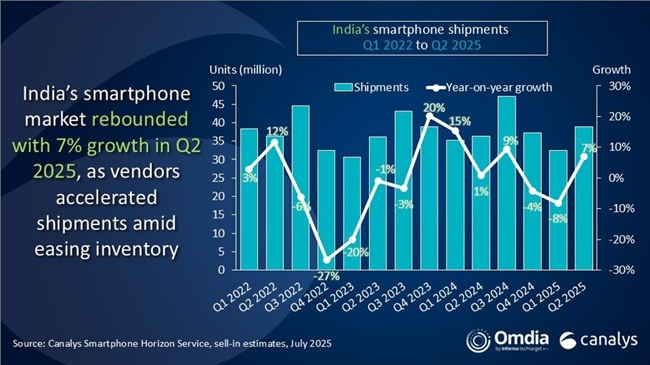

The Indian smartphone sector rebounded in Q2 2025 with shipments reaching 39 million units—a 7% YoY increase compared to the same period last year—reports Canalys, now operating under Omdia. Following a cautious start to the year, the industry benefited from easing stock imbalances and renewed vendor initiatives.

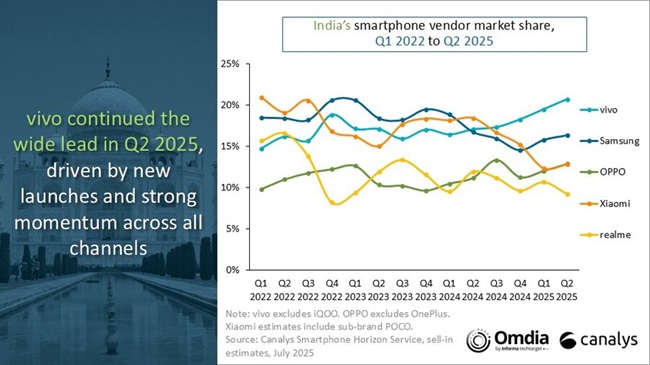

Top Vendors: vivo Leads, OPPO Surpasses Xiaomi

Despite seasonal softness and challenges such as severe heatwaves and ongoing geopolitical tensions, consumer demand rebounded, supported by multiple new device launches, the report said.

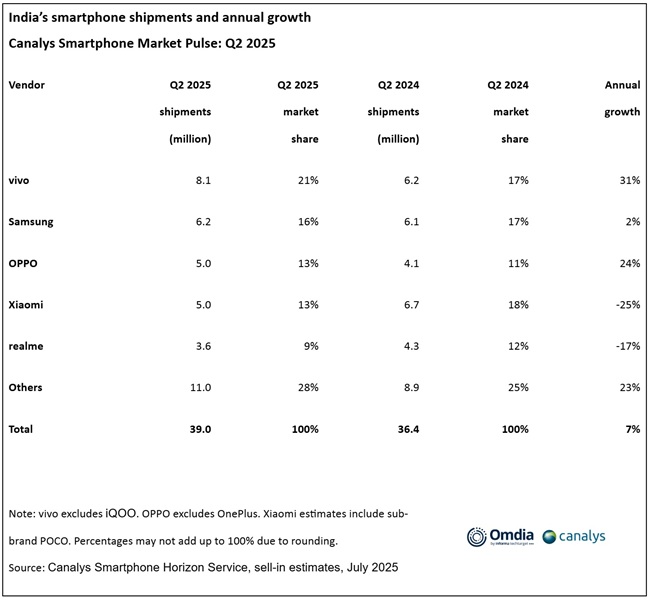

- vivo accounted for 8.1 million unit shipments in Q2 2025, securing a 21% market share, excluding iQOO.

- Samsung was the runner-up with 6.2 million units delivered, capturing a 16 percent share.

- OPPO, not counting OnePlus, shipped five million devices, narrowly beating Xiaomi’s shipment count of five million.

- realme completed the top five with 3.6 million devices shipped.

vivo and OPPO Gain Through Targeted Launches and Channel Support

Canalys Principal Analyst Sanyam Chaurasia observed that vivo’s new offerings resonated well with consumers, especially the V50 lineup, which found favor in primary and secondary urban markets aided by large-format retail and targeted campaign activity.

- The Y-series sustained sales momentum in smaller cities thanks to broad distribution and active promoter engagement.

- Additionally, the T-series expanded its online footprint with a wider model range.

OPPO’s performance was buoyed by offline sales of the A5 range and increasing online interest in the K13 model.

Focused Push Strategies by Samsung, Xiaomi, and realme

Other key players pursued selective marketing:

- Samsung strengthened its mid-tier segment via zero-interest EMI financing plans extending up to 24 months on popular models like the A36 and A56.

- Xiaomi, though down year-on-year, pushed Q2 growth with the Redmi 14C 5G, A5, and a refreshed Note 14 series design.

- realme’s year-over-year volume decreased, but offline sales gains from models such as C73, C75, and 14X accounted for 35 percent of the quarter’s shipments.

Apple, Motorola, Infinix, and Nothing Show Notable Growth

Competition intensified beyond the top five brands:

- Apple held the sixth position with over 55 percent of shipments coming from the iPhone 16 family. Models like the iPhone 13 and 15 remained popular. However, the iPhone 16e faced slower uptake post-launch, attributed to concerns about its single-camera design and limited Apple Intelligence features.

- motorola expanded retail access in smaller urban areas following strong growth in metros.

- Infinix overtook TECNO as TRANSSION’s leading brand in India, responsible for 45 percent of TRANSSION’s 1.8 million unit shipments, driven by bold product designs and marketing targeting gamers and creators.

- Nothing reported an explosive 229 percent year-on-year increase, largely due to urban consumers’ enthusiasm for design-focused models like the CMF Phone 2 Pro, Phone 3a, and Phone 3a Pro.

Outlook: Emphasis on Distribution and Affordability in H2 2025

Looking ahead, Canalys forecasts that India’s smartphone market will rely more on distribution and retail execution than new product launches during the second half of 2025.

According to Sanyam Chaurasia, brands are deploying high-value incentives — including foreign vacations and vehicles — to motivate channel partners during key sales periods such as the Monsoon, Durga Puja, and Diwali festivals.

Retail stores are also receiving upgrades featuring improved product displays and stricter sales targets for in-store promoters. Concurrently, extended financing options are being expanded, especially for mid-to-premium segments, to enhance affordability.

Despite these measures, Canalys expects a slight decline for the full year 2025, citing ongoing structural challenges affecting consumer demand.