Smartphone market in India crossed the 30 Million unit shipments milestone for the first time ever in a quarter in CY Q3 2016, according to the International Data Corporation’s (IDC) Quarterly Mobile Phone Tracker. The market continued its healthy traction with 11 percent YoY growth.

Smartphone shipments clocked 32.3 million units in CY Q3 2016 with 17.5% growth over the previous quarter, said IDC. Karthik J, Senior Market Analyst, Client Devices, IDC India attributed the growth in shipments due to the festive season, mega online sales and early import of smartphones owing to Chinese holidays in October.

Online share of smartphone increased to 31.6% with impressive 35% Quarter-on-Quarter (QoQ) growth due to strong performance by key online players primarily from China-based vendors. Also, closing weeks of the quarter witnessed incremental supplies as many vendors were preparing their inventories for the online festival sales in October. Lenovo Group continues to lead online channel followed by Xiaomi. Karthik said that Lenovo Group accounted for almost one-fourth of total online smartphone shipments driven primarily by Lenovo’s K5 series and Motorola’s G4 series models. Meanwhile Xiaomi’s Redmi Note 3 and newly launched Redmi 3S fueled the online shipments to a large extent.

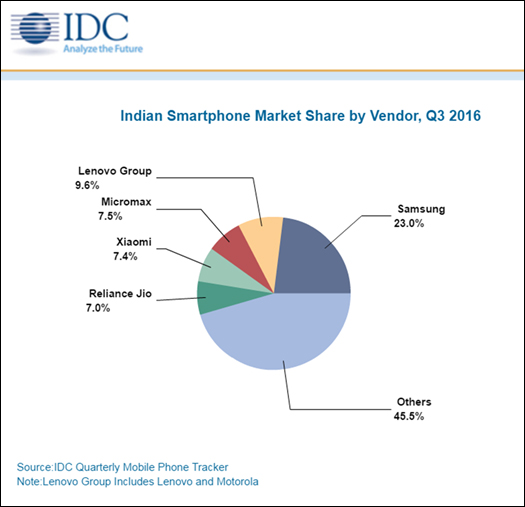

4G smartphone shipments grew 24.8% over previous quarter in CY Q3 2016. Rollout of Reliance Jio network has further increased the share of 4G enabled smartphones in India. 7 out of 10 smartphone shipped in Q3 2016 were 4G enabled and 9 out of 10 smartphone sold by e-tailers were 4G. Samsung lead the Indian smartphone market with 23% share with 8% sequential growth and 9.7% growth from the same period last year. Lenovo, Micromax and Xiaomi had a market share of 9.6%, 7.5% and 7.4% respectively.

Jaipal Singh, Market Analyst, Client Devices, IDC India said,

Mobile vendor ecosystem is going through a multi-dimensional transition. Continuous investment from China based vendors on retail expansion and high decibel marketing has led to disruption in the plans of home-grown vendors to some extent. To remain relevant, home-grown vendors are counting on the feature phone market even though they are facing certain supply issues for a few components. Also, vendors are relooking at the channel strategy by getting lower tier distributors on-board, positioning more staff at storefronts and adopting the right mix of products in both online and offline channels.

We expect 2016 to end with a higher single digit annual growth, considering the smartphone performance till CY Q3 2016. “Entry of the new vendors have extended the feature phone supply since past few quarters. However, with expected entry of Jio in the feature phone market, category is expected to grow significantly. This in turn might further slowdown the feature phone to smartphone migration.