Global PC shipments in the first quarter of 2025 grew by 4.9% year-over-year, reaching a total of 63.2 million units, according to preliminary results from IDC’s Worldwide Quarterly Personal Computing Device Tracker.

While this growth is positive, the PC market faces several challenges moving forward, including the impact of new US tariffs and global economic risks. These factors are making it harder to plan for demand in the coming months.

First-Quarter Pull-In Ahead of Tariffs

Jean Philippe Bouchard, research vice president at IDC, noted that the growth in Q1 2025 reflects a “pull-in” effect as vendors and end-users rushed to make deliveries before the new US tariffs took effect.

He said,

In a first quarter still relatively untouched by tariffs, the entire ecosystem attempted to accelerate the pace of deliveries to avoid the first round of US tariffs and expected volatility for the remainder of the year.

Bouchard also highlighted that commercial demand remained strong in Q1 but added that the tariffs announced on April 2, 2025, could lead to price hikes and delays in IT spending for the rest of the year.

Concerns Over US Tariffs and Inflation

Ryan Reith, group vice president at IDC, said that while the full impact of the April 2 tariff announcement is still being assessed, companies are closely monitoring the situation. Reith explained that, so far, their supply chain checks haven’t revealed any “drastic shifts”, which isn’t unexpected given how “volatile” the situation is for making major business decisions.

He emphasized that businesses are re-evaluating everything from their existing inventory to possible adjustments in manufacturing locations and shipping routes.

Reith further added,

When it comes to hardware like PCs and similar devices, we still believe most (if not all) price increases will get passed directly to the consumer.

Q1 2025 PC Shipments

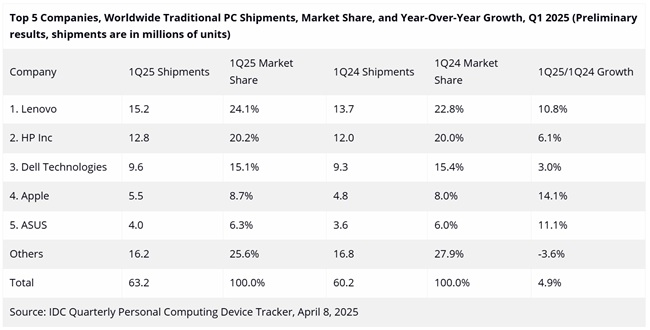

During the first quarter of 2025, the global PC market recorded a total shipment of 63.2 million units, reflecting a 4.9% rise compared to the same period last year. The breakdown of the top five vendors is as follows:

- Lenovo delivered 15.2 million units, capturing 24.1% of the market, with shipments rising 10.8% year-over-year.

- HP Inc shipped 12.8 million units, representing a 20.2% share and a 6.1% increase from Q1 2024.

- Dell Technologies reported 9.6 million units shipped, accounting for 15.1% of total shipments, with volume growing by 3% compared to the previous year.

- Apple saw shipments of 5.5 million units, securing an 8.7% market share and achieving the highest growth among the top five at 14.1%.

- ASUS recorded 4.0 million units, giving it a 6.3% share of the market, along with a solid 11.1% annual increase.

- Other vendors combined shipped 16.2 million units, which made up 25.6% of the market but reflected a 3.6% decline from the same quarter last year.

PC Industry Outlook for 2025

IDC’s report emphasized that several factors are driving demand for PCs, including the need for upgrades as Windows 10 approaches end-of-support and growing interest in devices with on-device AI capabilities. This demand was reflected in the strong shipment volumes in Q1 2025.

However, IDC warned that the ongoing uncertainty surrounding US tariffs, inflation, and potential recessionary risks will likely reduce demand for PCs in the coming months.

As IDC’s report concluded, the PC market will face both “tailwinds and headwinds,” making it a challenging environment for companies to navigate in the remainder of 2025.