According to CyberMedia Research’s (CMR) India Mobile Handset Market Review for Calendar Year 2025 (CY2025), the Indian smartphone sector has entered a significant phase of structural transition.

While overall shipments witnessed a marginal decline of 1% year-over-year (YoY), the market demonstrated strong underlying resilience, characterized by a polarization of demand: explosive growth in the affordable 5G segment and sustained appetite for premium devices.

The Democratization of 5G

The most notable trend of CY2025 was the rapid mass adoption of 5G technology. 5G smartphones accounted for 88% of total shipments, a 12% increase from the previous year. This shift indicates that 5G has moved from being a premium differentiator to a standard market default.

This growth was primarily driven by the entry-level segment:

- Budget Surge: The INR 6,000–8,000 price bracket saw 5G shipments surge by over 1900% YoY.

- Drivers: This expansion was steered by aggressive pricing strategies, the increased availability of entry-level 5G chipsets, and the completion of nationwide 5G network coverage.

Evolving Consumer Preferences: Bigger and Longer-Lasting

Consumer hardware preferences largely solidified around media consumption and battery endurance in CY2025.

- Display: Large screens are now the standard, with devices featuring 6.7-inch and larger displays comprising nearly 80% of all shipments.

- Battery: Reflecting heavier daily usage patterns, almost one in three smartphones shipped with a battery capacity of 6,000mAh or higher.

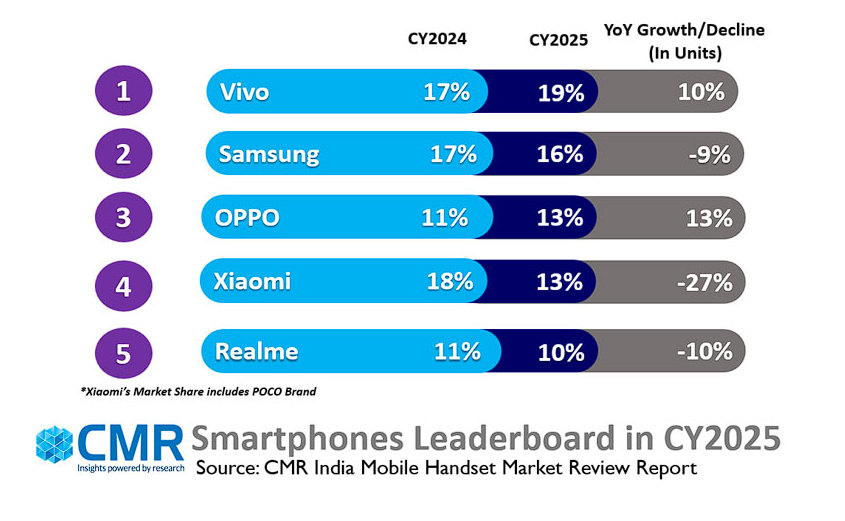

Competitive Landscape: Market Leaders

The competitive hierarchy saw distinct shifts in market share and strategy among the top players.

| Rank | Brand | Market Share | Key Highlights |

| 1 | Vivo | 19% | Market leader for CY2025. Vivo also led the 5G segment (19% share), driven by mass-market execution. The T4X, Y19, Y29, and Y39 models contributed 34% of their 5G shipments. |

| 2 | Samsung | 16% | Maintained the second spot. While volume was steady, the uber-premium segment (>INR 1,00,000) saw 45% YoY growth, fueled by the Galaxy S and Galaxy Z series. |

| 3 | OPPO | 13% | Registered 13% YoY growth. Success was attributed to a refreshed portfolio catering to both value (A3X, A5 Pro) and premium consumers. |

| 4 | Xiaomi | 13% | Saw a 27% YoY decline as the brand faced intensified competition in the premium space and shifting consumer preferences. |

Premium and Niche Growth Stories

Beyond the top four, specific brands carved out significant growth through targeted strategies:

- Apple: The company recorded 25% YoY growth, capturing approximately 9% of the market. The base iPhone 16 model was a standout, accounting for 47% of all 16-series volumes, indicating a strong consumer preference for the value-led base model over Pro variants.

- Fastest Growers: iQOO (+81%), CMF (+78%), and Motorola (+50%) emerged as the fastest-growing players. Their growth was fueled by aggressive offerings in the super-premium segment (INR 50,000 – INR 1,00,000) and channel expansion.

- Lava: Growing 8% YoY, Lava remained one of the few brands to expand in a flat market, relying on steady traction in the affordable segment.

- OnePlus: Despite a 32% YoY decline, the brand maintained volume through its Nord lineup (67% share), with early traction noted for the new 13 and 15 series.

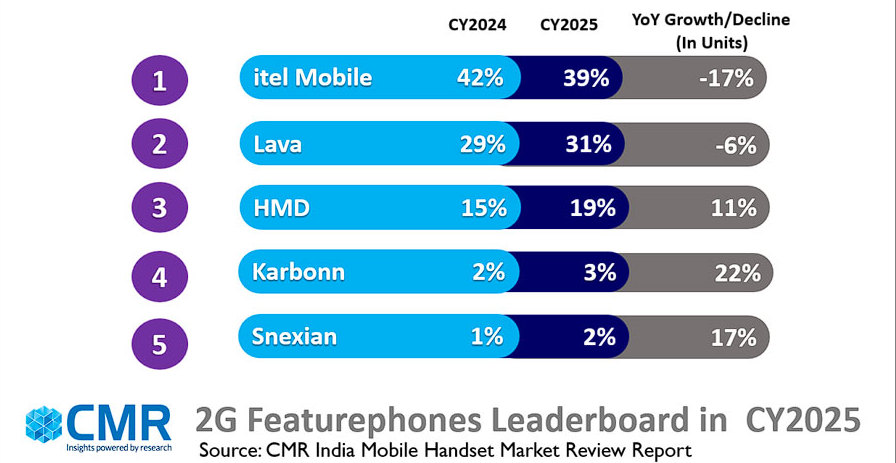

Feature Phone and Component Landscape

The feature phone segment continued its downward trajectory. 2G feature phones declined by 12%, while 4G feature phones dropped by 48%. The market remains consolidated, with Itel (39%), Lava (31%), and HMD (19%) leading the diminishing 2G vertical.

In the chipset arena, MediaTek maintained its dominance with a 45% overall market share. However, Qualcomm retained its stronghold in the premium segment (>INR 25,000), commanding a 34% share.

Future Outlook

Looking ahead, CMR anticipates a single-digit decline for the Indian smartphone market in CY2026. However, analysts expect a demand recovery to materialize throughout the year as current pricing pressures begin to ease.