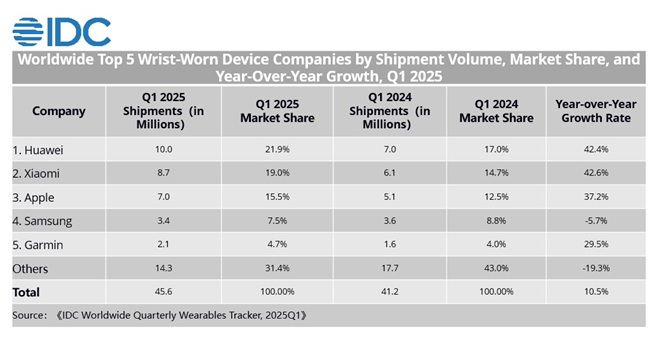

Shipments of wrist-worn devices worldwide grew by 10.5% year-over-year in the first quarter of 2025, reaching 45.6 million units, according to IDC. This rise was supported by recoveries across Western Europe, the United States, Latin America, and Asia-Pacific (excluding India), while China benefited from subsidy programs that increased consumer interest. As per the report:

Global Wrist-Worn Device Shipments: Smartwatch shipments reached 34.8 million units worldwide, up 4.8% compared to the previous year. Wristband shipments increased sharply by 34.0%, totaling 10.8 million units.

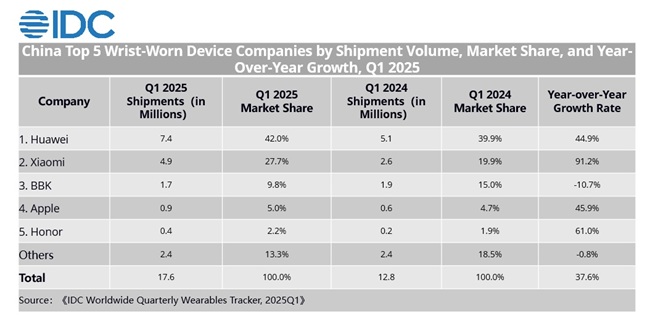

China Market Trends: Smartwatch shipments in China grew by 25.3%, reaching 11.4 million units, with wristband shipments jumping 67.9% to 6.2 million units. April 2025 saw a 52.7% year-over-year rise in shipments.

Global Leading Brands and Their Market Positions: Q1 2025

- HUAWEI claimed the leading position in the wrist-worn market in both China and worldwide in Q1 2025. Its growth was supported by the HarmonyOS platform and new product launches like the Band 10 and updated FIT series watches, aimed at mid-to-high-end consumers.

- Xiaomi showed the fastest shipment growth among the top five brands in China, boosted by entry-level wristbands, Redmi smartwatches, and strong integration with its smartphone and IoT ecosystem. The mid-range S series also performed well.

- Apple experienced its highest year-on-year shipment growth since 2023. The increase was helped by U.S. retailers stocking up ahead of possible tariffs and subsidies in China that enhanced Apple Watch sales.

- Samsung faced a slight decline in shipments, pressured by competition from Chinese brands and Apple, especially in mid-range and premium segments.

- Garmin returned to the global top five list, driven by more affordable Forerunner models and a dual-generation approach to its Fenix line, which appeals to outdoor and sports enthusiasts.

Outlook for China’s Market

China’s government recently launched the “Healthy Weight Management Action” campaign, running from 2025 to 2027, focusing on improving public health. This initiative, combined with subsidies for wrist-worn devices, is expected to drive further adoption, especially of wearables featuring blood pressure and glucose monitoring.

IDC’s Forecast

IDC forecasts that shipments in China’s wrist-worn market will reach 58.5 million units in 2025, representing a 36.9% increase year-over-year. The compound annual growth rate (CAGR) is expected to be 8.5% over the next five years.

Globally, the wrist-worn device market is expected to continue steady growth, propelled by health-related features, improved device ecosystems, and broader consumer acceptance.

Sophie Pan, Research Director at IDC China, notes that manufacturers are expanding their offerings to cover a wide range of prices and use cases to meet changing consumer preferences.