The Global Fintech Festival (GFF) 2025 featured significant announcements from the Department of Financial Services (DFS) and the Reserve Bank of India (RBI), introducing multiple digital payment innovations designed to enhance speed, security, accessibility, and financial inclusion.

The launches cover biometric authentication, wearable-enabled payments, multi-signatory accounts, micro ATM cash access, and simplified forex transactions.

DFS Introduces Biometric and Cash Access Innovations

UPI with On-Device Biometric Authentication

DFS Secretary Shri M. Nagaraju, IAS, launched On-Device Biometric Authentication for UPI, allowing users to authorize payments using smartphone security features such as fingerprint or face unlock, instead of entering a PIN manually.

Customers can opt in for this feature, providing control over their authentication method while maintaining robust security through cryptographic verification by issuing banks.

Aadhaar-Based Face Authentication in UPI

The DFS also introduced Aadhaar-based facial verification for setting or resetting UPI PINs, simplifying onboarding for first-time users, senior citizens, and those without easy access to debit cards.

Using UIDAI’s FaceRD app, the process removes the need for OTPs or card-based verification, ensuring a secure and convenient experience. Future updates will extend this feature for transaction authentication.

Cash Withdrawal via Micro ATMs Using UPI

A new UPI-enabled cash withdrawal option was launched at Micro ATMs operated by Business Correspondents (BCs). Customers can scan a dynamic QR code and authorize transactions through their UPI app, complementing Aadhaar-based AePS and card-based withdrawals. This initiative aims to improve access to cash in underserved regions, supporting financial inclusion.

RBI Unveils Next-Level UPI and Forex Innovations

UPI Multi-Signatory

RBI Deputy Governor Shri T. Rabi Sankar announced UPI Multi-Signatory, allowing joint or multi-signatory accounts to authorize payments through any UPI or bank app.

This feature ensures interoperability, faster approvals, and complete digital transparency. It is designed for corporates, MSMEs, start-ups, trusts, and joint account holders, supporting payments such as vendor settlements, recurring bills, and reimbursements.

Small Value Transactions Using Wearable Glasses via UPI Lite

RBI also introduced UPI Lite integration with wearable glasses, enabling hands-free payments via voice authentication. Users can scan QR codes and complete transactions without a phone or PIN, intended for small-value, frequent payments in retail, food, and transit.

This extension of UPI to wearable devices represents a step toward ambient payments, reducing core banking system load while improving user convenience.

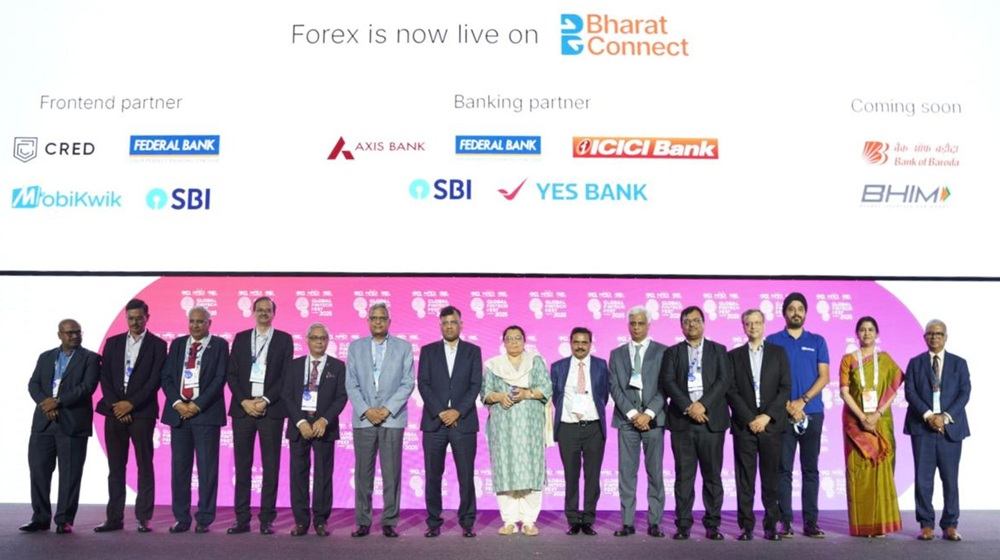

Forex on Bharat Connect

The RBI launched Forex on Bharat Connect, linking the FX Retail Platform with Bharat BillPay. Customers can buy US Dollars digitally for currency notes, Forex card load, or outward remittance. Participating banks include Axis Bank, ICICI Bank, Federal Bank, State Bank of India, and Yes Bank.

The integration provides transparent pricing, competitive rates, and faster processing, addressing issues like long queues, inconsistent markups, and complex documentation.

Outlook

These innovations are expected to accelerate adoption of digital payments, reduce reliance on cash, and enhance transparency across financial transactions. By integrating advanced authentication, ambient payments, and forex access, India continues to lead globally in fintech innovation, promoting financial inclusion and efficiency across the country.