![]()

Have you ever come across a post on social media where people rant about the drastic increase in prices of consumer RAM and SSD storage? It’s not just noise; the numbers back it up.

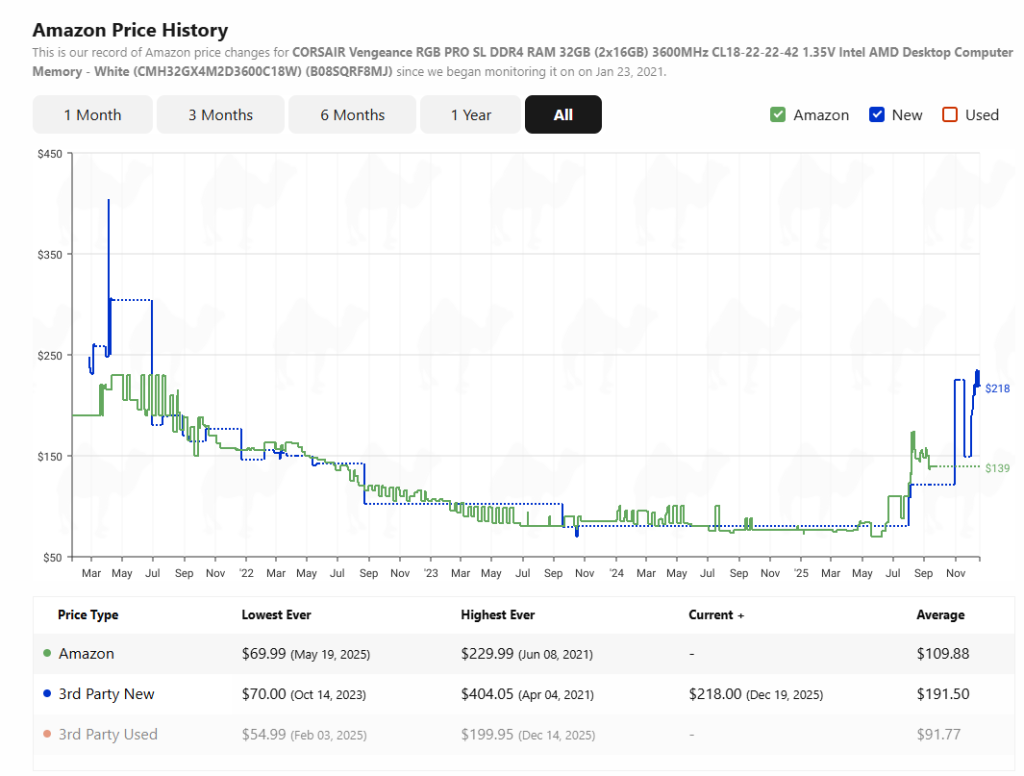

Take the CORSAIR Vengeance RGB PRO SL DDR4 32GB kit, for instance, in the US. For the first half of 2025, this RAM sat comfortably around USD 70 (Rs. 6,270 approx.), but as stock dried up in Q4, prices skyrocketed to USD 218 (Rs. 19,525 approx.) by December. That represents a staggering 211% surge in just six months, meaning builders are now paying triple for the exact same hardware they could have bought in July.

Memory isn’t a luxury component; it’s the backbone of every modern computing device, including mobile devices and AI compute units. The same RAM and storage chips inside your PC or smartphone decide how smoothly apps load, how long tasks stay in memory, and how well your device multitasks.

And because of these price hikes due to increased demand for storage, there’s a high chance that your next smartphone/laptop will likely cost more and deliver less. The memory chip has become the silent casualty of artificial intelligence’s relentless appetite for computing power.

As we get used to integrating AI into everyday tasks, and as most companies like Google and Perplexity offer their best AI products completely free for a limited time, this shift has become inevitable. However, all of this comes at a cost that is now indirectly taking shape. Welcome to the memory crisis of 2025, where the AI revolution eating through data centers is now devouring your wallet.

The Invisible Vacuum: AI Demand

Behind every ChatGPT query and every AI image generation lies an insatiable hunger for high-bandwidth memory (HBM). HBM uses 3D-stacking technology to layer multiple DRAM dies on top of each other, used primarily in high-performance computing (HPC), artificial intelligence (AI) accelerators, and advanced graphics cards.

Memory manufacturers, like SK Hynix and Micron, have made a calculated pivot away from consumer products, and the numbers are staggering. By the end of 2024, the DRAM industry allocated approximately 250,000 wafers per month, representing 14% of total capacity, to HBM production, a dramatic surge from just 93,000 wafers monthly at the end of 2023. According to TrendForce, HBM’s revenue share within DRAM skyrocketed from 8.4% in 2023 to 20.1% by late 2024.

SK Hynix leads this transformation with HBM production capacity exploding from 30,000 wafers annually in 2023 to a targeted 170,000 wafers in 2025. Samsung has ramped to approximately 150,000 wafers per month by the end of 2025, while Micron tripled its capacity from 20,000 to 65,000 wafers monthly.

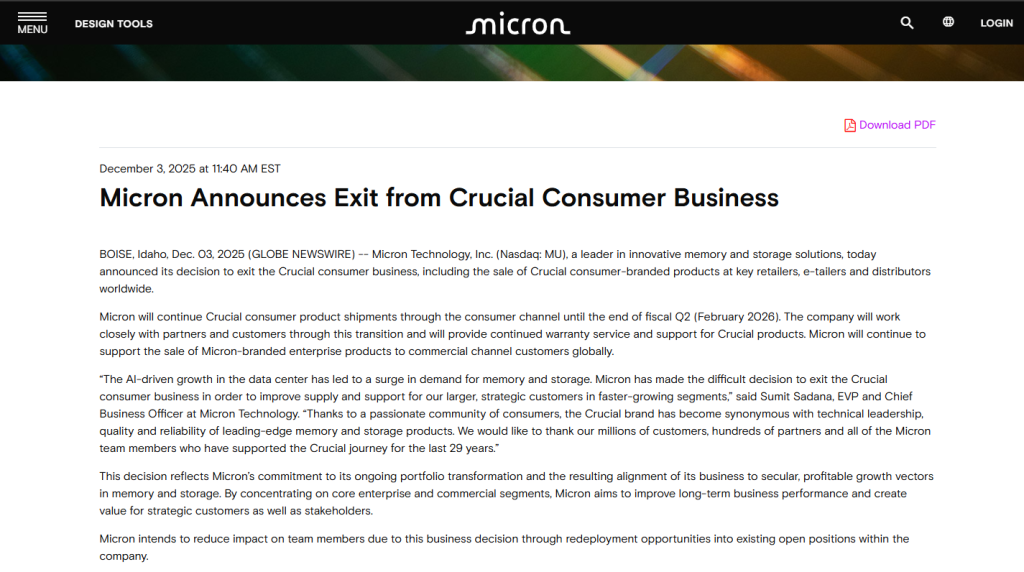

The economics are irresistible for manufacturers: HBM commands premium prices and profit margins that dwarf traditional DDR5 chips. Micron made this strategy explicit in December 2025 by announcing it would exit the consumer memory business entirely under its Crucial brand.

Sticker Shock in 2025: PC and Smartphone Prices

The consequences hit consumers with brutal force. In the United States, contract prices for 16GB DDR5 chips skyrocketed nearly 300% in Q4 alone, while retail kits like the Team T-Force Vulcan surged from $82 to $310. This financial devastation isn’t limited to the US or the newest DDR5 standard.

Remember the CORSAIR Vengeance RGB PRO SL from our introduction? Indian consumers are facing an identical nightmare. In May 2025, that same kit cost around Rs. 10,750 (USD 120 approx.). By December, it had nearly tripled to a staggering Rs. 29,796 (USD 332 approx.), mirroring the broader Indian market, where even standard 16GB DDR5 modules climbed from Rs. 4,000 to over Rs. 12,500.

Major PC manufacturers didn’t absorb these costs; they passed them directly to consumers. Dell announced 15-20% price increases starting mid-December 2025 across its entire lineup. Lenovo notified customers that all current prices would expire on January 1, 2026, citing memory shortage and AI growth.

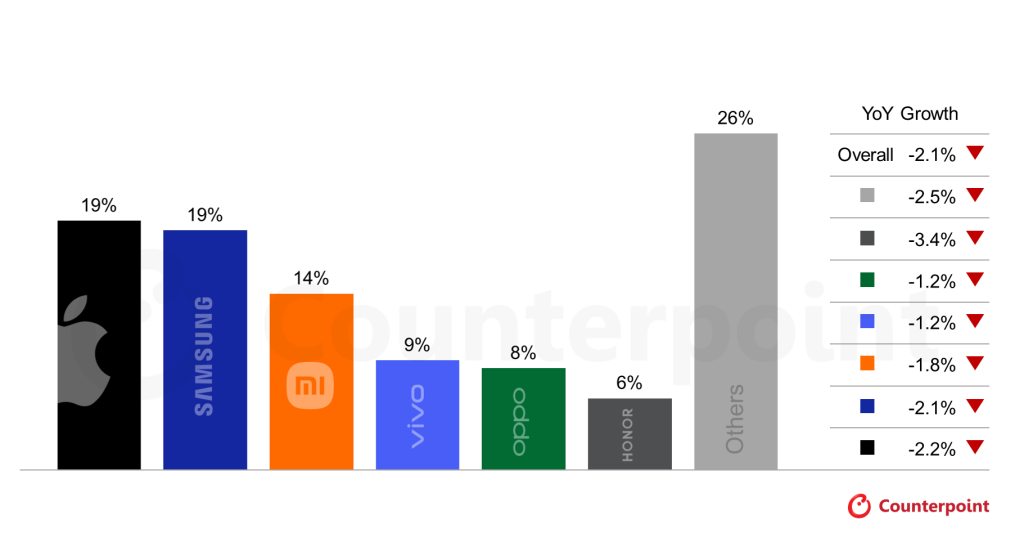

Smartphones face an even more insidious problem: shrinkflation. Counterpoint Research projects smartphone average selling prices will jump 6.9% in 2026, while memory prices could rise another 40% through Q2 2026. Counterpoint Research says,

DRAM price surges have already increased low-, mid- and high-end smartphone BoM costs by around 25%, 15% and 10%, respectively. We are expecting further cost impacts in the 10%-15% range through Q2 2026.

But here’s the twist: you’ll pay more for less. TrendForce reports low-end phones will revert to just 4GB RAM in 2026, down from the 6-8GB standard. The number of phone models offering 12GB RAM has dropped approximately 40%, while 8GB models declined around 50%. Budget phones face material cost increases of 20-30%, with the bill of materials (BOM) potentially rising 8-15% above current levels by mid-2026.

No Relief in Sight: 2026 Forecast

Industry forecasts offer zero comfort. SK Hynix predicts the memory shortage will persist through late 2027, while Micron CEO Sanjay Mehrotra expects tight memory markets past 2026. OpenAI’s Stargate project alone is projected to require up to 900,000 DRAM wafers monthly by 2029, approximately double the current global monthly HBM output. Building new production capacity requires a minimum of two years, meaning relief won’t arrive until 2027 or 2028.

For consumers, the message is clear: budget significantly more for any tech purchase in 2026. The AI boom reshaping data centers isn’t just a tech industry story; it’s reaching into your pocket, one memory chip at a time.

Views from Fissal Oubida, General Manager of Lexar, a leading memory solution provider,

As the global technology landscape is experiencing a rapid shift driven by AI, it is crucial to acknowledge the growing impact of the ongoing RAM shortage. The rise in AI-based applications in data centres, consumer devices, and enterprise applications has increased the demand for high-performance memory. With AI models becoming larger and more compute-intensive, the availability of DRAM components is becoming more constrained, hence, costs are increasing continuously. In this environment, it is becoming significant for both businesses and consumers to embrace reliable, highly efficient memory solutions that address the current workload, while also offering the future scalability requirements.