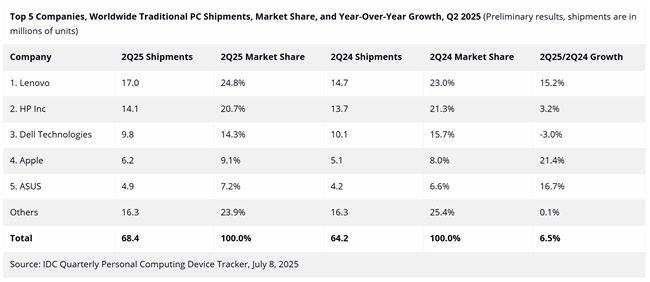

Global PC shipments climbed 6.5% year-over-year in Q2 2025, reaching 68.4 million units, based on preliminary data from IDC’s Worldwide Quarterly Personal Computing Device Tracker. This follows a 4.9% YoY increase in Q1 2025, reinforcing signs of continued recovery across most international markets.

Q2 2025 Global PC Shipments

IDC’s report highlighted the performance of major vendors during the quarter:

- The market leader, Lenovo, shipped 17 million units, capturing 24.8% of total PC shipments.

- HP Inc followed with 14.1 million units and a 20.7% share.

- Dell Technologies shipped 9.8 million units, claiming a 14.3% share.

- Apple’s PC shipments totaled 6.2 million units, giving the company a 9.1% global market share

- ASUS contributed 4.9 million units, equating to 7.2% of global shipments.

- Other vendors combined shipped 16.3 million units, accounting for 23.9% of the market.

- Total global shipments: 68.4 million units.

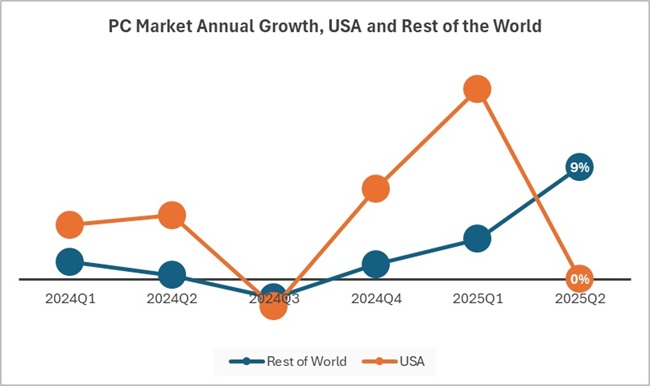

US Market Slows Amid Tariff Concerns

While global demand remained strong, the US market showed signs of softening. Jean Philippe Bouchard, IDC’s VP for Mobile Device Trackers, pointed to inventory buildup earlier this year and concerns over upcoming import tariffs as key reasons behind the slowdown.

He noted that the looming tariff deadline may be prompting US buyers to delay purchases, slowing demand. However, other regions continue to show strong interest in PCs, driven by aging hardware and the ongoing shift to Windows 11.

Industry Outlook: Uncertain Yet Active

Ryan Reith, Group VP at IDC, said the growth seems surprising, given market uncertainties, but multiple factors are keeping momentum going. He noted that vendors are actively responding to market signals, balancing risk and opportunity.

Reith also warned of possible inventory challenges later in the year, especially if demand slows in late Q3 and beyond. He expects price hikes tied to tariffs to vary by region and vendor strategy. Interestingly, this could also lead to promotional pricing aimed at clearing excess inventory—despite general expectations of rising prices.