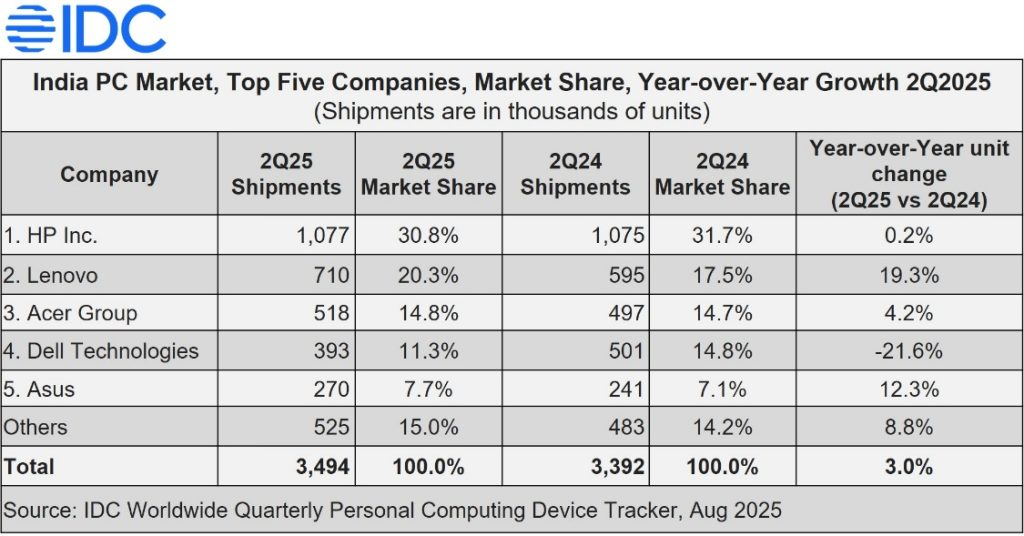

India’s traditional PC market, which includes desktops, notebooks, and workstations, grew 3.0% year-over-year (YoY) in the second quarter of 2025 (2Q25), shipping 3.5 million units and marking the eighth consecutive quarter of growth, according to the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

Key Highlights – 2Q25

- Notebook shipments grew 3.0% YoY.

- Workstation shipments saw a sharp rise of 37.0% YoY.

- Desktop shipments edged up 0.2% YoY.

- Premium notebooks (over US$1,000) declined 6.9% YoY in 2Q25 and 0.5% YoY in 1H25, as vendors prioritized budget-friendly models.

- AI notebooks surged 145.2% YoY in 1H25, with basic AI notebooks making up 88.1% of all AI shipments.

Market Segments – 2Q25

- Commercial PC shipments rose 9.5% YoY, driven by a 21.2% YoY increase in enterprise demand for the quarter and 26.4% YoY in 1H25.

- Consumer PCs fell 3.9% YoY, mainly due to inventory clearance and supply bottlenecks.

- The e-tail (online) channel continued to grow, increasing 1.6% YoY in 2Q25 and 11.7% YoY in 1H25, showing stable online demand.

- Overall, consumer PC demand remained strong across both online and offline channels, with 1H25 growth supported by strategic inventory adjustments.

Bharath Shenoy noted that consumer PC demand remained strong across online and offline channels. Shipments were slightly impacted by aging inventory and vendor delays, with vendors keeping lean stock from July to accommodate fresh inventory for Independence Day in August and the major festive season anticipated from late September.

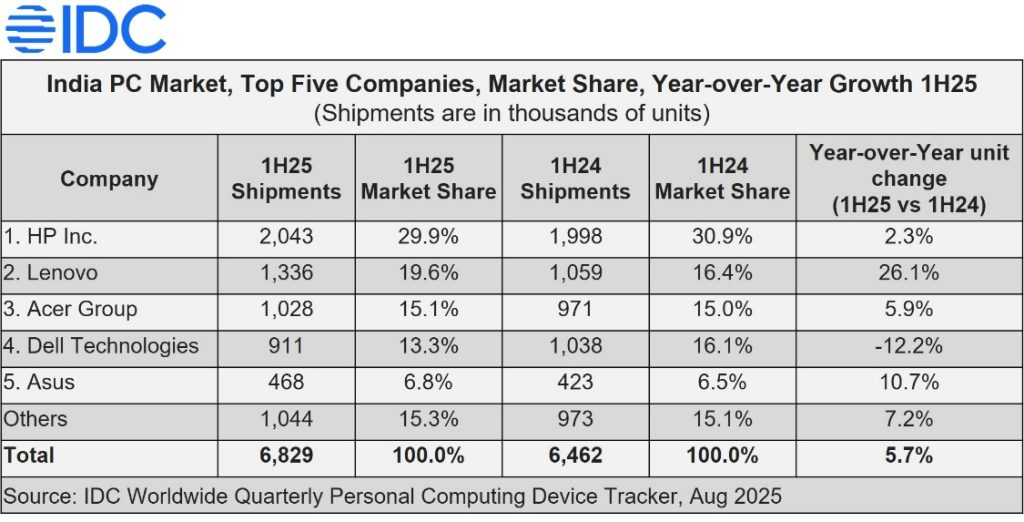

Top 5 PC Vendors in Q2 2025

- HP Inc. remained the market leader with a 30.8% share, topping both consumer and commercial segments. About 35% of its sales came from commercial PCs, fueled by enterprise demand in the IT/ITES sector, while consumer shipments declined 16.8% YoY due to channel inventory adjustments.

- Lenovo captured 20.3% of the market, posting 9.8% YoY growth in consumer notebooks, led by gaming models and strong online sales. Its commercial segment expanded 26.4% YoY, driven by Windows refresh programs in large enterprises and growing SMB adoption.

- Acer Group accounted for 14.8% share, with consumer growth driven by budget-friendly PCs and wider offline reach. The commercial segment, however, fell 11.8% YoY, affected by slower government orders.

- Dell Technologies held 11.3% share, with its commercial business climbing 9.8% YoY from enterprise and SMB demand, while consumer shipments dropped to 2% due to billing delays.

- ASUS reached 7.7% share, with consumer notebooks, especially gaming models, pushing 12.8% YoY growth. Commercial sales increased 7.8% YoY supported by stronger channel presence.

Outlook

Navkendar Singh, Associate Vice President, Devices Research, IDC India, South Asia & ANZ, highlighted that Windows refresh cycles have gained momentum and will continue to drive enterprise demand.

He noted that US tariffs may impact spending, but government projects like ELCOT, along with rising interest in gaming and AI PCs and upcoming etail and festive promotions, will boost commercial procurement and strengthen the consumer segment in the second half of 2025.

IDC projects that upbeat market sentiment and upcoming promotions for gaming and AI PCs will drive robust consumer growth.