Paytm said on Tuesday that it had collaborated with Samsung retailers all over India to use point-of-sale systems to enable smart payments and its Paytm Postpaid loan service.

Through the agreement, customers may use Paytm payment methods, including UPI, wallet, the purchase now pay later programme, debit cards, and credit cards, to pay for Samsung products, including laptops, smartphones, televisions, smartwatches, and more, from any authorized retailer in the nation.

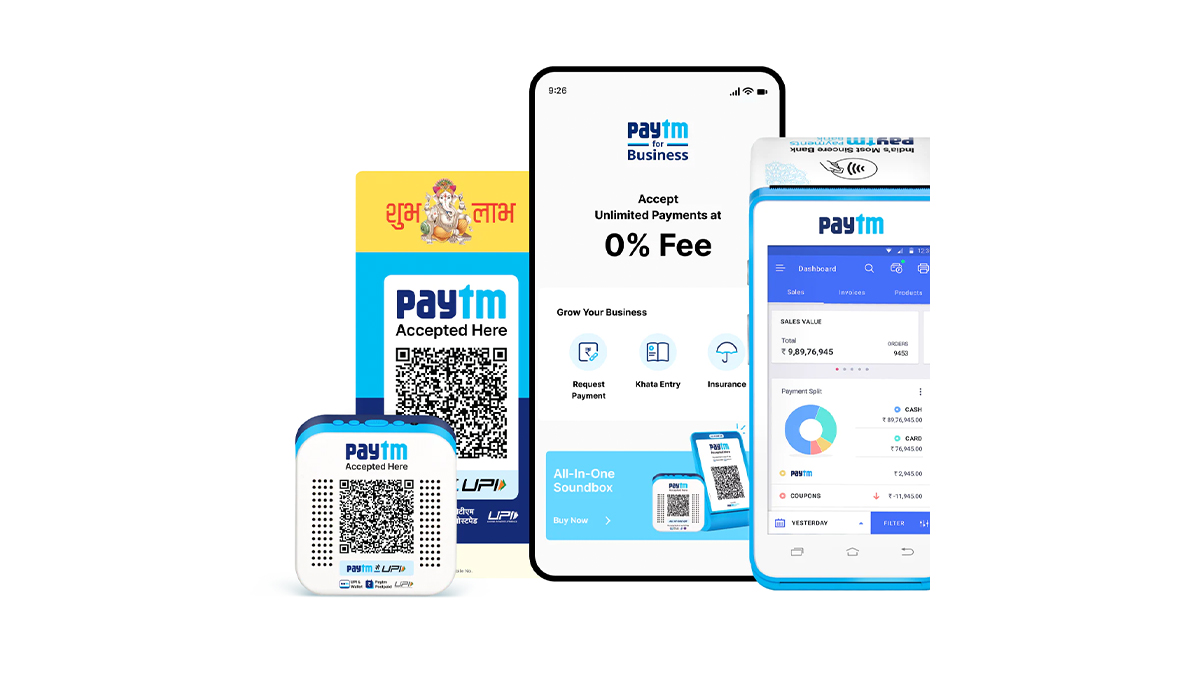

Paytm offers a credit limit of up to Rs 60,000 per month through its postpaid or buy-now-pay-later services. According to a statement from the firm, consumers will also have the option of obtaining personal loans through Paytm’s financial institution partners up to Rs 2 lakh. As of July 2022, Paytm said that it had installed 4.1 million devices all over the country, making it the leader in offline payments.

Customers will benefit greatly from the ability to pay with Paytm Postpaid or “Buy now, pay later” through PoS devices installed at Samsung stores, allowing them to acquire goods without worrying about their budget, says the firm.

Paytm will also offer No Cost EMI options and interesting deals for Point of Sale (PoS) payments. Furthermore, PoS devices from the company include streamlined billing, integrated payments, targeted marketing, and real-time inventory status. Paytm PoS devices handle payments, confirmations, and reconciliation for sound, visual, and print-based merchant solutions.

Speaking on the announcement, Bhavesh Gupta, Paytm CEO – Lending and Head Payments, said,

We continue to drive innovation in the offline payments market and with our PoS (Point of Sale) devices, merchants are able to drive higher customer loyalty. The partnership with Samsung stores will enable us to further extend the convenience of smart payments to a larger customer base.