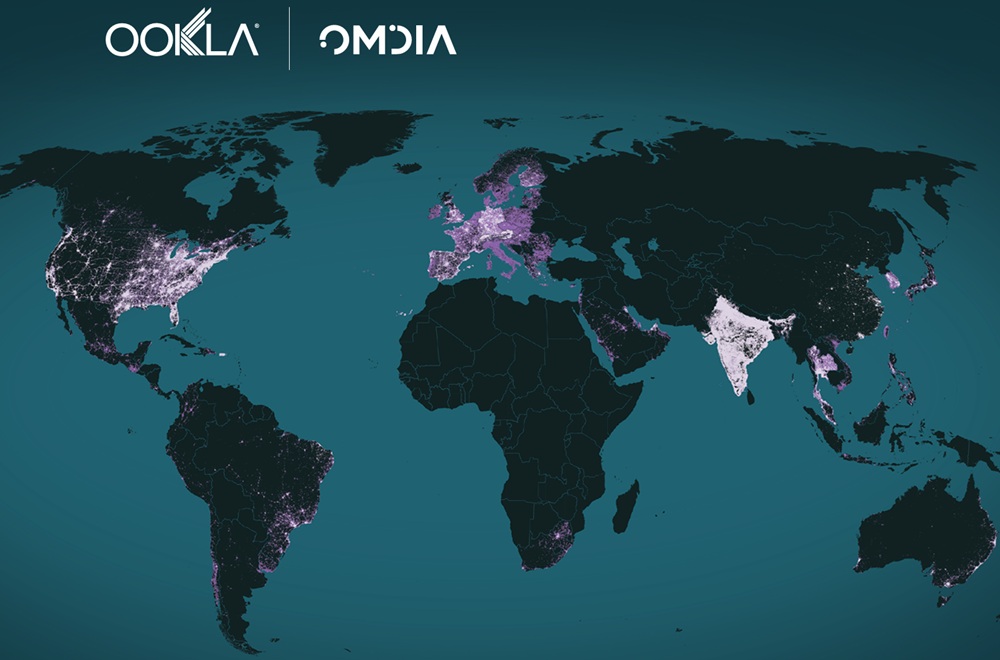

Ookla today shared the second edition of “A Global Reality Check on 5G SA and 5G Advanced,” in collaboration with Omdia. The report examines the global state of standalone (SA) 5G and 5G Advanced, highlighting performance, adoption, and monetization trends.

Data is based on global Speedtest measurements, voice performance studies (VoNR/VoLTE), and network usage analytics. The findings show that 5G SA has moved beyond launch announcements into an execution-driven deployment phase, with leaders combining rich spectrum, carrier aggregation, and end-to-end network optimization.

Global 5G SA Landscape

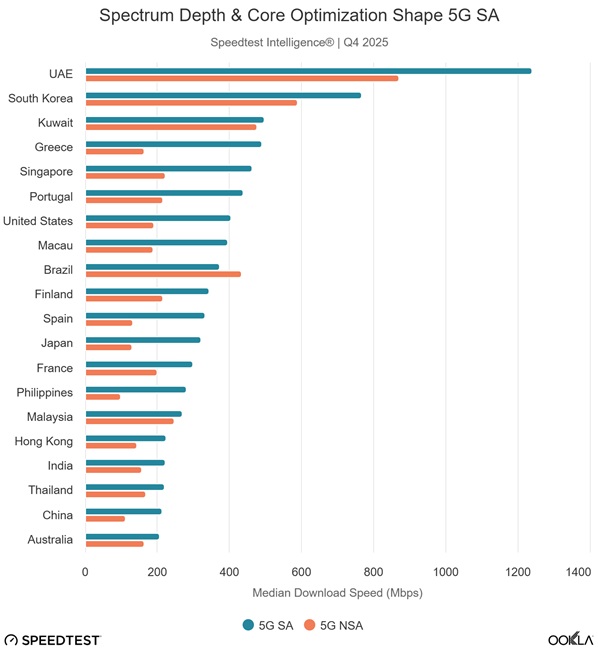

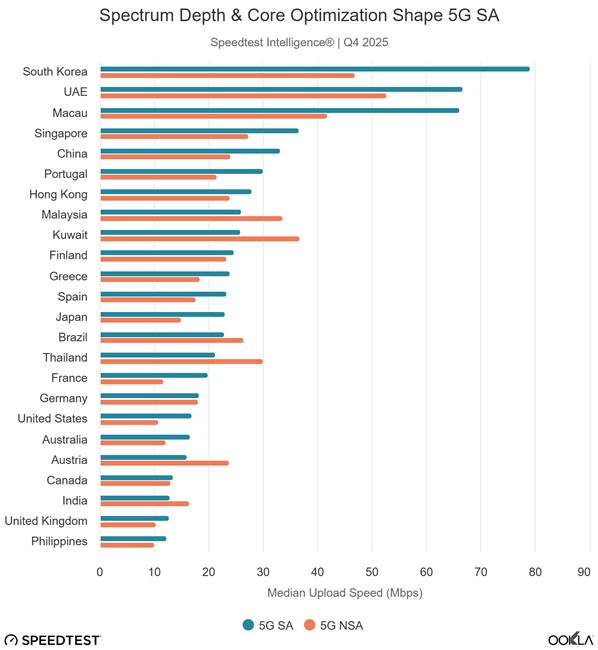

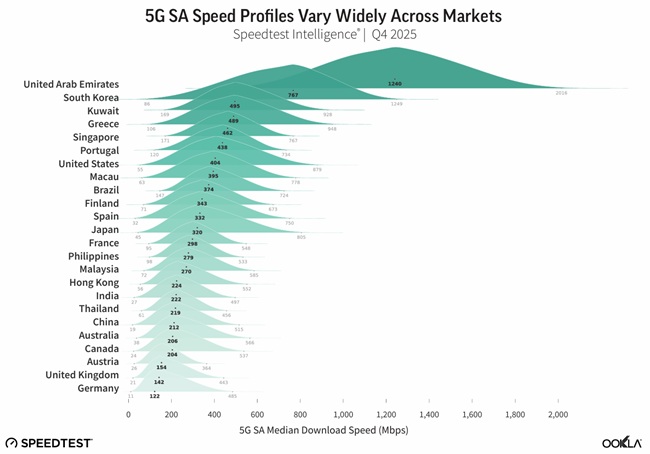

By Q4 2025, global 5G SA sample share reached 17.6%, up from 16.2% in Q4 2024. The headline median SA download speed was 269.51 Mbps, representing a 52% premium over NSA networks. Regional variation remains, reflecting differences in spectrum allocation, carrier aggregation, and network architecture.

Regional Highlights:

- GCC and UAE: Fastest 5G SA median download speeds (1.13 Gbps GCC, 1.24 Gbps UAE) using four-carrier aggregation and enhanced MIMO.

- South Korea: Median SA speed 767 Mbps, driven by wide 3.5 GHz channels.

- U.S.: Median SA speed 404 Mbps, following completion of Tier-1 SA deployments.

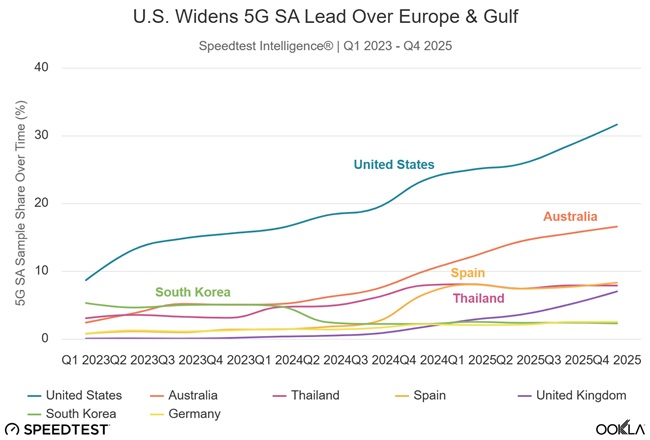

- Europe: Median SA speed 205 Mbps, sample share increased 1.1% → 2.8%, led by Austria (8.7%), Spain (8.3%), UK (7.0%), and France (5.9%).

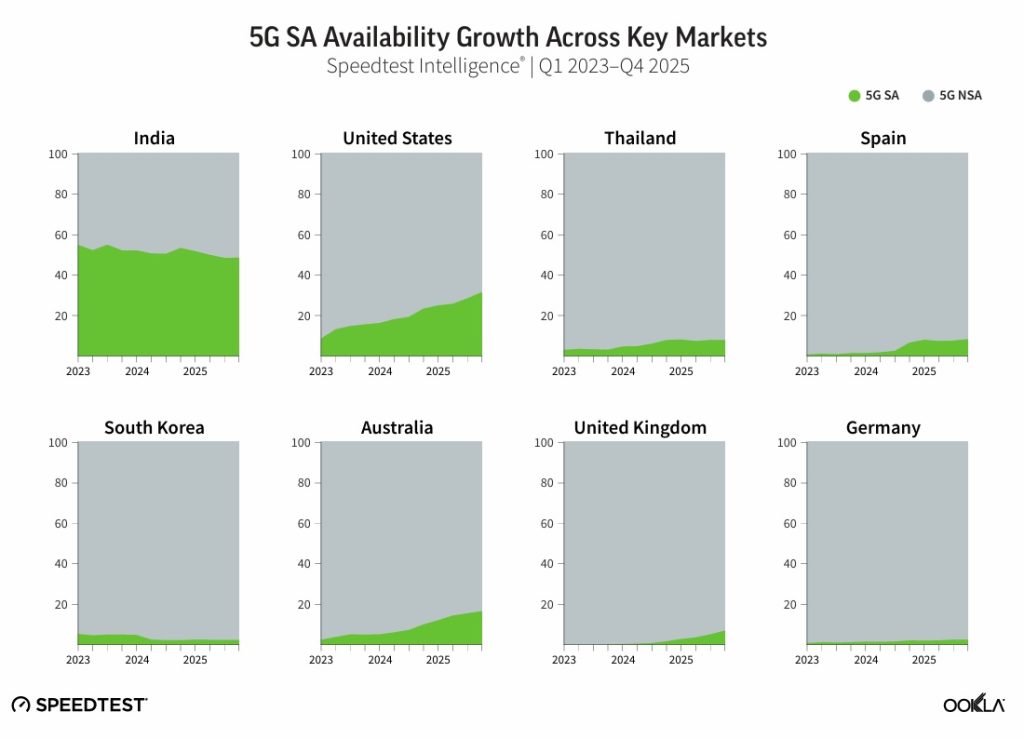

- Asia-Pacific: China leads with 80.9% SA sample share and over 10 million 5G Advanced subscribers; Singapore at 38.9%; Hong Kong up +7.1pp to 8.8%; Japan at 6.9%; India’s SA footprint remains steady beyond Reliance Jio’s rollout.

- North America: SA adoption accelerated from 8.2% (Q1 2023) to 29.9% (Q4 2025).

5G SA in India

- 5G SA footprint has remained steady over two years.

- Limited expansion beyond Reliance Jio’s 5G SA rollout.

- Performance and cloud latency vary regionally despite strong throughput in some urban centers.

Performance and Quality of Experience

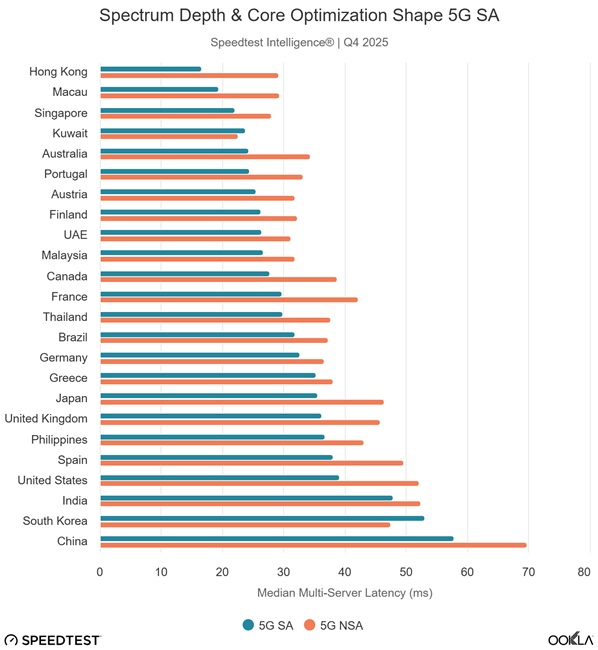

5G SA connections deliver measurable benefits, although standalone core migration alone does not guarantee improved end-user experience. Quality of experience varies depending on spectrum allocation, backbone infrastructure, and peering density.

- Global median latency improvement: SA reduces multi-server latency by over 6% compared to NSA.

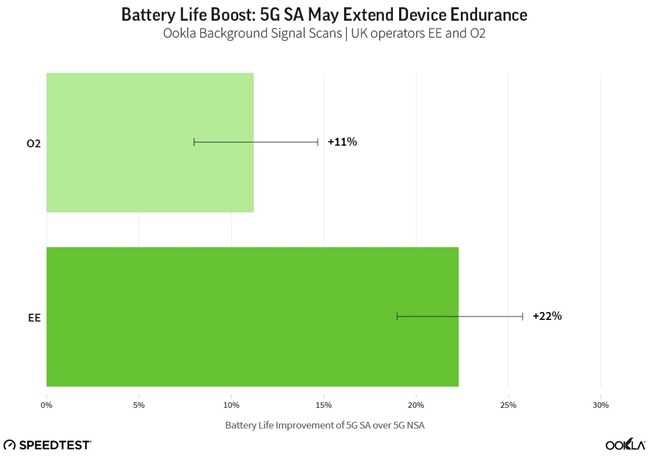

- Battery life gains: UK devices on EE’s SA network show 22% longer median discharge, O2 devices 11% longer.

- Regional cloud and gaming QoE: North America reports lowest latency due to dense hyperscaler proximity.

European network performance:

- France: 41 ms to cloud endpoints

- Austria: 48 ms

- Finland: 50 ms

These results highlight the impact of end-to-end optimization rather than SA deployment alone.

Monetization and Core Investment

5G SA commercialization continues to expand in both consumer and enterprise segments. Core network investments are increasing to support software-defined networks and 5G Advanced features.

- Consumer monetization: Speed tiers (Europe), network slicing (Singapore, France, U.S.), 5G Advanced segmentation (China).

- Enterprise monetization: SLA-based slicing; T-Mobile SuperMobile represents the first nationwide B2B slicing service in the U.S.

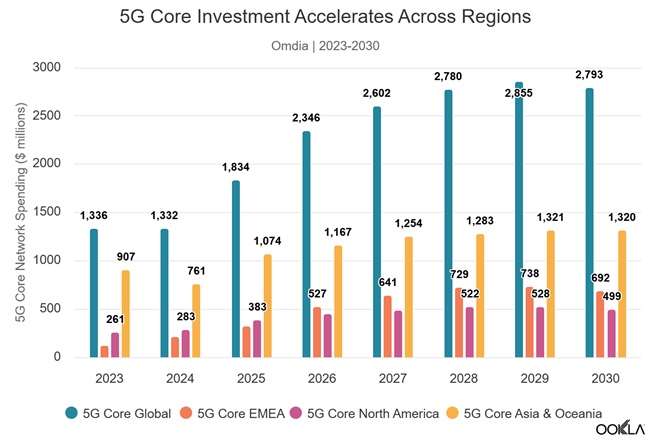

- Core network spend: Global 5G core software projected to grow at 8.8% CAGR (2025–2030); EMEA at 16.7%, North America 5.5%, Asia & Oceania 4.2%.

- Operator deployments: By Q3 2025, 83 operators globally had deployed 5G core networks; core investment accounts for 63.6% of global 5G core software spend.

Countries with coordinated regulatory frameworks consistently outperform fragmented markets, reinforcing the role of policy in shaping 5G SA outcomes.

Case Studies

HUAWEI and du – Indoor 5G Advanced in UAE

- First commercial indoor 5G A deployment in the Middle East (Sep 2024).

- LampSite X solution delivers up to 5.1 Gbps peak data rates using three-carrier aggregation.

- Supports millimeter-wave and sub-6 GHz bands, Distributed Massive MIMO, and 10 Gbps user experience.

Orange – 5G SA Dedicated Bandwidth for Business

- Launched 5G+ for B2B (Feb 2025) with VoNR, SIM-level encryption, low latency, and network slicing.

- Dedicated premium bandwidth supports stable connectivity in high-traffic areas.

- 5G+ Special Series: 350 GB data allowance, unlimited voice/SMS/MMS, €79/month (excl. VAT).

Outlook

Ookla emphasizes that 5G SA has shifted from coverage to capability. Operators combining rich spectrum, carrier aggregation, and end-to-end optimization achieve measurable gains in:

- Speed: Global median SA speeds significantly higher than NSA.

- Latency: Improved cloud and gaming QoE.

- Battery life: Longer device discharge times in SA networks.

- Monetization: Consumer slicing, enterprise SLAs, and 5G Advanced packages.

Regulatory alignment, core network investment, and strategic deployment decisions will define digital competitiveness over the next decade, establishing the foundation for 5G Advanced and the path toward 6G.