Opensignal published its June 2025 Mobile Network Experience report, based on data collected from February 1 to May 1, 2025. The report reviews the performance of India’s main mobile operators across various metrics during this period.

Market Overview

India’s mobile networks continue to improve in most areas. However, signs show that 5G download speeds for Airtel and Jio, the country’s leading 5G providers, have slightly dropped. This slowdown likely results from higher network congestion as more users adopt 5G and consume more data.

Despite this, Airtel and Jio have expanded their 5G coverage aggressively, making India a regional leader in 5G Availability. Jio’s 5G Availability score recently surpassed 70%, more than double Airtel’s score, but Airtel leads in 5G Experience metrics such as download and upload speeds.

The two operators follow different 5G strategies:

- Jio uses standalone (SA) 5G technology, combining low-band spectrum (700MHz) for rural areas with mid-band (3.5GHz) for cities, reserving mmWave (26GHz) for high-capacity uses.

- Airtel uses non-standalone (NSA) 5G on its existing 4G core, focusing on faster rollout in urban centers.

This competition benefits users by pushing both networks to improve.

Spectrum and Operators

In the 2022 5G auction, Airtel and Jio secured most licenses across low, mid, and high bands, while Vi holds smaller spectrum mainly in the 3,300MHz and 26GHz bands with limited low-band holdings. Although the government added 687MHz of spectrum in early 2025, the Cellular Operators Association of India (COAI) reports a 400MHz shortfall—mostly in the 6GHz range—and calls for more auctions to boost 5G coverage.

Vi’s Regional 5G Presence

Vi launched 5G in Mumbai, Delhi, Chandigarh, and Patna. In Mumbai, its 5G Availability matches Airtel’s and closely trails in video and gaming, though speeds remain lower.

Vi’s download speeds in Mumbai are roughly four times its overall average. The company provides affordable unlimited 5G plans starting at INR 299 ($3.45) per month and aims to cover 17 priority circles by August 2025.

However, Vi faces financial challenges, including a pending INR 450 billion (US$5.23 billion) AGR dues liability and investor uncertainty. The company warns it may not survive beyond 2025 without government support or investment, which affects its network plans.

Regulatory Actions

The Telecom Regulatory Authority of India (TRAI) auctioned spectrum in the 900MHz and 1800MHz bands in 2024 and recommended including mmWave spectrum (37-40GHz and 42.5-43.5GHz) in upcoming auctions. The government plans to refarm nearly 1,100MHz of spectrum by 2030.

Airtel is reallocating mid-band spectrum to handle more traffic and will soon launch standalone 5G, having also acquired 400MHz of mmWave spectrum from Adani Data Networks to enhance its network. Meanwhile, BSNL, India’s only national operator without 5G, is expanding 4G and has shown the largest gains in Consistent Quality, Download Speed, and Upload Speed but still trails other operators.

Key Findings

-

Upload Speed Experience: Jio overtook Airtel, with average upload speeds of 9.1Mbps versus Airtel’s 9.0Mbps. Jio improved by 2.7Mbps since the last report, compared to Airtel’s 2.1Mbps rise.

-

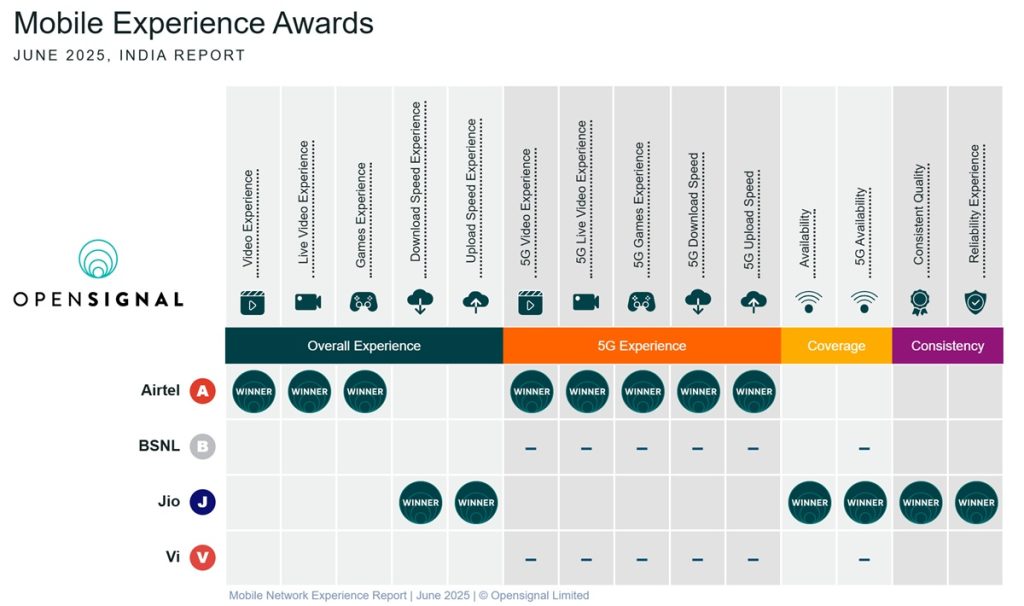

5G Experience: Airtel won all 5G Experience awards, including video, live video, gaming, and speed metrics, although its 5G speed scores declined slightly. Jio improved in all 5G Experience areas except download speed.

-

Video Experience: Airtel leads with 66 points on a 100-point scale, narrowly ahead of Jio (65.7). Vi scored 62.7, and BSNL lagged at 42.1. All operators improved since the previous report.

-

Coverage and Consistency: Jio led in overall availability, 5G availability, consistent quality, and reliability, while Airtel saw the biggest 5G availability growth but stayed behind Jio.

-

Download Speeds: All four operators saw double-digit percentage growth. Jio passed 100Mbps average download speed for the first time. Airtel holds the 5G download speed award, though both Airtel and Jio’s speeds dropped slightly, likely due to higher user numbers.

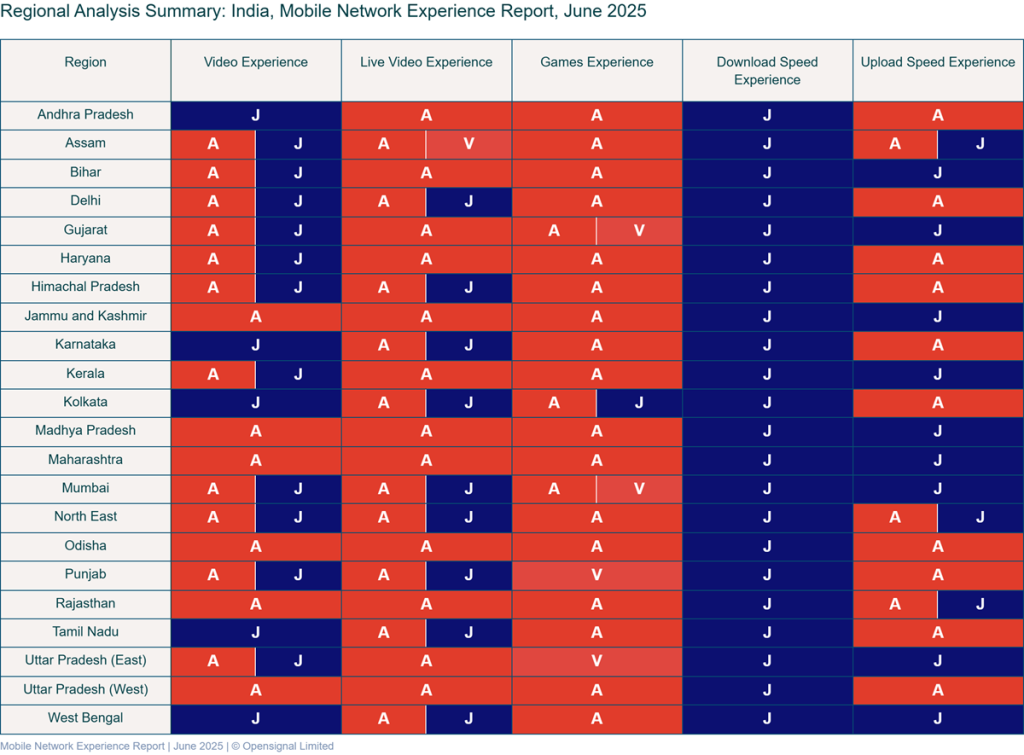

National and Regional Scores

Airtel, Jio, and Vi fall within the “Good” category (scores 58-68) for video experience, while BSNL ranks “Poor” (under 48).

A “Good” rating means users typically stream 720p or better video with acceptable loading and minimal stalling. “Poor” indicates lower quality and frequent interruptions.

Regional data from Tamil Nadu shows:

- Video Experience: Jio (67.3), Airtel (66.6)

- Live Video Experience: Airtel (58.6), Jio (58.5)

- Gaming Experience: Airtel (73.8), Vi (72.2)

- Download Speed: Jio (128.9 Mbps), Airtel (63.0 Mbps)

- Upload Speed: Airtel (9.1 Mbps), Jio (8.6 Mbps)

Future Outlook

Opensignal expects growing competition among Airtel, Jio, and Vi, along with regulatory support through new spectrum auctions, to drive better 5G coverage and network quality in India. While Airtel and Jio lead now, ongoing improvements are likely as operators expand and upgrade, though BSNL will need to accelerate efforts to keep pace with rising 5G adoption.