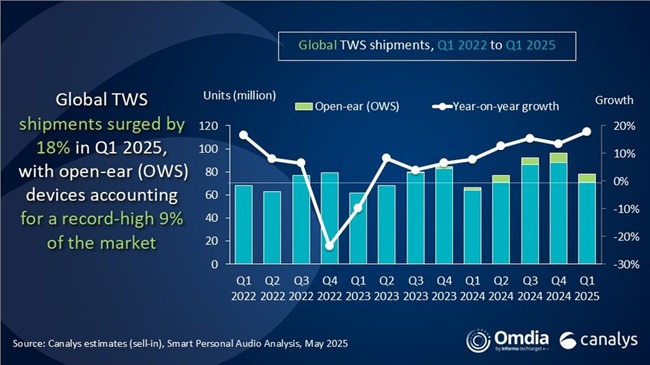

The global market for true wireless stereo (TWS) earbuds showed significant recovery in the first quarter of 2025. Shipments rose 18% compared to the previous year, reaching 78 million units, marking the fastest growth since 2021, according to Canalys, now part of Omdia.

Global TWS Market Highlights (Q1, 2025)

This growth was driven by manufacturers expanding their reach across regions and pricing categories. Key players continued to lead while others gained ground in emerging markets.

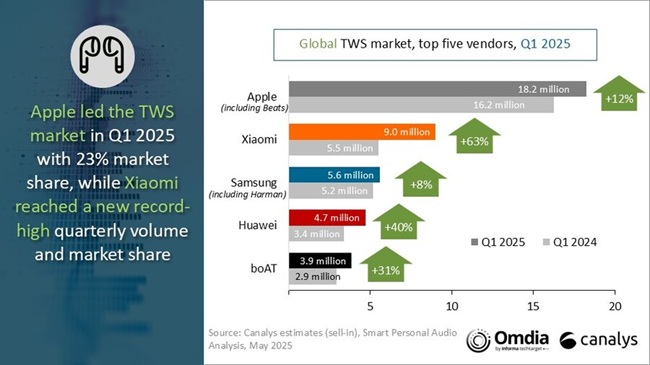

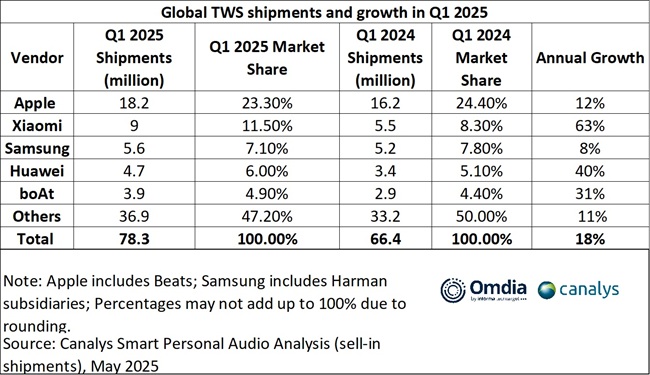

Top Vendors and Market Shares

- Apple, along with Beats, held the largest share of the global TWS earbuds market in Q1 2025 at 23%, supported by its ecosystem and increased emphasis on health features.

- Xiaomi moved up to second place, increasing shipments by 63% year-over-year and shipping over 9 million units, capturing 11.5% market share, driven by growth in emerging markets.

- Samsung, along with Harman brands, held 7% of the market, boosted by the Galaxy series and JBL products. Harman’s purchase of Sound United, which owns Bowers & Wilkins, suggests plans to expand into premium offerings.

- HUAWEI and boAt ranked fourth and fifth, holding 6% and 5% of the market, respectively.

Market Dynamics and Regional Trends

Jack Leathem, an analyst at Canalys, said that ecosystem-focused brands are driving market growth by expanding in regions like Southeast Asia, Central and Eastern Europe, Latin America, and Africa. These companies strengthen their position by offering affordable products and adapting their operations to local markets. He noted that Xiaomi and HUAWEI are replacing generic white-label players by building stronger brands, improving after-sales support, and developing better sales networks.

In the United States, the TWS market grew significantly in the first quarter of 2025, with double-digit increases partly due to stockpiling ahead of possible tariff changes. Apple continued to dominate North America, holding more than 50% of the market. Meanwhile, some low-cost brands are pulling back on investments because of weak consumer demand and uncertain regulations, indicating the market’s recovery may still be fragile.

Open-Ear Wireless Devices (OWS) Gain Momentum

Open-ear wireless devices (OWS) are expanding more rapidly than traditional TWS models, marking a shift from utility-focused audio to lifestyle-oriented wearables. According to Cynthia Chen, Research Manager at Canalys, brands are exploring new designs like ear-hooks and ear-clips, incorporating bold colors, materials, and decorative elements such as gradient shades and metallic accents.

As per Chen, emerging manufacturers are working with audio labs to enhance sound performance and close the gap with traditional TWS standards. OWS has become a major focus for 2025, enabling brands to diversify their offerings through a “dual-form factor strategy” that caters to different user preferences.

Market Outlook

The report predicts that the TWS market is entering a new stage characterized by a wider range of products, stronger brand presence, and more tailored user experiences. In the short term, growth will be driven by new product designs and practical use cases. However, long-term success will depend on brands moving past just competing on price.

According to the report, features like real-time translation, fitness monitoring, and AI interactions will push companies to create complete ecosystems. It concludes that top brands must prioritize innovation, design for specific scenarios, and offer integrated services to provide value across work, health, and entertainment needs.