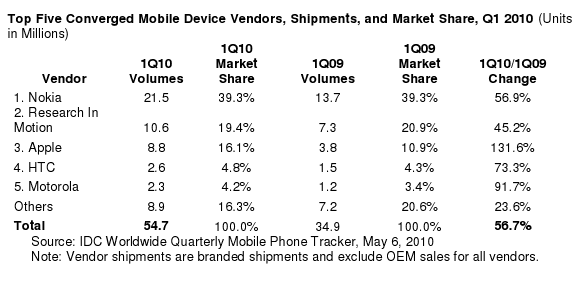

According to report by Research Firm IDC(International Data Corporation) , the Worldwide Smartphone Market saw a 56.7% growth year over year.54.7 million Converged Mobile Devices or Smartphones were shipped my Handset makers in the first Quarter of 2010. And these make up for only 1.8% of the total mobile phone shipments worldwide. As you can see in the chart below the Top 5 smartphone phone makers based on volumes and market share are Nokia with a 39.3% share followed by Blackberry maker RIM at 19.4%. Apple iPhone shipments have more than doubled and it has 16.1 % of the market share. HTC is at a distant 4th followed by Motorola.

Our Observations

We can clearly see that Nokia needs start selling more high-end devices or it might loose market share to iPhone or HTC.

RIM has always been a Enterprise player but made foray into the consumer segment with devices like the 8520. They need to offer more value for money phones to woo the non-enterprise crowd which is already glued on to iPhone or Android.

Apple iPhone has been clearly eating into Blackberry’s market share in the US but recent Android devices have even managed to grab potential iPhone buyers. The iPhone 4G or HD is expected in June and if it addresses the missing features in the current generation iPhone, Apple might become the number 2 smartphone maker.

HTC might not grab the number 3 spot pretty soon but considering their current device portfolio anything is possible. One thing is sure they will definitely pose competition to Moto , RIM and Apple devices

Motorola saw huge success with the Droid / Milestone and they badly need a Droid2 to retain their position. They are also expected to launch some new phones based on Android this year.

Full Press Release

Worldwide Converged Mobile Device (Smartphone) Market Grows 56.7% Year Over Year in First Quarter of 2010, Says IDC

May 7, 2010 – Growth of the worldwide converged mobile device market

(commonly referred to as smartphones) more than doubled that of the overall mobile phone

market in the first quarter, a sign the segment is in high-growth mode again. According to the

International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, vendors

shipped a total of 54.7 million units in the first quarter of 2010 (1Q10), up 56.7% from the same

quarter a year ago. In contrast, the overall mobile phone market grew 21.7%. Converged mobile

devices accounted for 18.8% of all mobile phones shipped in 1Q10, up slightly from 14.4% in

1Q09.

The smartphone market’s growth is impressive too when contrasted to the 38% growth in the

fourth quarter, which is typically the strongest of the year. This demonstrates the tremendous

potential of the market and the depths to which it plunged in the first quarter of last year.

“2010 looks to be another year of large-scale consumer adoption of converged mobile devices,”

says Ramon Llamas, senior research analyst with IDC’s Mobile Devices Technology and Trends

team. “Consumers will gravitate to smartphones not just because the devices themselves look

‘cool’ and ‘slick’, but because the overall experience aligns with their individual tastes and

demands. Users are seeking – and finding – experiences that are intuitive, seamless, and fun.

Already, we’ve seen what Palm’s webOS and Google’s Android can do. This year, we expect

updates for BlackBerry, Symbian, and Windows Mobile to spark greater smartphone demand with

their offerings.”

Market Outlook for 2010

Kevin Restivo, senior analyst with IDC’s Worldwide Mobile Phone Tracker, said higher

smartphone sales this year will be a result of greater awareness, increasingly affordable data

plans, and the global economic recovery. “More consumers are aware of smartphones now due

to positive referrals from friends and family and manufacturer’s mass media campaigns,” said.

Restivo. “Coupled with increased confidence on the part of consumers, these factors will create a

perfect storm of demand for suppliers this year.”

Top Five Smartphone Vendors Q1 2010

Nokia firmly maintained its position as the leading smartphone vendor worldwide during 1Q10. In

addition to introducing several new models – the C3, C6, and the E5 – Nokia announced its first

Symbian^3 model, the N8. This, and other Symbian^3 devices, are expected to launch in the

fourth quarter of this year. According to CEO Olli-Pekka Kallasvuo, Symbian^3 will be more

intuitive and fun for end users, and on par with other competitive offerings available on the

market.

Research In Motion kept its position as the number two smartphone vendor worldwide on

continued growth of its popular BlackBerry devices. Key to its success were its BlackBerry Curve

8520 and BlackBerry Bold 9700, as well as stronger consumer adoption. Co-CEOs Mike

Lazaridis and Jim Balsillie recently unveiled the company’s new BlackBerry OS 6.0, which

promises a smoother and more interactive user interface.

Apple more than doubled its shipments from a year ago, with more iPhones arriving outside its

home territory of North America. CEO Steve Jobs announced the latest operating system update,

enabling multi-tasking, folders, enhanced email, iBooks for consumers, and iAd, a mobile

advertising platform, for developers. A fourth generation iPhone is expected to arrive this

summer.

HTC posted high double-digit growth to start off the year, driven primarily by its growing stable of

Android-powered products including the Hero, Droid Eris, and MyTouch. The company shows no

signs of slowing down, having announced several new devices, including the first WiMAX Android

phone, the EVO 4G, slated to launch later this year. HTC also remains committed to Windows

Mobile devices, with the HD2 receiving a warm reception and Windows Phone 7 devices

expected to launch before the end of the year.

Motorola, having stormed back into the smartphone space in the fourth quarter of 2009, followed

up with a new milestone in its short history of shipping Android devices. Now that the DROID and

CLIQ (known as the Milestone and DEXT respectively outside the United States) both have a full

quarter of availability, the company followed up with six additional devices. The company expects

to launch 20 different models and ship 12–14 million Android smartphones this year.

Note: Vendor shipments are branded shipments and exclude OEM sales for all vendors.

Converged Mobile Devices – These mobile devices are either voice or data centric and are

capable of synchronizing personal information and/or email with server, desktop, or laptop

computers. These devices must match wireless telephony capability to high level operating

systems, include the ability to download data to local storage, run applications, and store user

data beyond PIM capabilities. Converged mobile devices must offer the full extent of their

application processing capability to the user, regardless of network availability.

About IDC

IDC is the premier global provider of market intelligence, advisory services, and events for the

information technology, telecommunications, and consumer technology markets. IDC helps IT

professionals, business executives, and the investment community to make fact-based decisions

on technology purchases and business strategy. More than 1,000 IDC analysts provide global,

regional, and local expertise on technology and industry opportunities and trends in over 110

countries worldwide. For more than 46 years, IDC has provided strategic insights to help our

clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading

technology media, research, and events company. You can learn more about IDC by visiting

www.idc.com.