India’s smartphone market shipped 70 million units in the first half of 2025 (1H25), showing a modest 0.9% year-over-year (YoY) increase, according to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker.

In Q2 2025, shipments grew 7.3% YoY to 37 million units, marking a recovery after two consecutive quarters of decline. However, soft consumer demand and rising average selling prices (ASPs) are expected to limit overall growth for the year.

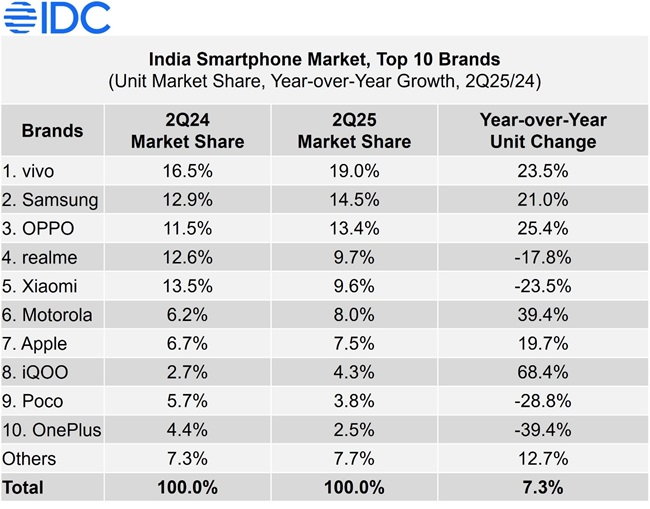

Brand Performance Overview

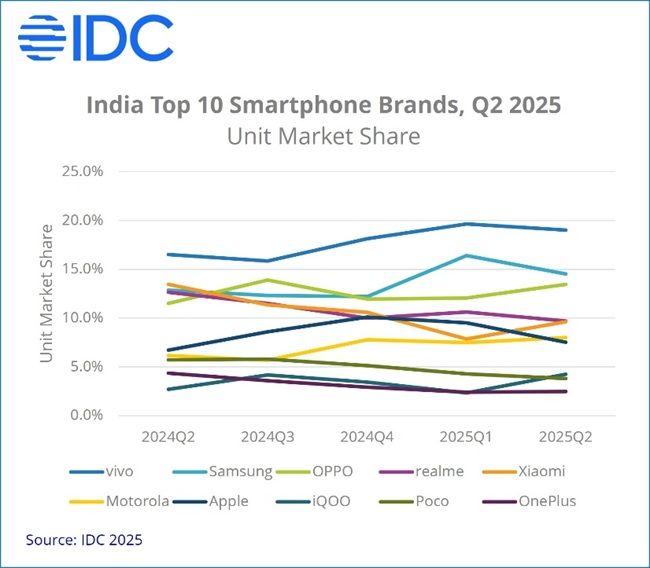

vivo continues to lead the Indian smartphone sector, holding the top position for six consecutive quarters thanks to a balanced product portfolio across various price segments and distribution channels.

Samsung ranks second, showing strong 21% growth, supported by new launches in its Galaxy A, M, and F series, including AI-enabled models targeted at mid-range buyers.

OPPO is third, driven by affordable K13 and A5x models along with expanded service networks. Meanwhile, Nothing and iQOO posted the highest annual growth rates at 84.9% and 68.4%, respectively.

Apple’s Market Share and Growth

Apple’s shipments increased 21.5% YoY to 5.9 million units in the first half of 2025. The iPhone 16 emerged as the top-selling smartphone across India, making up approximately 4% of all shipments in this timeframe.

Factors Fueling Market Growth

According to Aditya Rampal, Senior Research Analyst at IDC Asia Pacific, growth in Q2 was fueled by the launch of new devices across all pricing tiers, price cuts on older models, increased margins for offline retailers, and strong marketing campaigns.

Breakdown by Price Segments (Q2 2025)

- Average Selling Price (ASP): Reached a record high of US$275, rising 10.8% compared to last year.

- Entry-Level (Below US$100): Shipments grew by 22.9%, making up 16% of the market. Xiaomi’s Redmi A4 and A5 led this segment.

- Mass Budget ($100–$200): Shipments rose slightly by 1.1%, but market share dropped from 44% to 42%. The segment is mainly led by vivo, OPPO, and realme.

- Entry-Premium ($200–$400): Shipments fell 2.5%, with market share falling from 30% to 27%. vivo, Samsung, and OPPO are the leaders here, and Motorola rose to fourth place.

- Mid-Premium ($400–$600): Shipments increased by 39.5%, pushing market share from 4% to 5%, mainly helped by OPPO and OnePlus.

- Premium ($600–$800): Shipments almost doubled with 96.4% growth, raising market share to 4%. Over 60% of shipments in this range came from iPhone 15 and 16 series.

- Super-Premium (Above $800): Shipments rose by 15.8%, keeping a steady 7% market share. Samsung leads with 49%, Apple follows closely at 48%. Popular phones include iPhone 16, Galaxy S24/S25 Ultra, and iPhone 16 Plus.

- Chipset Market Share: Qualcomm-powered phones grew by 37.6% to capture 33.9% market share. MediaTek’s share dropped to 44.3% after a 15.4% shipment decline.

Offline vs. Online Channel Trends

Offline shipments rose by 14.3%, boosting their market share to 53.6%. Meanwhile, online shipments stayed steady compared to last year. Year-over-year, online’s share dropped from 49.7% to 46.4%, but it increased quarter-on-quarter from 41.9%.

Upasana Joshi, Senior Research Manager at IDC Asia Pacific, notes offline growth was bolstered by omnichannel sales strategies such as better channel margins, in-store promotions, and price reductions. Online platforms responded with summer sales offering significant discounts on mid-range and premium devices.

Outlook for the Indian Smartphone Market in 2025

IDC anticipates a slight decline in overall shipments this year as rising ASPs and economic challenges dampen demand, especially in the budget segment. Conversely, premium smartphones, led by Apple, are forecast to continue double-digit growth.

The mid-range market is crowded with many new models, risking excess inventory during the upcoming festive season. IDC recommends that brands and retailers focus on fresh shipments rather than heavy discounting to clear old stock in the second half of 2025.