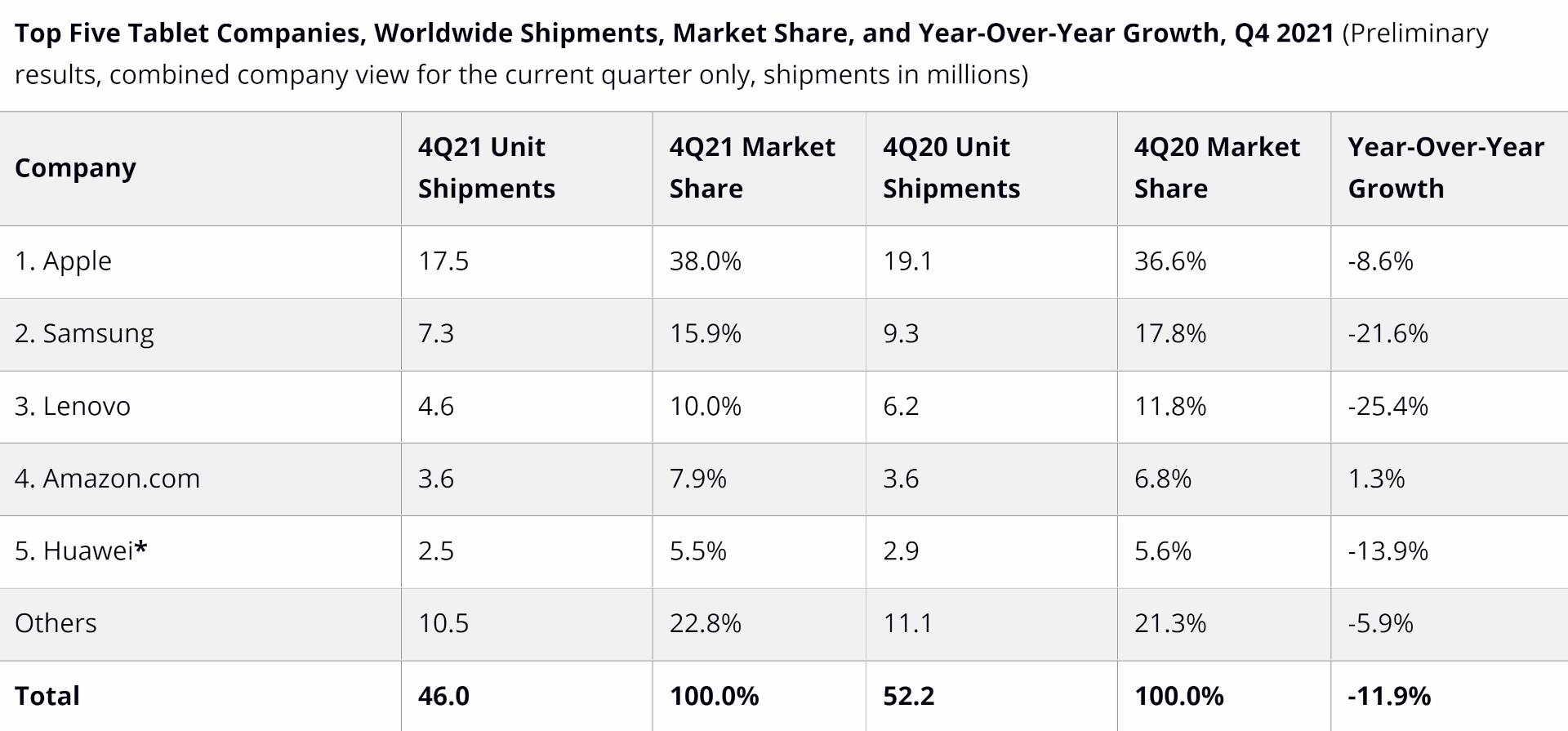

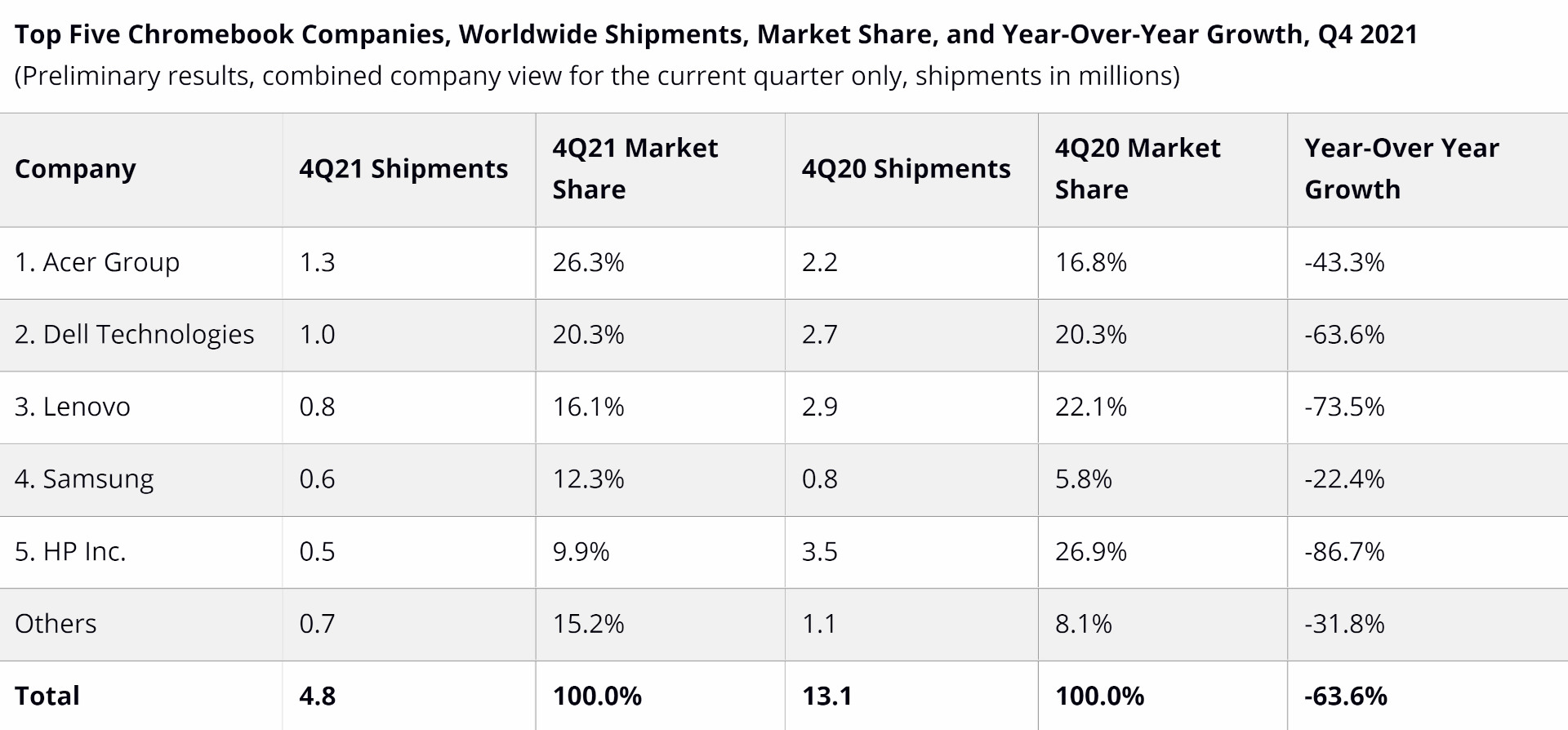

The worldwide smartphone market shipped a total of 46 million units during the fourth quarter of 2021, declining 11.9% YoY. For the entire year, the market shipped 168.8 million units, which is the highest since 2016. Chromebooks on the other hand declined 63.6% YoY during Q4 2021, but managed to grow 13.5% for the entire 2021 year.

To no one’s surprise, Apple led the tablet market in terms of devices shipped both during Q4, 2021 and also for the entire 2021 year. During Q4, 2021, Apple shipped 17.5 million units which calculates to a decline of 8.6%, and during the entire year, they shipped 57.8 million units, which calculates to a 8.4% YoY growth.

Samsung came in 2nd place with 7.3 million units shipped in Q4 2021, and 30.9 million units shipped in 2021. Lenovo took third place with 4.6 million units shipped during Q4 2021, and 17.7 million units shipped in 2021. Lenovo in particular grew 19.2% YoY during the entire year of 2021. Next was Amazon.com shipping 16.1 million units in 2021, followed by HUAWEI, who shipped 9.7 million units in 2021.

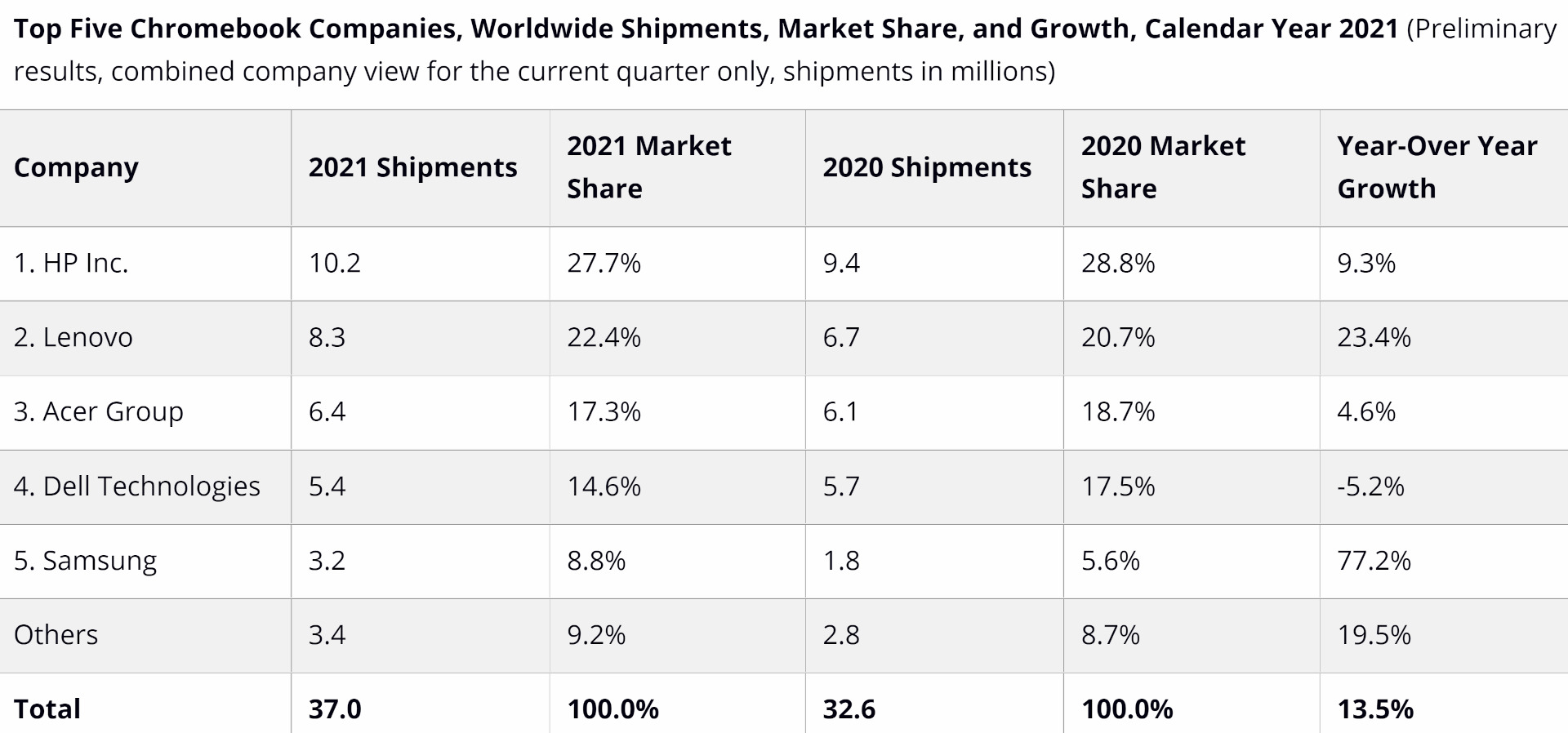

Regarding chromebooks, HP continued to lead the market with 10.2 million units shipped and growing 9.3% YoY. Lenovo shipped 8.3 million units with a healthy growth of 23.4%, and Acer followed them with 6.4 million units shipped and 4.6% YoY growth.

The entire market saw declines across the board during Q4 2021. Acer, who took the first spot, shipped 1.3 million units in 2021, which is a decline of 43.3% YoY, followed by Dell, who shipped 1 million units and declining 63.6% YoY. Lenovo came in 3rd place with 0.8 million units shipped and declining 73.5% YoY.

Commenting on the tablet market, Anuroopa Nataraj, senior research analyst with IDC’s Mobility and Consumer Device Trackers said:

Though 2021 was a great year for the tablet market, shipments have begun to decelerate as the market has moved past peak demand across many geographies. However, shipments in the near future will remain above pre-pandemic levels as virtual learning, remote work, and media consumption remain priorities for users.

On the chromebook market, Jitesh Ubrani, research manager with IDC’s Mobility and Consumer Device Trackers said:

Much of the initial demand for Chromebooks has been satiated in primary markets like the U.S. and Europe and this has led to a slowdown in overall shipments. However, Chromebook demand in emerging markets has seen continued growth in the past year. Supply has also been unusually tight for Chromebooks as component shortages have led vendors to prioritize Windows machines due to their higher price tags, further suppressing Chromebook shipments on a global scale.