Meta, in partnership with Ipsos, has released a research report titled “From Feeds to Financial Futures”, revealing the increasing influence of digital media in shaping how Indian consumers approach financial products.

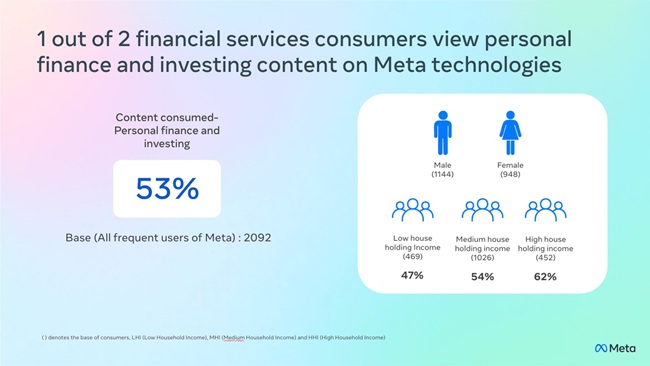

The study involved over 2,000 participants aged 25 to 45, across metro cities—Delhi, Mumbai, Bengaluru, and Kolkata—who are either active financial services users or in the market for such products.

Online Platforms Dominate the Financial Journey

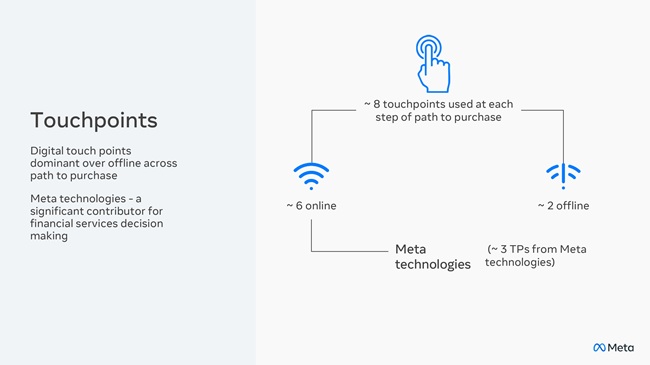

The study indicates a clear move away from traditional financial touchpoints. Consumers are turning to digital spaces to explore topics such as loans, savings, and investments. Advice that was once confined to newspaper columns or physical branches is now accessed through bite-sized content on social apps, creator-led videos, and private chat groups.

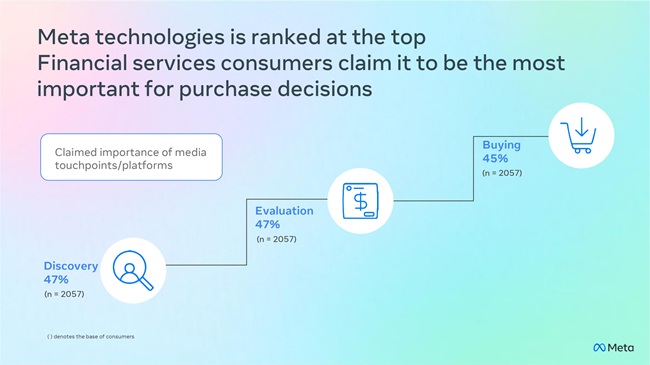

According to the findings, six out of eight steps in the financial decision-making process now happen online. Of those digital steps, about half are influenced by Meta’s platforms—namely WhatsApp, Instagram, and Facebook.

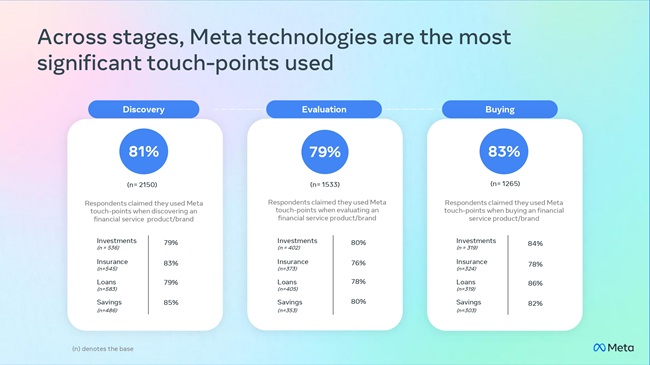

Breakdown of usage across decision stages:

- Product Discovery: 81% of respondents used Meta apps

- Evaluation Phase: 79%

- Final Purchase: 83%

The trend spans across financial categories:

- Loans: 86%

- Investments: 84%

- Savings Accounts: 82%

- Insurance: 78%

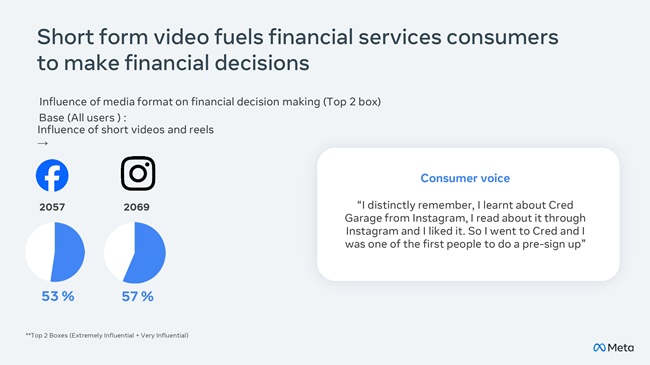

Short Videos Simplify Complex Financial Topics

Despite financial services often involving intricate details, short-form video content has proven to be an effective tool in translating that complexity into accessible insights. Instagram Reels and Facebook videos are being used to explain key concepts—from mutual funds to credit scores.

The study found:

- 57% of users use Instagram to assist in financial decisions

- 53% turn to Facebook for similar guidance

These formats are reshaping how users build financial awareness, making knowledge both digestible and timely.

Consumers Favor Relatable Advice Over Endorsements

The report also shows that people place more trust in authentic voices over traditional advertising. Consumers increasingly rely on podcasts, influencers, and online experts for guidance.

Key trust metrics:

- Financial Podcasts: Trusted by 75%

- Influencers and Experts: Trusted by 67%

- Celebrity Ambassadors: Trusted by 60%

This shift indicates a growing preference for peer-driven insights and credible creator content.

Women Lead Their Own Financial Decision-Making

The research challenges outdated beliefs about women’s role in finance. Nearly four in five women surveyed said they make financial choices independently.

Women are also highly engaged users of digital platforms:

- They spend more time on Instagram and WhatsApp than men

- Their Facebook usage is on par with their male counterparts

These numbers reflect the increasing financial autonomy and digital participation of women in India’s urban centers.

WhatsApp Supports the Full Purchase Funnel

WhatsApp’s role in the consumer journey stands out, being used consistently across the decision cycle:

- Discovery Stage: 44% of users

- Evaluation Stage: 50%

- Purchase Phase: 48%

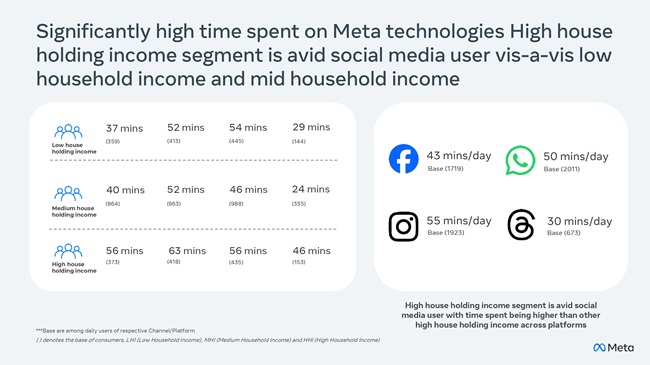

Users in this segment spend an average of 56 minutes per day on WhatsApp, making it a powerful tool for financial brands to engage users via private, conversational channels.

Outlook

The financial services landscape in India is undergoing a decisive shift toward digital-first behavior. Consumers are no longer depending solely on offline advisors or traditional formats—they’re navigating their financial choices through Reels, messaging apps, and creator-driven content. Meta’s platforms have become central to this evolution, actively shaping decision-making at every stage—from discovery to purchase.

For financial brands and institutions, this shift presents both a challenge and an opportunity: to build trust, simplify complex offerings, and connect with users in the spaces where they are most engaged. As digital content continues to drive awareness, confidence, and action, the future of financial engagement in India is clearly being written on mobile screens and in digital communities.