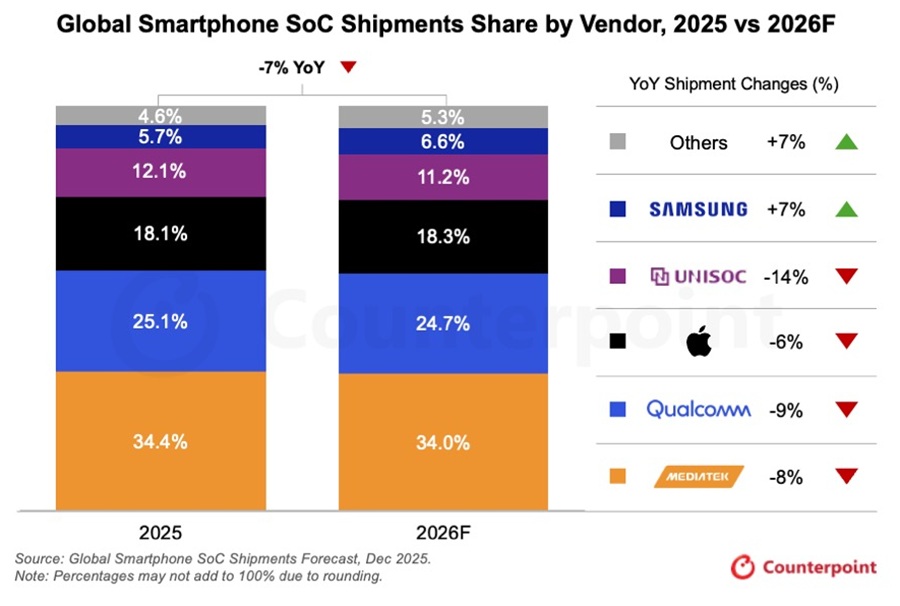

The global smartphone SoC (System-on-Chip) market is expected to slow in 2026, with shipments projected to decline 7% year-on-year (YoY), according to Counterpoint Research’s Global Smartphone SoC Model Shipments and Revenue Tracker, Q4 2025, Preliminary View. After several years of consistent growth, the industry faces challenges from rising memory costs and shifting market dynamics.

Memory Prices and Entry-Level Segment Pressure

Rising memory prices are emerging as a key headwind, particularly affecting smartphones priced below $150. Foundries and memory suppliers are increasingly focusing on high-margin HBM production for data centers, creating supply constraints and higher component costs. SoC vendors heavily exposed to 4G and entry-level 5G smartphones are expected to face the most pressure in 2026.

Key factors affecting the market:

- Higher memory prices impacting sub-$150 smartphones

- Supply constraints due to HBM production focus on data centers

- 4G and entry-level 5G SoC vendors under greater pressure

- Brands with in-house SoC development (Samsung, Google, HUAWEI, Xiaomi) better positioned to handle challenges

Counterpoint Senior Analyst Shivani Parashar notes that the market continues to move up the value curve, with nearly one in three smartphones expected above $500, reflecting sustained demand for higher-performance devices.

Premiumization and Revenue Growth

Despite shipment declines, revenue growth is expected to remain strong due to ongoing premiumization. Short-term recovery in overall smartphone shipments is unlikely before 2027, as OEMs:

- Streamline and optimize product portfolios

- Make strategic trade-offs

- Explore cloud offloading strategies amid memory constraints

Technology Transition to 2nm

The smartphone SoC market is entering a new technological phase, with premium manufacturers shifting from 3nm to 2nm process nodes. Highlights include:

- Samsung announced the Exynos 2600 in December 2025, the world’s first 2nm smartphone SoC

- Premium SoC players moving to 2nm for next-generation devices

Senior Analyst Soumen Mandal emphasizes that, despite near-term shipment pressures, the market is expected to deliver double-digit revenue growth in 2026, driven by premiumization, rising memory prices, and AI feature adoption.

Market Leaders and Competitive Landscape

Apple and Qualcomm are likely to benefit most from premiumization, while MediaTek is increasing its presence in the Android segment, intensifying competition. Samsung is gradually expanding premium adoption, aligned with the 2nm transition for the Galaxy S26 series.

AI Integration and Device Performance

- Generative AI rollout driving higher device average selling prices (ASPs)

- Peak on-device AI performance expected to reach ~100 TOPS by 2026

- Nearly 90% of premium smartphones supporting on-device AI

- Mid-range devices ($100–$500) likely to rely on cloud-based AI to manage costs amid memory price pressures

Outlook and Expectations

Counterpoint Research expects the smartphone SoC market to remain transitional in 2026. While shipments may decline due to memory pricing and market softness, revenue is expected to grow, driven by premiumization, AI adoption, and the shift to 2nm process nodes. Full recovery in shipments is unlikely before 2027, but higher-value devices and on-device AI will support market profitability.