India’s smartphone shipments saw a notable increase in Q1 2024, with a volume growth of 8% year-on-year (YoY) and a value growth of 18%, according to Counterpoint’s Monthly India Smartphone Tracker.

Volume and Value Growth

The growth in volume was mainly due to healthy inventory levels and the low base of Q1 2023.

Meanwhile, the increase in value was propelled by the trend of premiumization and the introduction of new models like the Samsung Galaxy S24 and OnePlus 12 series.

Premium Segment Expansion

The premium segment, comprising smartphones priced above INR 30,000, reached its highest-ever volume share of 20% and contributed 51% to the total market value in Q1 2024.

Shilpi Jain, Senior Research Analyst, highlighted that India’s smartphone market achieved its highest-ever Q1 value during the quarter. This growth was fueled by consumers upgrading to higher-value smartphones across various price tiers, supported by factors like affordable financing, trade-in offers, bundled schemes, and the demand for advanced features such as AI, gaming, and enhanced imaging.

Brand Performances

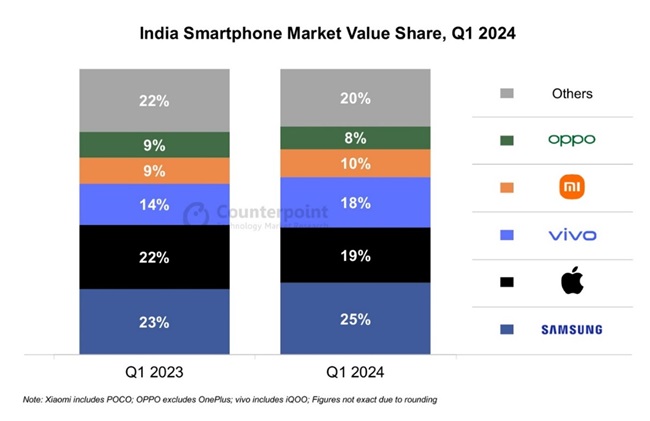

Samsung led the market in terms of value with a one-fourth share. Samsung’s average selling price (ASP) hit a record high of around $425, driven by its strong presence in the >INR 20,000 segment.

Apple recorded a remarkable quarter in India, dominating both the value and volume aspects of the premium segment, largely due to the latest iPhone 15 series.

Among the fastest-growing brands were:

- Nothing witnessed a remarkable 144% YoY growth due to its mid-segment model Nothing (2a).

- Motorola experienced a 58% YoY increase in shipments, driven by demand for better CMF and stock Android experience.

- Xiaomi secured the second spot with a 28% YoY growth, focusing on a streamlined portfolio and proactive offline strategies.

- Transsion brands grew by 20% YoY by enhancing offline presence and offering premium features in the affordable segment.

Key Trends

Counterpoint predicts single-digit growth for India’s smartphone market in 2024, fueled by factors like premiumization, 5G adoption, and post-COVID upgrades. In Q1 2024:

- 5G smartphone shipments accounted for a record 71% share.

- MediaTek led the chipset market with a 53% share, while Qualcomm dominated the premium segment with 35%.

- Offline channels captured 64% of the market share, marking a significant post-COVID quarterly figure.

- vivo emerged as the top brand by volume for the first time, capturing a 19% share driven by its 5G leadership and strong imaging capabilities.

Market Dynamics and Channel Strategies

Shubham Singh, Research Analyst, noted that the beginning of 2024 showed promise for OEMs, with improved inventory levels allowing for multiple new launches.

However, sales fell short of expectations due to reduced retail footfalls and consumer spending. Key OEMs diversified their channel strategies, resulting in shipment growth in offline channels, he added.