a unique design.

- In Q1 2022, online-only local brand Truke increased 75% YoY. Endorsements, new models every quarter since Q2 2021, as well as entry-level products, all assisted in its steep increase.

Commenting on the overall market, Senior Research Analyst Anshika Jain said,

Indian brands’ shipments more than doubled in Q1 2022 to capture 72% share in the overall India TWS market. The top four positions were taken by India-based brands, which captured more than half of the total TWS market. Indian brands put more emphasis on targeting the low-price tier (less than INR 2,000 or $26) and forming partnerships to market their devices.

We expect brands to go aggressive in the second half of this year to introduce made-in-India devices. boAt is expected to locally manufacture more than half of its total portfolio in the coming period. Other top players like Noise and realme are also expected to release locally-made devices within the first half of 2022.

Talking about premium TWS market growth, Senior Research Analyst Liz Lee said,

The premium segment (more than INR 5,000 or $65) registered 53% YoY growth in Q1 2022 led by Apple, Samsung and Sony. Sony was the fastest growing brand in the premium segment, having refreshed its portfolio with two new devices. In terms of models, the Samsung Galaxy Buds 2, Sony WF-C500, Nothing Ear 1, Apple Airpods Pro and Airpods 3rd Generation were the best TWS devices in the premium segment.