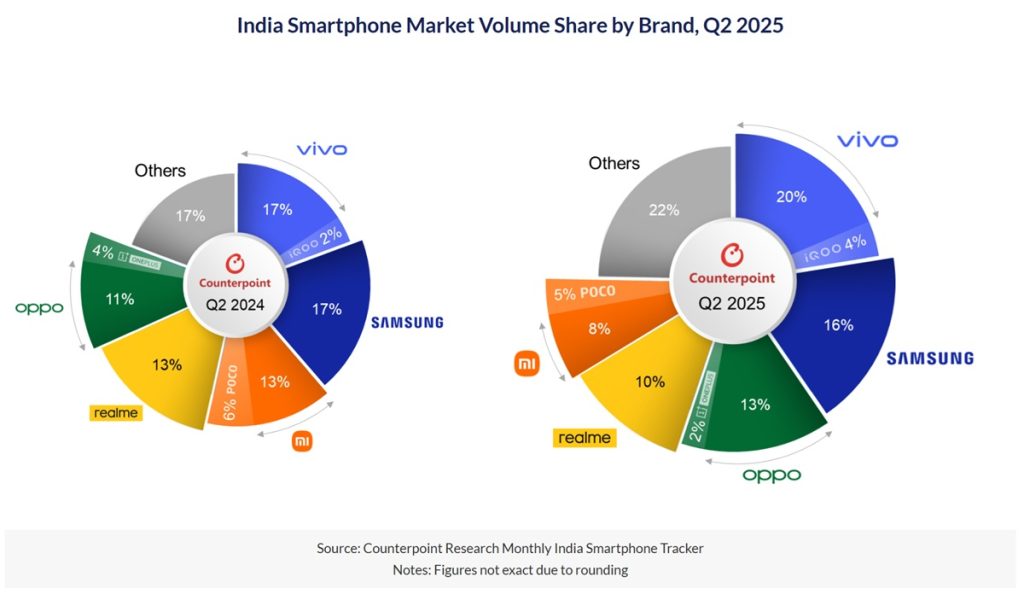

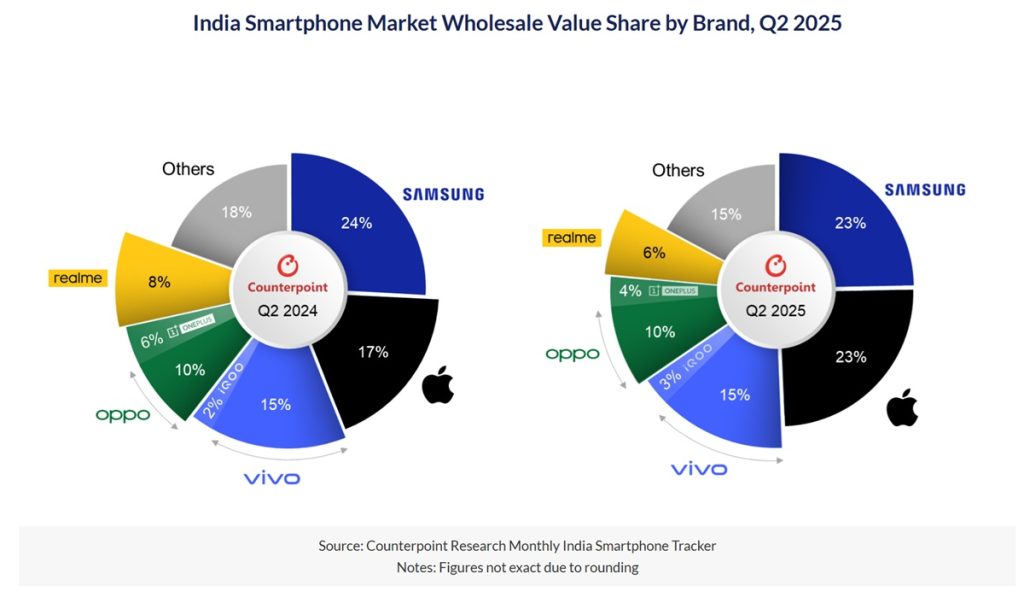

India’s smartphone shipments rose by 8% year-on-year in the second quarter of 2025, with market value increasing 18%, as per Counterpoint’s Monthly India Smartphone Tracker.

The market bounced back strongly after a slow beginning, fueled by a 33% rise in new launches and robust sales aided by aggressive promotions. Discounts, easy EMIs, and bundled deals, especially in mid and premium segments, boosted demand, the report highlighted.

Market Overview: Q2 2025

Senior Research Analyst Prachir Singh attributed the growth to a healthier macroeconomic backdrop, which boosted consumer confidence and spending power.

Prachir Singh mentioned that retail inflation hit a six-year minimum, lightening the load on household expenses. Repo rate reductions made financing easier, while tax reliefs introduced earlier increased disposable income, prompting higher discretionary spending.

Prachir Singh further explained:

- The ultra-premium segment (above INR 45,000) grew 37% year-on-year, outpacing other price brackets.

- This growth propelled the Indian market to its peak Q2 value and average selling price (ASP).

- To tap into this trend, Apple and Samsung offered trade-in deals, interest-free EMIs, and summer discount campaigns.

Brand Performance Highlights

- Nothing achieved a 146% year-on-year shipment increase, fueled by the launch of the CMF Phone 2 Pro and its expanding retail footprint, marking six consecutive quarters of rapid growth.

- motorola saw shipments rise 86% year-on-year, driven by strong demand for its G and Edge models, along with broader availability in smaller towns.

- Lava was the fastest-growing brand in the sub-INR 10,000 segment with a 156% increase, supported by competitive offerings, a clean stock Android interface, and better after-sales service.

- MediaTek dominated the smartphone chipset market with a 47% share, followed by Qualcomm at 31%. Qualcomm’s shipments grew 28% year-on-year.

- The iPhone 16 was the top shipped smartphone in Q2 2025, supported by ongoing promotions, extended EMI options, and improved retail execution, helping Apple achieve its best-ever Q2 shipments in India.

- OnePlus grew its ultra-premium segment by 75% year-on-year, boosted by the success of the 13 and 13R series and the early adoption of the compact 13s.

- With the GT series 7 Pro Dream Edition, realme moved into the ultra-premium space, aiming at younger consumers and increasing offline visibility to drive sales of premium devices.

Competitive Landscape and Future Outlook

Research Analyst Shubham Singh said that a mix of sales events—offline and online—helped clear old inventory and back new launches, while improved retailer incentives and marketing further drove market recovery.

- vivo, excluding iQOO, grew 23% year-on-year, driven by strong demand for the Y and T series in the ₹10,000 to ₹15,000 price segment. The T series helped vivo expand offline reach across retail tiers.

- Samsung retained its position as the second-largest brand, bolstered by aggressive summer promotions on the A and S series and demand for its N-1 flagship upgrades, maintaining momentum in mid to premium segments.

- OPPO (excluding OnePlus) secured third place, with refreshed A5 and K series driving growth. Enhanced retailer engagement and margin improvements supported its offline presence and market recovery.

The report expects India’s smartphone market to continue its upward trajectory through H2 2025, supported by favorable economic indicators, strategic product refreshes, and deeper expansion into offline channels. Brands are expected to focus more on premiumization and value-driven upgrades to sustain the growth momentum.