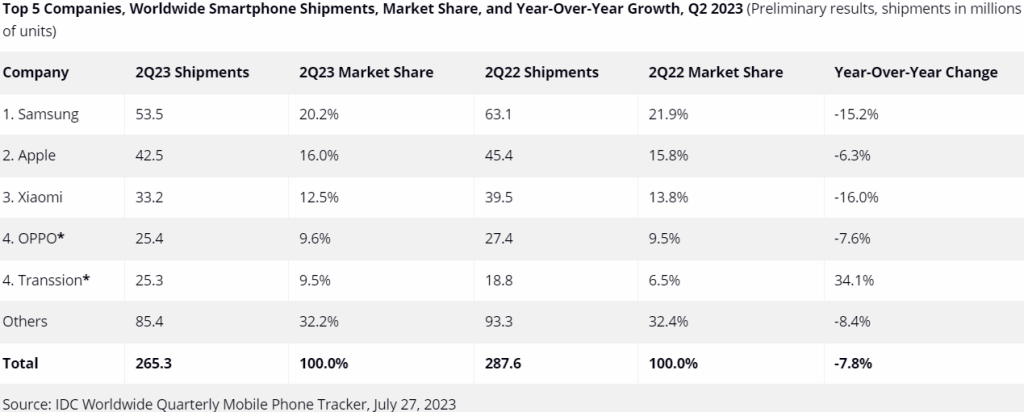

According to the International Data Corporation (IDC), global smartphone shipments experienced a year-over-year decline of 7.8% in the second quarter of 2023 (2Q23).

The slowdown in the decline signals potential stabilization of the market, despite ongoing challenges such as soft demand, inflation, macroeconomic uncertainties, and excess inventory.

The decline in smartphone shipments marks the eighth consecutive quarter of contraction for the market. Earlier, it was reported by Counterpoint that global smartphone shipments declined by 8% YoY and 5% QoQ in Q2 2023.

China’s Market Shows Signs of Improvement

China witnessed a year-over-year decline of 2.1% in 2Q23, after experiencing five quarters of significant double-digit contractions. While this is an improvement, consumer sentiment and spending remain low. Even the highly anticipated 618 online shopping festivals in June saw a 6.5% year-over-year drop in smartphone sales.

Shipments Decline in Other Regions

Other large regions, including Asia/Pacific (excluding Japan and China), the United States, and Europe, the Middle East, and Africa (EMEA), also saw shipments decline by 5.9%, 19.1%, and 3.1% respectively in 2Q23.

Growth in the Foldable Market

Consumers are excited about the foldable market, and the introduction of new models and vendors is expected to lead to increased adoption and more affordable prices. According to IDC, the foldable market is projected to experience nearly 50% growth in 2023, despite a downturn in the overall market.

Positive Outlook for Q3 and Beyond

IDC’s research director, Nabila Popal, states that inventory levels are showing signs of improvement, and there is optimism among key Original Equipment Manufacturers (OEMs) and supply chains. It is expected that excess inventory in finished devices and components will clear up by Q3.

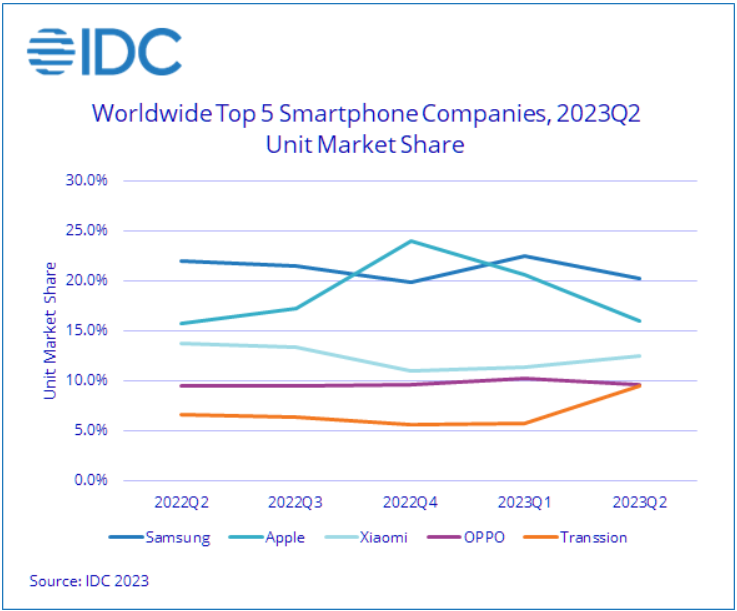

As inventory levels normalize, the market is expected to return to growth by the end of the year and continue into 2024. This growth presents an opportunity for vendors to gain market share, resulting in a potential shift in vendor rankings.

The situation also presents an opportunity for vendors to gain share, leading to a potential shift in vendor rankings at the bottom of the stack. This quarter already saw Transsion entering the Top 5 for the first time, according to IDC.

Commenting on the report, Anthony Scarsella, Research Director, Mobile Phones at IDC, said:

Even though the market has faced many challenges in the first half of the year, we believe that there is still plenty of potential for growth in the second half.